Question: Question 2 ( 1 0 Marks ) In mid - July, JK Ltd ( a US firm ) holds a pay - fixed, receive -

Question Marks

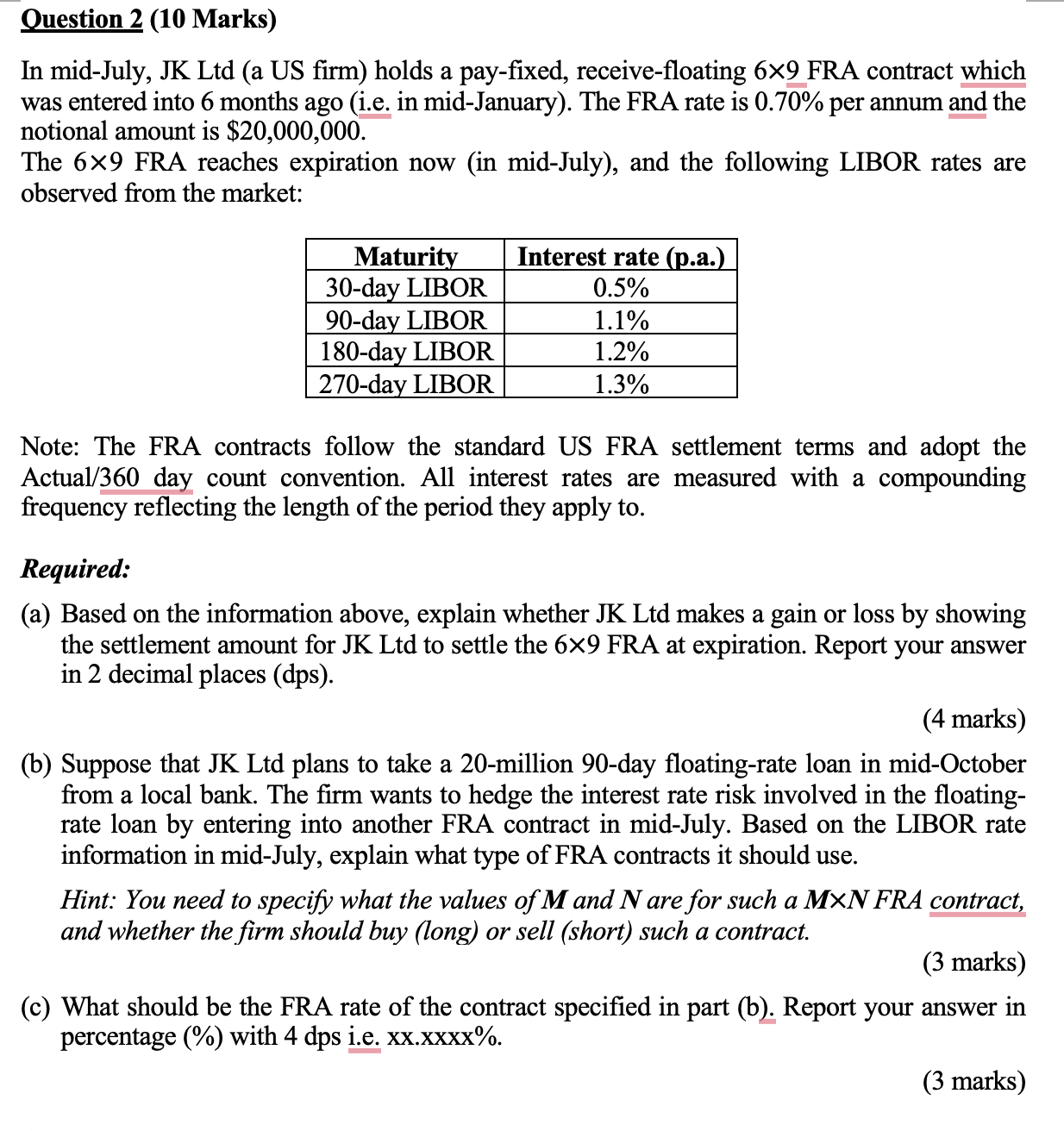

In midJuly, JK Ltd a US firm holds a payfixed, receivefloating FRA contract which

was entered into months ago ie in midJanuary The FRA rate is per annum and the

notional amount is $

The FRA reaches expiration now in midJuly and the following LIBOR rates are

observed from the market:

Note: The FRA contracts follow the standard US FRA settlement terms and adopt the

Actual day count convention. All interest rates are measured with a compounding

frequency reflecting the length of the period they apply to

Required:

a Based on the information above, explain whether JK Ltd makes a gain or loss by showing

the settlement amount for JK Ltd to settle the FRA at expiration. Report your answer

in decimal places

marks

b Suppose that JK Ltd plans to take a million day floatingrate loan in midOctober

from a local bank. The firm wants to hedge the interest rate risk involved in the floating

rate loan by entering into another FRA contract in midJuly. Based on the LIBOR rate

information in midJuly, explain what type of FRA contracts it should use.

Hint: You need to specify what the values of and are for such a FRA contract,

and whether the firm should buy long or sell short such a contract.

marks

c What should be the FRA rate of the contract specified in part b Report your answer in

percentage with dps ie

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock