Question: QUESTION 2 A. Anissa is currently evaluating the two stocks: Stock Q and Stock R. Given below is the data on the two stocks: States

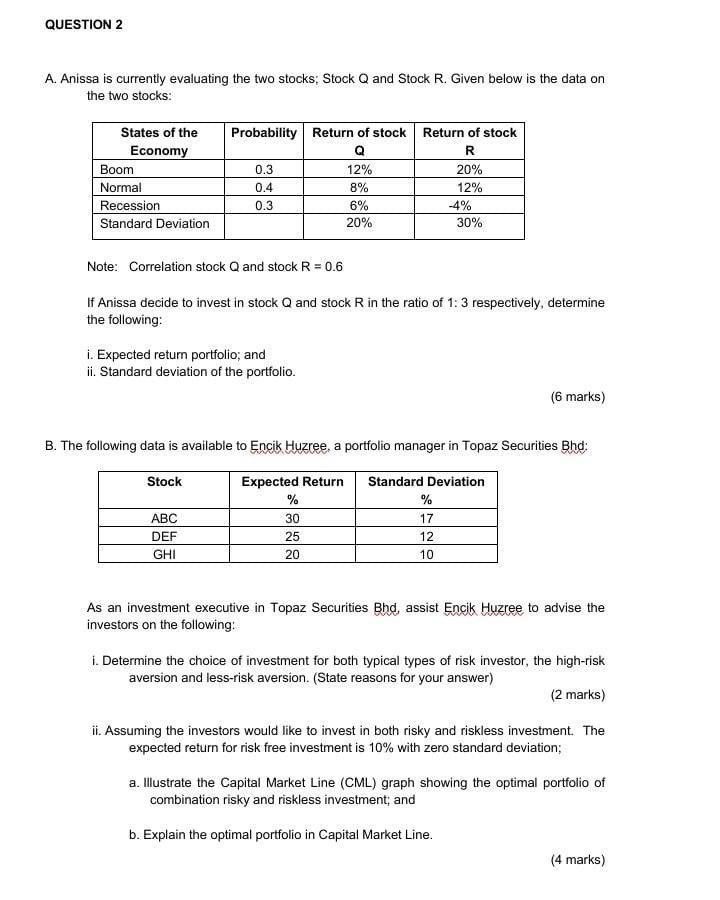

QUESTION 2 A. Anissa is currently evaluating the two stocks: Stock Q and Stock R. Given below is the data on the two stocks: States of the Economy Boom Normal Recession Standard Deviation Probability Return of stock Return of stock Q R 0.3 12% 20% 0.4 8% 12% 0.3 6% -4% 20% 30% Note: Correlation stock Q and stock R = 0.6 If Anissa decide to invest in stock Q and stock R in the ratio of 1: 3 respectively, determine the following: i. Expected return portfolio, and ii. Standard deviation of the portfolio. (6 marks) B. The following data is available to Encik Huzree, a portfolio manager in Topaz Securities Bhd: Stock Standard Deviation % ABC DEF GHI Expected Return % 30 25 20 17 12 10 As an investment executive in Topaz Securities Bhd, assist Encik Huzree to advise the investors on the following: 1. Determine the choice of investment for both typical types of risk investor, the high-risk aversion and less-risk aversion. (State reasons for your answer) (2 marks) ii. Assuming the investors would like to invest in both risky and riskless investment. The expected return for risk free investment is 10% with zero standard deviation; a. Illustrate the Capital Market Line (CML) graph showing the optimal portfolio of combination risky and riskless investment; and b. Explain the optimal portfolio in Capital Market Line. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts