Question: QUESTION 2 Based on the same information given in question 1, suppose now the stock rises to $150, is the original combined postion still perfectly

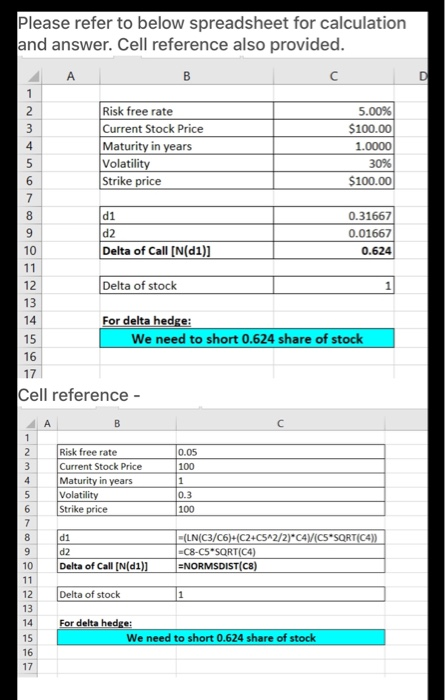

QUESTION 2 Based on the same information given in question 1, suppose now the stock rises to $150, is the original combined postion still perfectly hedged? If not, what is the net delta of the original combined position. Yeah, it is still perfectly hedged No it is not. The net delta of the original combined position is 0.328 No it is not. The net delta of the original combined position is -0.328 It cannot be determined from the information given above. Please refer to below spreadsheet for calculation and answer. Cell reference also provided. Risk free rate Current Stock Price Maturity in years Volatility Strike price 5.00% $100.00 1.0000 30% $100.00 0.31667 0.01667 0.624 Delta of Call [N(D1)] Delta of stock For delta hedge: We need to short 0.624 share of stock Cell reference - Risk free rate Current Stock Price Maturity in years Volatility Strike price 0.05 100 1 lo 3 100 -(LN(C3/06) (C24CS42/2)*C4VICS "SORT(04)) -C8-CS SQRT(C4) =NORMSDIST(CS) Delta of Call [N(D1)] Delta of stock For delta hedge: We need to short 0.624 share of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts