Question: QUESTION 2 Based on the same information given in question 1, suppose now the stock rises to $150, is the original combined postion still perfectly

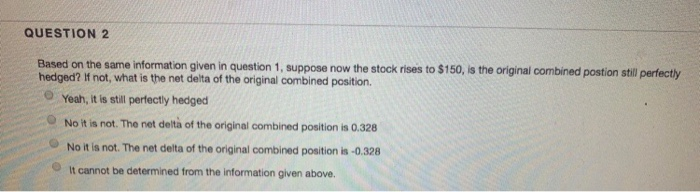

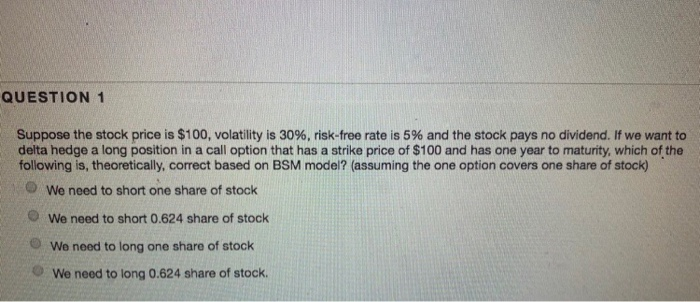

QUESTION 2 Based on the same information given in question 1, suppose now the stock rises to $150, is the original combined postion still perfectly hedged? If not, what is the net delta of the original combined position. Yeah, it is still perfectly hedged No it is not. The net delta of the original combined position is 0.328 No it is not. The net delta of the original combined position is -0.328 It cannot be determined from the information given above. QUESTION 1 Suppose the stock price is $100, volatility is 30%, risk-free rate is 5% and the stock pays no dividend. If we want to delta hedge a long position in a call option that has a strike price of $100 and has one year to maturity, which of the following is, theoretically, correct based on BSM model? (assuming the one option covers one share of stock) We need to short one share of stock We need to short 0.624 share of stock We need to long one share of stock We need to long 0.624 share of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts