Question: QUESTION 33 Questions 33 through 35 are based on the following: Michael was hired to work as a sales associate for FAN Corporation (FAN) in

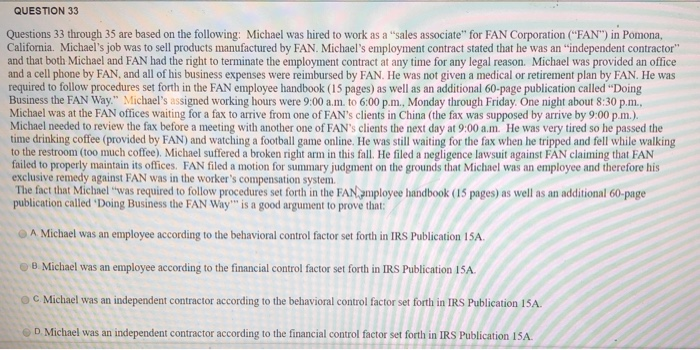

QUESTION 33 Questions 33 through 35 are based on the following: Michael was hired to work as a "sales associate" for FAN Corporation ("FAN") in Pomona, California. Michael's job was to sell products manufactured by FAN. Michael's employment contract stated that he was an independent contractor" and that both Michael and FAN had the right to terminate the employment contract at any time for any legal reason. Michael was provided an office and a cell phone by FAN, and all of his business expenses were reimbursed by FAN. He was not given a medical or retirement plan by FAN. He was required to follow procedures set forth in the FAN employee handbook (15 pages) as well as an additional 60-page publication called "Doing Business the FAN Way." Michael's assigned working hours were 9:00 am to 6:00p.m., Monday through Friday. One night about 8:30 p.m., Michael was at the FAN offices waiting for a fax to arrive from one of FAN's clients in China (the fax was supposed by arrive by 9:00p.m.). Michael needed to review the fax before a meeting with another one of FAN's clients the next day at 9:00 a.m. He was very tired so he passed the time drinking coffee (provided by FAN) and watching a football game online. He was still waiting for the fax when he tripped and fell while walking to the restroom (too much coffee). Michael suffered a broken right arm in this fall. He filed a negligence lawsuit against FAN claiming that FAN failed to properly maintain its offices. FAN filed a motion for summary judgment on the grounds that Michael was an employee and therefore his exclusive remedy against FAN was in the worker's compensation system The fact that Michael was required to follow procedures set forth in the FAN amployee handbook (15 pages) as well as an additional 60-page publication called 'Doing Business the FAN Way" is a good argument to prove that A Michael was an employee according to the behavioral control factor set forth in IRS Publication 15A B. Michael was an employee according to the financial control factor set forth in IRS Publication 15A. C Michael was an independent contractor according to the behavioral control factor set forth in IRS Publication 15A. D. Michael was an independent contractor according to the financial control factor set forth in IRS Publication 15A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock