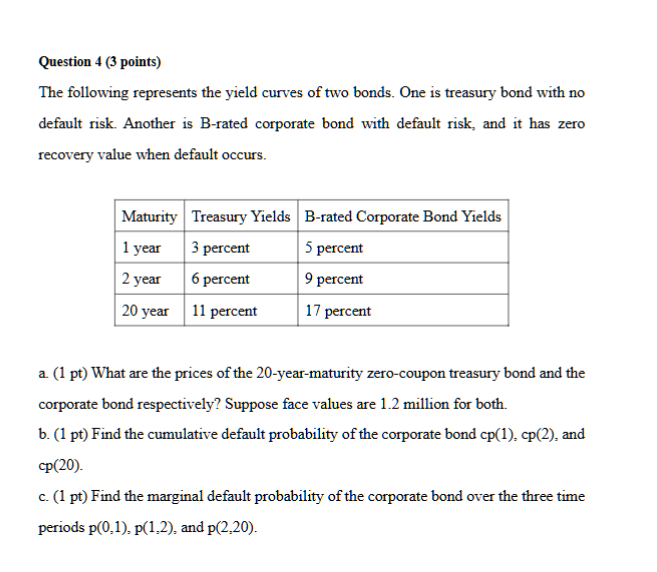

Question: Question 4 ( 3 points ) The following represents the yield curves of two bonds. One is treasury bond with no default risk. Another is

Question points The following represents the yield curves of two bonds. One is treasury bond with no default risk. Another is Brated corporate bond with default risk, and it has zero recovery value when default occurs. a pt What are the prices of the yearmaturity zerocoupon treasury bond and the corporate bond respectively? Suppose face values are million for both. b pt Find the cumulative default probability of the corporate bond mathrmcpmathrmcp and operatornamecp cmathrmpt Find the marginal default probability of the corporate bond over the three time periods mathrmpmathrmp and mathrmp

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock