Question: Question 4 (a) For the current year, Encorre Ltd. had net sales of $700,000 and paid $320,000 for the cost of goods sold. They had

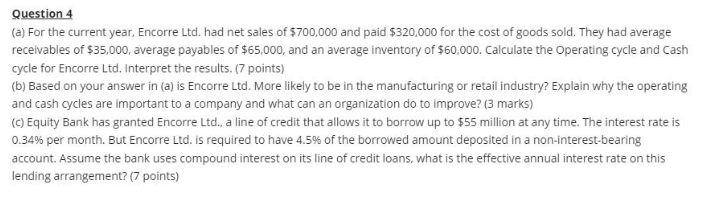

Question 4 (a) For the current year, Encorre Ltd. had net sales of $700,000 and paid $320,000 for the cost of goods sold. They had average receivables of $35,000, average payables of $65,000, and an average inventory of $60,000. Calculate the Operating cycle and Cash cycle for Encorre Ltd. Interpret the results. (7 points) (b) Based on your answer in (a) is Encorre Ltd. More likely to be in the manufacturing or retail industry? Explain why the operating and cash cycles are important to a company and what can an organization do to improve? (3 marks) (C) Equity Bank has granted Encorre Ltd., a line of credit that allows it to borrow up to $55 million at any time. The interest rate is 0.34% per month. But Encorre Ltd. is required to have 4.5% of the borrowed amount deposited in a non-interest-bearing account. Assume the bank uses compound interest on its line of credit loans, what is the effective annual interest rate on this lending arrangement? (7 points) Question 4 (a) For the current year, Encorre Ltd. had net sales of $700,000 and paid $320,000 for the cost of goods sold. They had average receivables of $35,000, average payables of $65,000, and an average inventory of $60,000. Calculate the Operating cycle and Cash cycle for Encorre Ltd. Interpret the results. (7 points) (b) Based on your answer in (a) is Encorre Ltd. More likely to be in the manufacturing or retail industry? Explain why the operating and cash cycles are important to a company and what can an organization do to improve? (3 marks) (C) Equity Bank has granted Encorre Ltd., a line of credit that allows it to borrow up to $55 million at any time. The interest rate is 0.34% per month. But Encorre Ltd. is required to have 4.5% of the borrowed amount deposited in a non-interest-bearing account. Assume the bank uses compound interest on its line of credit loans, what is the effective annual interest rate on this lending arrangement? (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts