Question: ' QUESTION 4 Consider the following information for Stocks A, B, and C. The returns on the three stocks are positively correlated, but they

" '

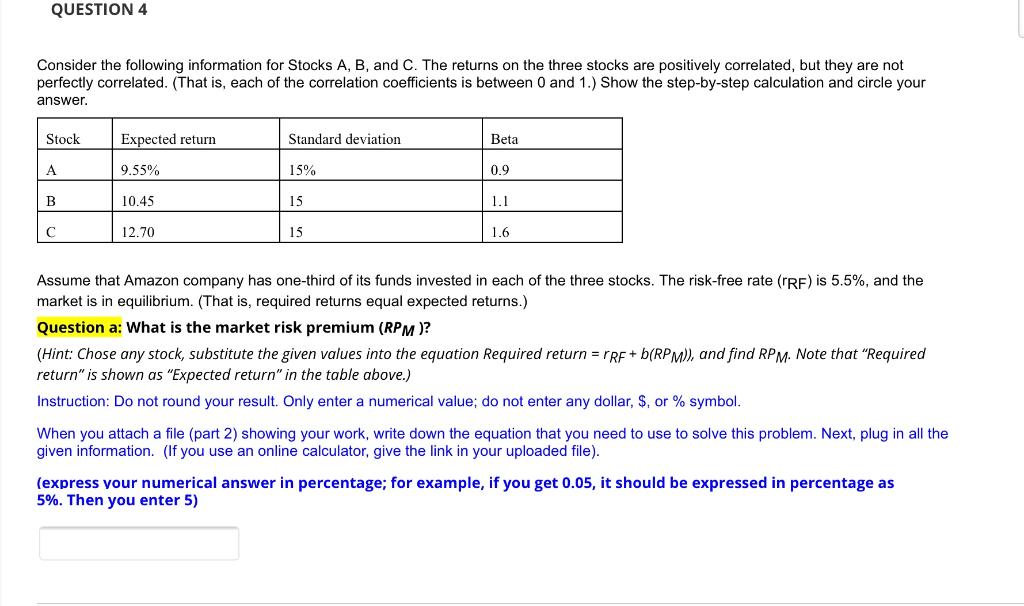

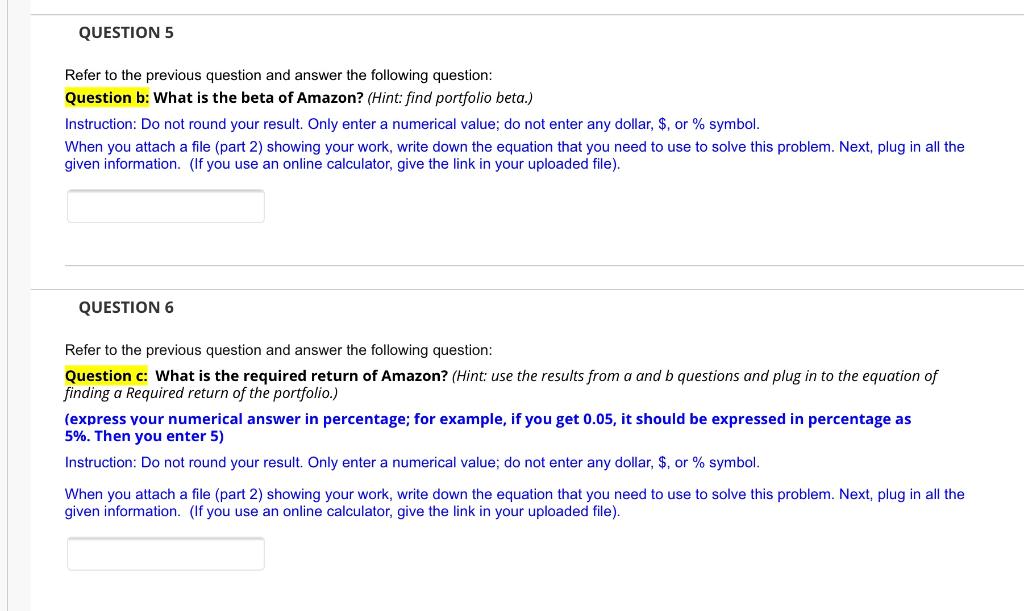

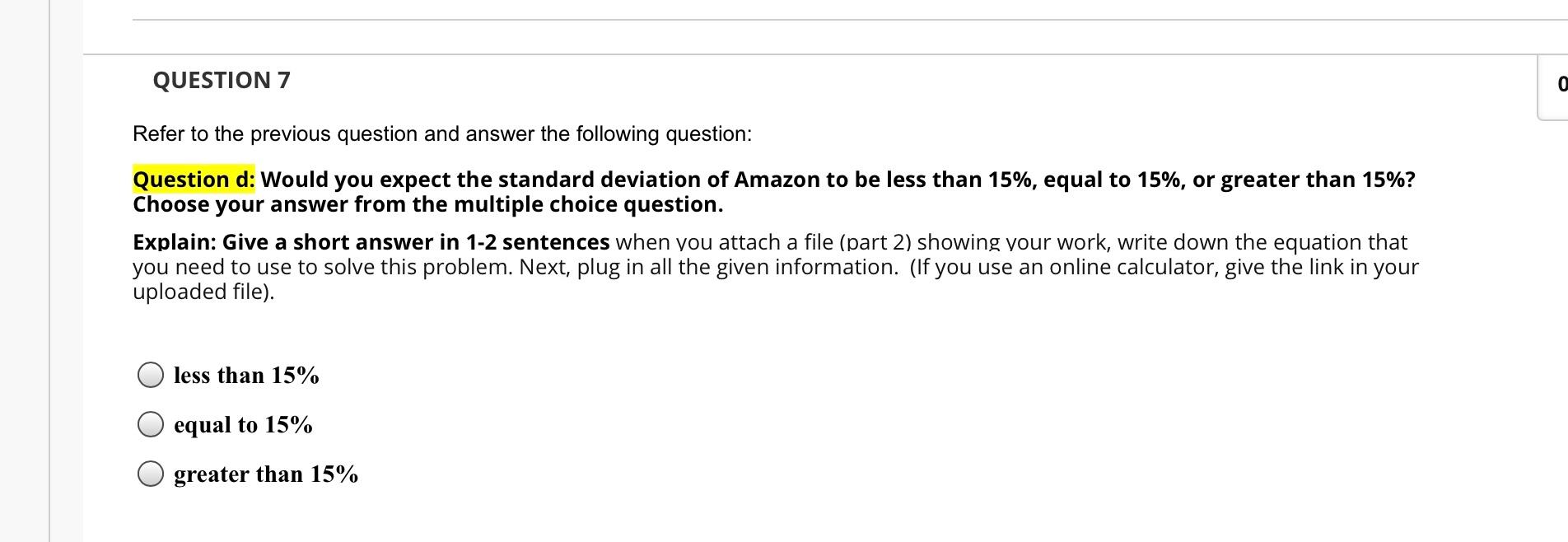

QUESTION 4 Consider the following information for Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Show the step-by-step calculation and circle your answer. Stock Expected return Standard deviation Beta A 9.55% 15% 0.9 B 10.45 15 1.1 12.70 15 1.6 Assume that Amazon company has one-third of its funds invested in each of the three stocks. The risk-free rate (TRF) is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) Question a: What is the market risk premium (RPM)? (Hint: Chose any stock, substitute the given values into the equation Required return = TRF + b(RPM)), and find RPM. Note that "Required return" is shown as "Expected return" in the table above.) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). (express your numerical answer in percentage; for example, if you get 0.05, it should be expressed in percentage as 5%. Then you enter 5) QUESTION 5 Refer to the previous question and answer the following question: Question b: What is the beta of Amazon? (Hint: find portfolio beta.) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 6 Refer to the previous question and answer the following question: Question c: What is the required return of Amazon? (Hint: use the results from a and b questions and plug in to the equation of finding a Required return of the portfolio.) (express your numerical answer in percentage; for example, if you get 0.05, it should be expressed in percentage as 5%. Then you enter 5) Instruction: your result. Only enter a merical ue; do not enter any dollar, or % symbol When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 7 o Refer to the previous question and answer the following question: Question d: Would you expect the standard deviation of Amazon to be less than 15%, equal to 15%, or greater than 15%? Choose your answer from the multiple choice question. Explain: Give a short answer in 1-2 sentences when you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). less than 15% equal to 15% greater than 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts