Question: Question 4 Let's consider a mean-variance portfolio problem with N securities. The problem of choosing a portfolio to minimize variance for a given mean is:

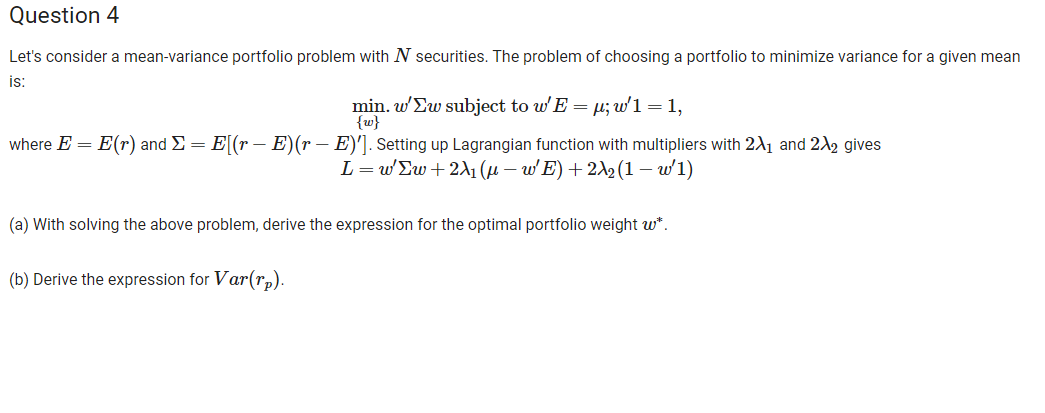

Question 4 Let's consider a mean-variance portfolio problem with N securities. The problem of choosing a portfolio to minimize variance for a given mean is: min. w'Ew subject to w'E=u; w'1 =1, {w} where E= E(r) and =E[(r E)(r E)']. Setting up Lagrangian function with multipliers with 211 and 212 gives L = w'Ew+241 (u W'E) +212(1 w'1) (a) With solving the above problem, derive the expression for the optimal portfolio weight w*. (b) Derive the expression for Var(rp). Question 4 Let's consider a mean-variance portfolio problem with N securities. The problem of choosing a portfolio to minimize variance for a given mean is: min. w'Ew subject to w'E=u; w'1 =1, {w} where E= E(r) and =E[(r E)(r E)']. Setting up Lagrangian function with multipliers with 211 and 212 gives L = w'Ew+241 (u W'E) +212(1 w'1) (a) With solving the above problem, derive the expression for the optimal portfolio weight w*. (b) Derive the expression for Var(rp)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts