Question: Question 5 (11 points) PROBLEM 5 (11 points) HP needs to spend $2,000 million at year 0 to develop a new micro-processor. The demand for

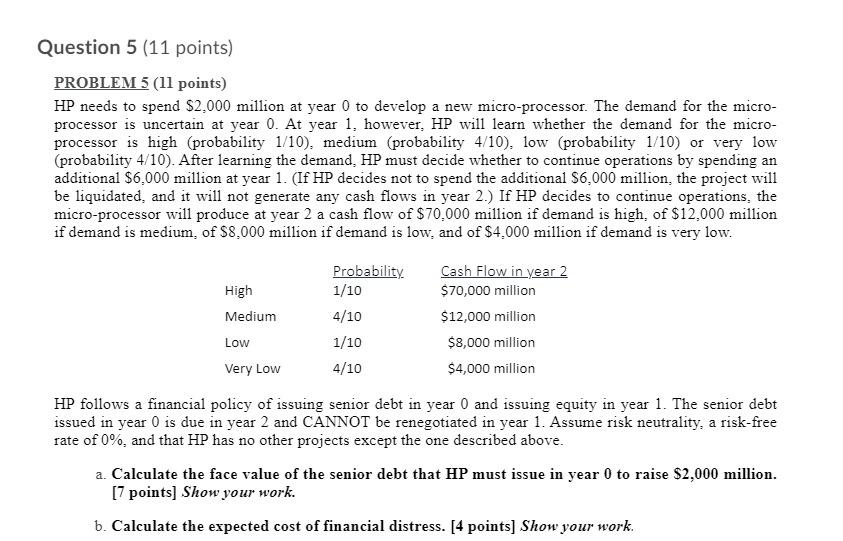

Question 5 (11 points) PROBLEM 5 (11 points) HP needs to spend $2,000 million at year 0 to develop a new micro-processor. The demand for the micro- processor is uncertain at year 0. At year 1. however, HP will learn whether the demand for the micro- processor is high (probability 1/10), medium (probability 4/10), low (probability 1/10) or very low (probability 4/10). After learning the demand, HP must decide whether to continue operations by spending an additional $6,000 million at year 1. (If HP decides not to spend the additional $6,000 million, the project will be liquidated, and it will not generate any cash flows in year 2.) If HP decides to continue operations, the micro-processor will produce at year 2 a cash flow of $70.000 million if demand is high, of $12,000 million if demand is medium of $8.000 million if demand is low, and of $4.000 million if demand is very low. High Medium Low Very Low Probability 1/10 4/10 1/10 4/10 Cash Flow in year 2 $70,000 million $12,000 million $8,000 million $4,000 million HP follows a financial policy of issuing senior debt in year 0 and issuing equity in year 1. The senior debt issued in year 0 is due in year 2 and CANNOT be renegotiated in year 1. Assume risk neutrality, a risk-free rate of 0%, and that HP has no other projects except the one described above. a. Calculate the face value of the senior debt that HP must issue in year 0 to raise $2,000 million. [7 points] Show your work. b. Calculate the expected cost of financial distress. [4 points] Show your work. Question 5 (11 points) PROBLEM 5 (11 points) HP needs to spend $2,000 million at year 0 to develop a new micro-processor. The demand for the micro- processor is uncertain at year 0. At year 1. however, HP will learn whether the demand for the micro- processor is high (probability 1/10), medium (probability 4/10), low (probability 1/10) or very low (probability 4/10). After learning the demand, HP must decide whether to continue operations by spending an additional $6,000 million at year 1. (If HP decides not to spend the additional $6,000 million, the project will be liquidated, and it will not generate any cash flows in year 2.) If HP decides to continue operations, the micro-processor will produce at year 2 a cash flow of $70.000 million if demand is high, of $12,000 million if demand is medium of $8.000 million if demand is low, and of $4.000 million if demand is very low. High Medium Low Very Low Probability 1/10 4/10 1/10 4/10 Cash Flow in year 2 $70,000 million $12,000 million $8,000 million $4,000 million HP follows a financial policy of issuing senior debt in year 0 and issuing equity in year 1. The senior debt issued in year 0 is due in year 2 and CANNOT be renegotiated in year 1. Assume risk neutrality, a risk-free rate of 0%, and that HP has no other projects except the one described above. a. Calculate the face value of the senior debt that HP must issue in year 0 to raise $2,000 million. [7 points] Show your work. b. Calculate the expected cost of financial distress. [4 points] Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts