Question: QUESTION 55 How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which

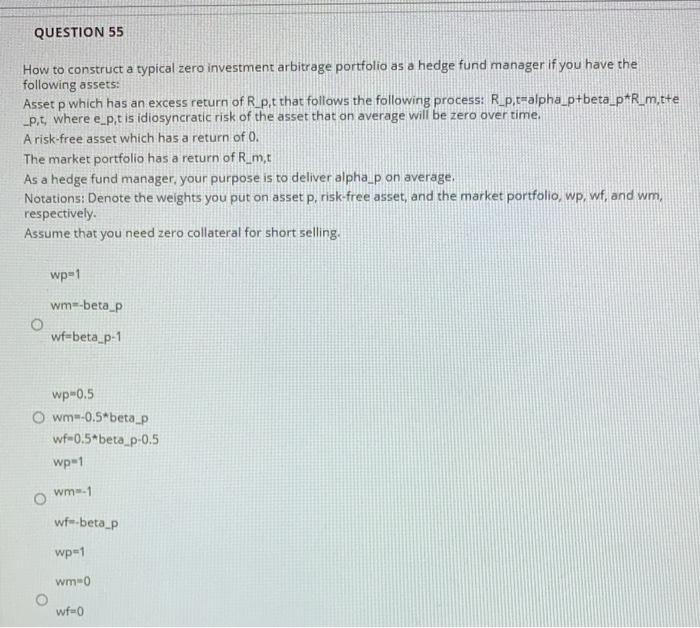

QUESTION 55 How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which has an excess return of Rp.t that follows the following process: Rp.c-alpha_p+beta_p+R_m.tte _pit, where e_p,t is idiosyncratic risk of the asset that on average will be zero over time. A risk-free asset which has a return of 0. The market portfolio has a return of R_mt As a hedge fund manager, your purpose is to deliver alpha_p on average, Notations: Denote the weights you put on asset p, risk-free asset, and the market portfolio, wp, wf, and wm, respectively Assume that you need zero collateral for short selling, wp=1 wm--beta_P wf-beta.p-1 wp-0.5 Owm-0.5 betap wf-0.5.beta.p.0,5 wp-1 wm-1 wf-beta_p wp=1 wm-0 wf=0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts