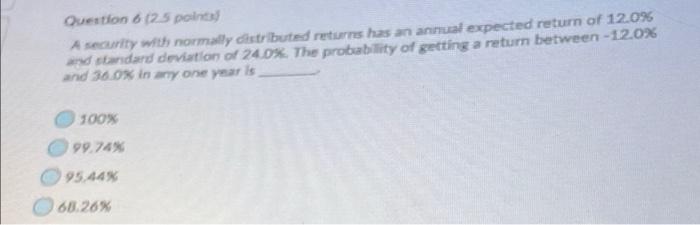

Question: Question 6 125 points A security with normally distributed returns has an annual expected return of 12.0% standard deviation of 240%. The probability of getting

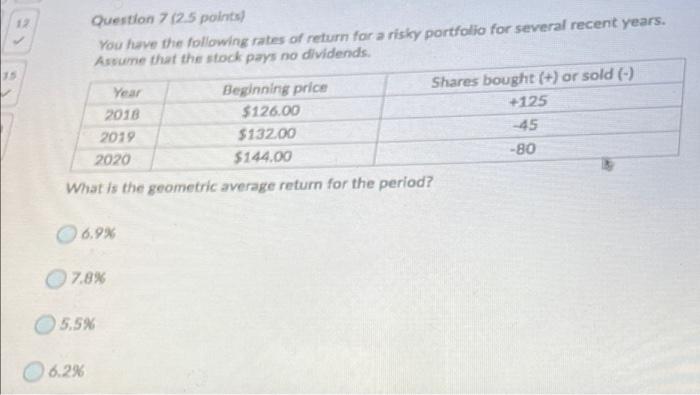

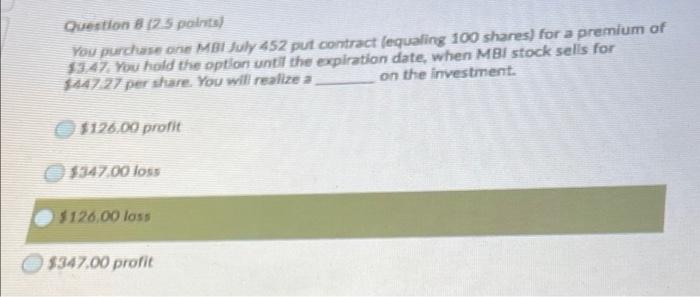

Question 6 125 points A security with normally distributed returns has an annual expected return of 12.0% standard deviation of 240%. The probability of getting a return between-12.0% and 36.0x in any one year is 100% 99.74% 95.44% 68.26% 12 Question 7 (25 points) You have the following rates of return for a risky portfolio for several recent years. Asume that the stock pays no dividends. Year Beginning price Shares bought(+) or sold (-) 2018 $126.00 +125 2019 $132.00 -45 2020 $144.00 -80 What is the geometric average return for the period? 6.9% 7.8% 5,5% 6,2% Question 8 125 points) You purchase one Mol July 452 put contract (equaling 100 shares) for a premium of 1947. You hold the option until the expiration date, when MB: stock sells for $44727 per stare. You will realize a on the investment $126.00 profit $347.00 loss $126,00 loss $347.00 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts