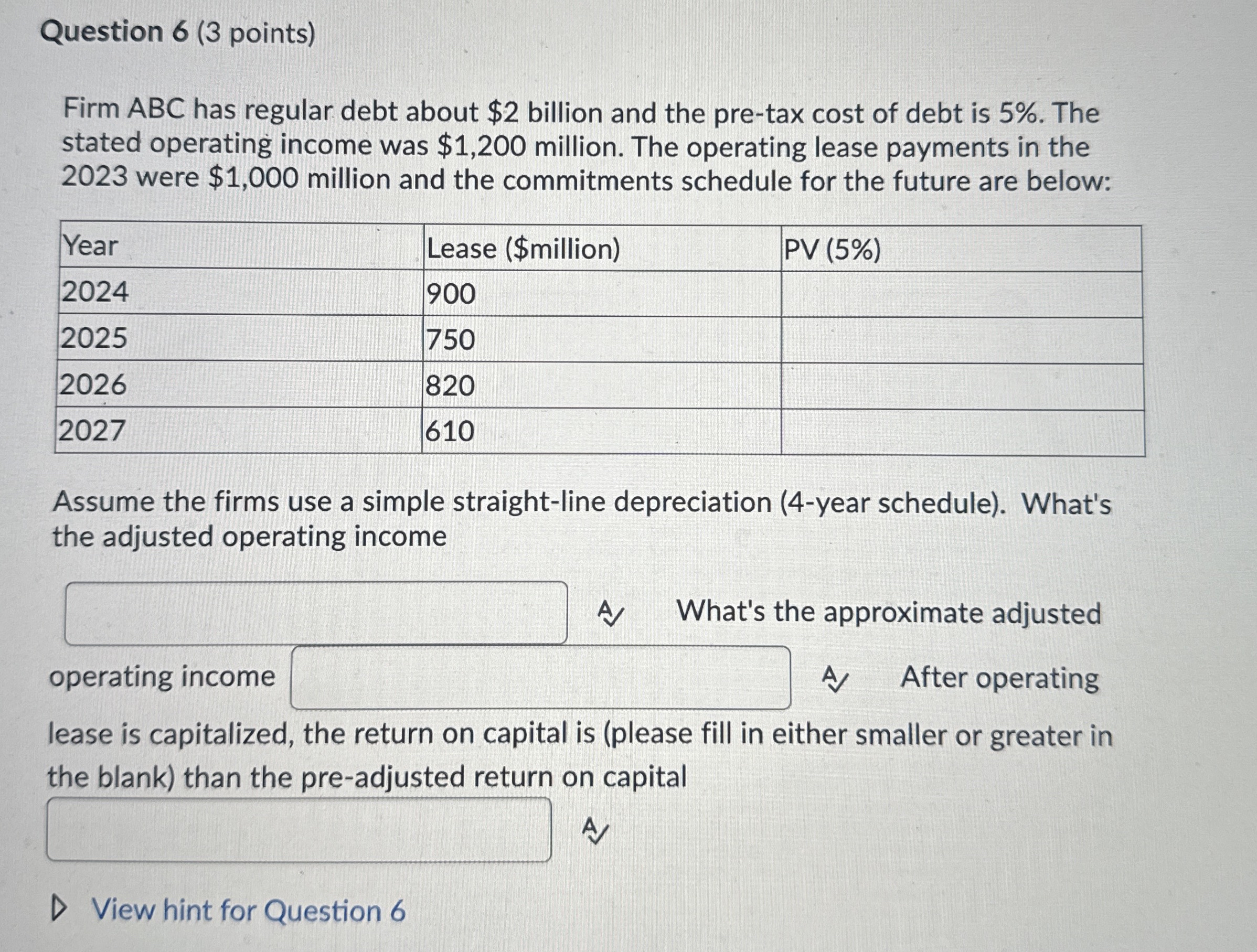

Question: Question 6 ( 3 points ) Firm ABC has regular debt about $ 2 billion and the pre - tax cost of debt is 5

Question points

Firm ABC has regular debt about $ billion and the pretax cost of debt is The

stated operating income was $ million. The operating lease payments in the

were $ million and the commitments schedule for the future are below:

Assume the firms use a simple straightline depreciation year schedule What's

the adjusted operating income

A What's the approximate adjusted

operating income

A After operating

lease is capitalized, the return on capital is please fill in either smaller or greater in

the blank than the preadjusted return on capital

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock