Question: QUESTION 6 5 points Save Answer A one-year $100 zero-coupon bond is currently trading at $97. A two-year zero-coupon bond is currently trading at $94.

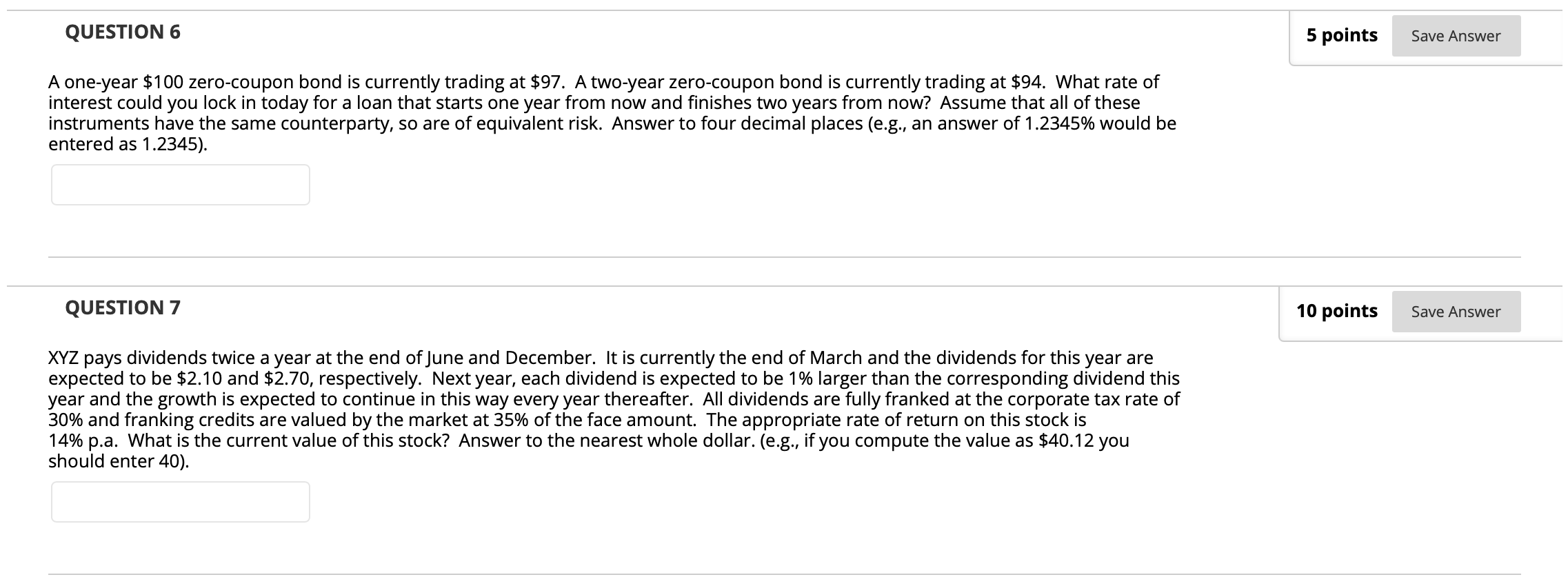

QUESTION 6 5 points Save Answer A one-year $100 zero-coupon bond is currently trading at $97. A two-year zero-coupon bond is currently trading at $94. What rate of interest could you lock in today for a loan that starts one year from now and finishes two years from now? Assume that all of these instruments have the same counterparty, so are of equivalent risk. Answer to four decimal places (e.g., an answer of 1.2345% would be entered as 1.2345). QUESTION 7 10 points Save Answer XYZ pays dividends twice a year at the end of June and December. It is currently the end of March and the dividends for this year are expected to be $2.10 and $2.70, respectively. Next year, each dividend is expected to be 1% larger than the corresponding dividend this year and the growth is expected to continue in this way every year thereafter. All dividends are fully franked at the corporate tax rate of 30% and franking credits are valued by the market at 35% of the face amount. The appropriate rate of return on this stock is 14% p.a. What is the current value of this stock? Answer to the nearest whole dollar. (e.g., if you compute the value as $40.12 you should enter 40)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts