Question: Question: Read the case and answer the question Evaluate the current bonus plan and new bonus plan, what is the advantages and disadvantages in current

Question: Read the case and answer the question Evaluate the current bonus plan and new bonus plan, what is the advantages and disadvantages in current bonus plan and new bonus plan. Recommendations for an optimal bonus plan for the company?

Question: Evaluate the current bonus plan and new bonus plan, what is the advantages and disadvantages in current bonus plan and new bonus plan. Recommendations for an optimal bonus plan for the company.

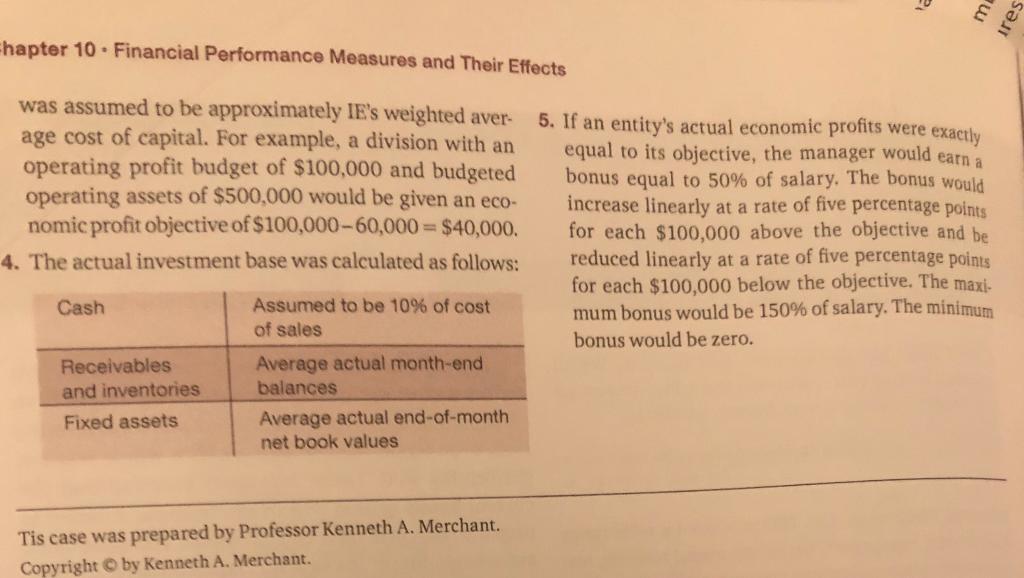

no reward for our hard work . It's very frustrating My division had another great year last year . We all worked hard , and the results were there . But again we got had been growing . Most of them stemmed largely from equipment , communications systems , and various piece complaints . punts and subassemblies such as motors , generators , and average approximately 50 % . But because of the reces- son in the prior two years , the bonus pool was zero . dollar of salary . " The maximum bonus paid was 150 % bomis. Sien Industrial Electronics, Inc. CASE STUDY Industrial Electronics, Inc. Complaints about the management bonus system division managers whose divisions were performing well, even while the corporation as a whole was not ra - Division manager, General Products Division Industrial Electronics, Inc. performing well. These managers believed that the current bonus system was unfair because it failed to Industrial Electronics, Inc. de produced a wide range properly recognize their contributions. The quote cited In response, top management, with the assistance of TE's stock was listed on the New York Stock Exchange. probes. Total annual sales were in excess of $8 billion personnel in the corporate Human Resources and The company's objective was to maximize share- bonus plan with the following features: Finance departments, proposed a new management holder value. In most of its business areas, IE had to be innovative to stay ahead of the competition. However, 1. Bonuses would be determined by the performance price competition was also significant, so the company of the entity for which each manager was responsi also had to maintain tight control over costs. ble. That is, division manager bonuses would be The company was organized by product line. Its 16 based 100% on division performance; group man- relatively autonomous divisions were managed as ager bonuses would be based 100% on group perfor- profit centers. The division managers reported to one of mance; and corporate manager bonuses would be four Business Group managers who, in turn, reported based 100% on corporate performance. to the company's CEO. 2. For bonus award purposes, actual performance Thirty managers, including all line managers at the would be compared with targets negotiated dur- level of division manager and above plus key corporate ing IE's annual budgeting process. IE's philosophy staff managers, were eligible for an annual manage- was to try to set budget targets at "threshold" lev. ment bonus award. (Many lower level employees were els that were likely to be achieved if the manage- included in a separate "management-by-objectives" ment teams performed effectively. Corporate Incentive plan.) The management bonuses were based managers knew that IE was a "high tech" com- pany that operated in many business areas in on company-wide performance. Each year, a bonus which there was significant operating uncer- pool equal to 10% of the corporation's profit after taxes tainty. It was often difficult to forecast the future in excess of 12% of the company's book net worth was accurately. They thought that the relatively het aside for assignment as bonuses to managers. This highly achievable budget targets provided the Amount was divided by the total salary of all the execu- operating managers with some insurance against fies eligible for a bonus. This yielded an award per an operating environment that might turn out to be more harsh than that seen at the time of budget preparation Historically ties managers had been earning bonuses Wettanged from of 30% to 120% of salary, with the 3. Each division would be given an "economic profit" objective equal to budgeted operating profit minus budgeted operating assets multiplied by 12%, which of salary 421 Chapter 10. Financial Performance Measures and Their Effects was assumed to be approximately IE's weighted aver- age cost of capital. For example, a division with an operating profit budget of $100,000 and budgeted operating assets of $500,000 would be given an eco- nomic profit objective of $100,000-60,000 = $40,000. 4. The actual investment base was calculated as follows: 5. If an entity's actual economic profits were exactly equal to its objective, the manager would earn a bonus equal to 50% of salary. The bonus would increase linearly at a rate of five percentage points for each $100,000 above the objective and be reduced linearly at a rate of five percentage points for each $100,000 below the objective. The maxi- mum bonus would be 150% of salary. The minimum bonus would be zero. Cash Receivables and inventories Fixed assets Assumed to be 10% of cost of sales Average actual month-end balances Average actual end-of-month net book values Tis case was prepared by Professor Kenneth A. Merchant. Copyright by Kenneth A. Merchant. no reward for our hard work . It's very frustrating My division had another great year last year . We all worked hard , and the results were there . But again we got had been growing . Most of them stemmed largely from equipment , communications systems , and various piece complaints . punts and subassemblies such as motors , generators , and average approximately 50 % . But because of the reces- son in the prior two years , the bonus pool was zero . dollar of salary . " The maximum bonus paid was 150 % bomis. Sien Industrial Electronics, Inc. CASE STUDY Industrial Electronics, Inc. Complaints about the management bonus system division managers whose divisions were performing well, even while the corporation as a whole was not ra - Division manager, General Products Division Industrial Electronics, Inc. performing well. These managers believed that the current bonus system was unfair because it failed to Industrial Electronics, Inc. de produced a wide range properly recognize their contributions. The quote cited In response, top management, with the assistance of TE's stock was listed on the New York Stock Exchange. probes. Total annual sales were in excess of $8 billion personnel in the corporate Human Resources and The company's objective was to maximize share- bonus plan with the following features: Finance departments, proposed a new management holder value. In most of its business areas, IE had to be innovative to stay ahead of the competition. However, 1. Bonuses would be determined by the performance price competition was also significant, so the company of the entity for which each manager was responsi also had to maintain tight control over costs. ble. That is, division manager bonuses would be The company was organized by product line. Its 16 based 100% on division performance; group man- relatively autonomous divisions were managed as ager bonuses would be based 100% on group perfor- profit centers. The division managers reported to one of mance; and corporate manager bonuses would be four Business Group managers who, in turn, reported based 100% on corporate performance. to the company's CEO. 2. For bonus award purposes, actual performance Thirty managers, including all line managers at the would be compared with targets negotiated dur- level of division manager and above plus key corporate ing IE's annual budgeting process. IE's philosophy staff managers, were eligible for an annual manage- was to try to set budget targets at "threshold" lev. ment bonus award. (Many lower level employees were els that were likely to be achieved if the manage- included in a separate "management-by-objectives" ment teams performed effectively. Corporate Incentive plan.) The management bonuses were based managers knew that IE was a "high tech" com- pany that operated in many business areas in on company-wide performance. Each year, a bonus which there was significant operating uncer- pool equal to 10% of the corporation's profit after taxes tainty. It was often difficult to forecast the future in excess of 12% of the company's book net worth was accurately. They thought that the relatively het aside for assignment as bonuses to managers. This highly achievable budget targets provided the Amount was divided by the total salary of all the execu- operating managers with some insurance against fies eligible for a bonus. This yielded an award per an operating environment that might turn out to be more harsh than that seen at the time of budget preparation Historically ties managers had been earning bonuses Wettanged from of 30% to 120% of salary, with the 3. Each division would be given an "economic profit" objective equal to budgeted operating profit minus budgeted operating assets multiplied by 12%, which of salary 421 Chapter 10. Financial Performance Measures and Their Effects was assumed to be approximately IE's weighted aver- age cost of capital. For example, a division with an operating profit budget of $100,000 and budgeted operating assets of $500,000 would be given an eco- nomic profit objective of $100,000-60,000 = $40,000. 4. The actual investment base was calculated as follows: 5. If an entity's actual economic profits were exactly equal to its objective, the manager would earn a bonus equal to 50% of salary. The bonus would increase linearly at a rate of five percentage points for each $100,000 above the objective and be reduced linearly at a rate of five percentage points for each $100,000 below the objective. The maxi- mum bonus would be 150% of salary. The minimum bonus would be zero. Cash Receivables and inventories Fixed assets Assumed to be 10% of cost of sales Average actual month-end balances Average actual end-of-month net book values Tis case was prepared by Professor Kenneth A. Merchant. Copyright by Kenneth A. MerchantStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts