Question: Questions: 1)What is the total cost difference between Ferguson's proposal to order 4 cases each time and Powells proposal to order 32 cases each time.

Questions:

1)What is the total cost difference between Ferguson's proposal to order 4 cases each time and

Powells proposal to order 32 cases each time. Explain your results.

2) Lewin suggested looking at economic order quantity (EOQ). Based on the lowest total annual cost, what order quantity should Martin recommend? What is the resulting total cost when using the EOQ (do not include the unit purchase price)? What is the cost difference compared to the Ferguson and the Powell proposals? Explain your results.

3) Let's explore the concept of "robustness." Lewins proposal to use economic order quantity may be unrealistic since CMC would like to place orders in whole cases. If the order quantity is decreased to the nearest whole case (which is a 2.78% reduction) what is the new total annual cost and what percent would your total annual cost change? What is the new total annual cost and what percent would your annual total cost change if the order quantity is increased to the nearest whole case? Hint: Use the formula [New Total Cost / Old Total Cost].

4) Powell has been working with the information technology department to implement some new Robotic Process Automation (RPA) scripts which will decrease the time required to place purchase orders. Powell estimates that if the new RPA processes are put in place, the cost of placing a purchase order will decrease to $32. What impact will this change have on the total annual cost for the sample item?

5) Based on these 4 different evaluations of the appropriate order quantity, what do you recommend? Explain your recommendation.

6) Calculate Reorder Point. Supplier lead-time given in the CASE above. Management policy is to serve the customers at 98%. What is your observation?

7) Prepare your individual response to the case using a Report Format. Start with a cover page, then an executive summary which briefly states the context and major issues of the case (1-2 paragraphs), then provide your Analysis starting with the completed table. Show calculations for partial credit. Follow the table with your numbered responses to the 6 questions (1 paragraph each). Save your final document as a PDF and upload it to Blackboard. Total # pages not to exceed 4-5 pages.

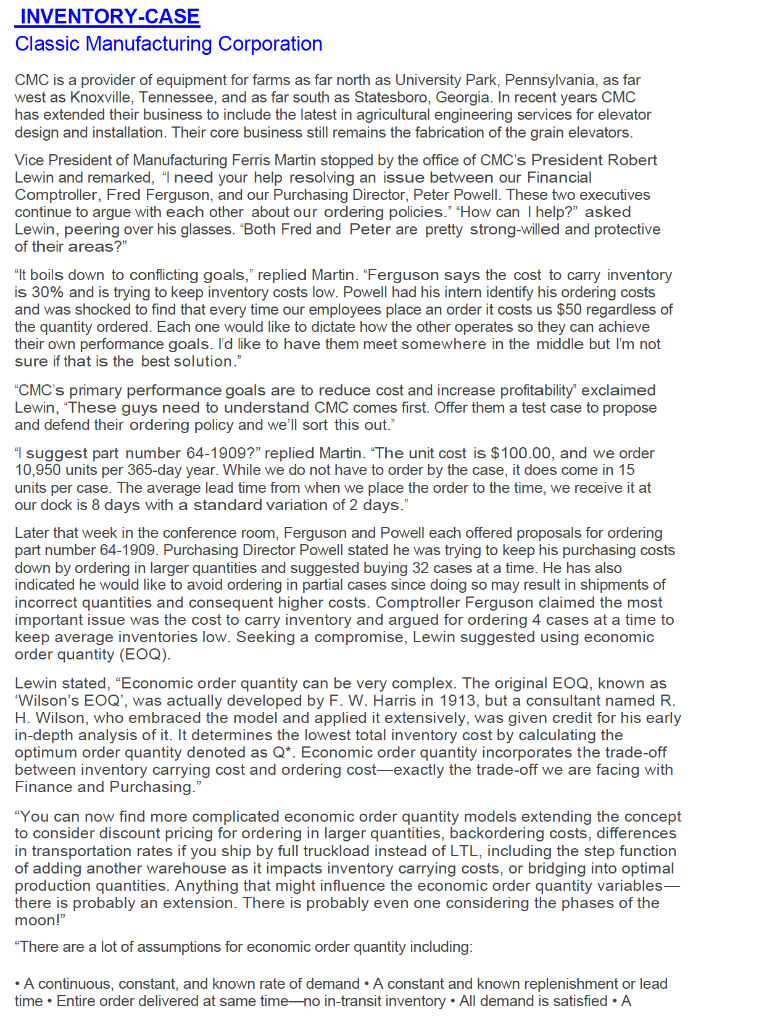

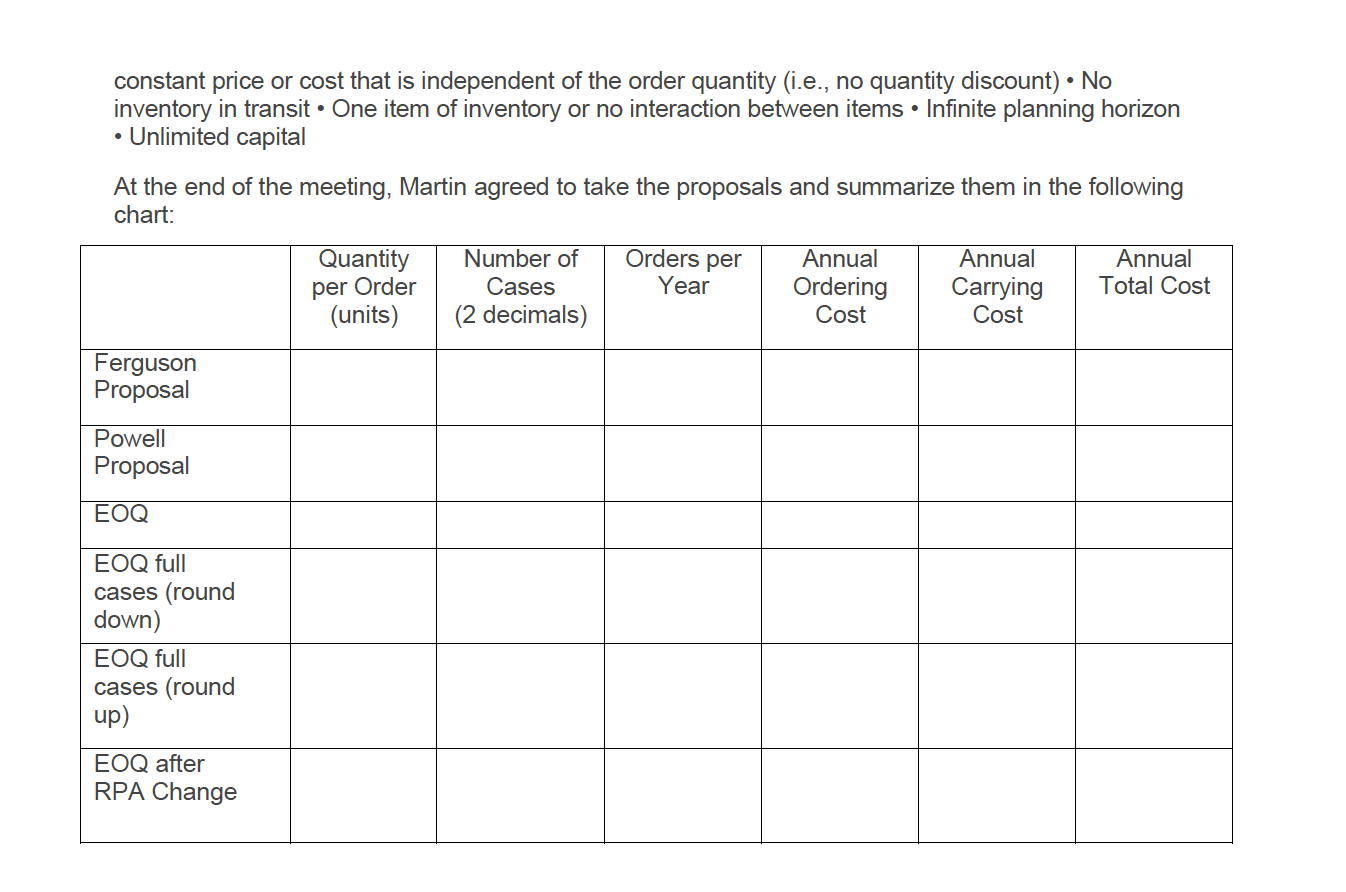

INVENTORY-CASE Classic Manufacturing Corporation CMC is a provider of equipment for farms as far north as University Park, Pennsylvania, as far west as Knoxville, Tennessee, and as far south as Statesboro, Georgia. In recent years CMC has extended their business to include the latest in agricultural engineering services for elevator design and installation. Their core business still remains the fabrication of the grain elevators. Vice President of Manufacturing Ferris Martin stopped by the office of CMC's President Robert Lewin and remarked, "I need your help resolving an issue between our Financial Comptroller, Fred Ferguson, and our Purchasing Director, Peter Powell. These two executives continue to argue with each other about our ordering policies." "How can I help?" asked Lewin, peering over his glasses. Both Fred and Peter are pretty strong-willed and protective of their areas?" "It boils down to conflicting goals," replied Martin. "Ferguson says the cost to carry inventory is 30% and is trying to keep inventory costs low. Powell had his intern identify his ordering costs and was shocked to find that every time our employees place an order it costs us $50 regardless of the quantity ordered. Each one would like to dictate how the other operates so they can achieve their own performance goals. I'd like to have them meet somewhere in the middle but I'm not sure if that is the best solution." "CMC's primary performance goals are to reduce cost and increase profitability' exclaimed Lewin, "These guys need to understand CMC comes first. Offer them a test case to propose and defend their ordering policy and we'll sort this out." "I suggest part number 64-1909?" replied Martin. 'The unit cost is $100.00, and we order 10,950 units per 365-day year. While we do not have to order by the case, it does come in 15 units per case. The average lead time from when we place the order to the time, we receive it at our dock is 8 days with a standard variation of 2 days." Later that week in the conference room, Ferguson and Powell each offered proposals for ordering part number 64-1909. Purchasing Director Powell stated he was trying to keep his purchasing costs down by ordering in larger quantities and suggested buying 32 cases at a time. He has also indicated he would like to avoid ordering in partial cases since doing so may result in shipments of incorrect quantities and consequent higher costs. Comptroller Ferguson claimed the most important issue was the cost to carry inventory and argued for ordering 4 cases at a time to keep average inventories low. Seeking a compromise, Lewin suggested using economic order quantity (EOQ). Lewin stated, Economic order quantity can be very complex. The original EOQ, known as 'Wilson's EOQ', was actually developed by F. W. Harris in 1913, but a consultant named R. H. Wilson, who embraced the model and applied it extensively, was given credit for his early in-depth analysis of it. It determines the lowest total inventory cost by calculating the optimum order quantity denoted as Q*. Economic order quantity incorporates the trade-off between inventory carrying cost and ordering cost-exactly the trade-off we are facing with Finance and Purchasing." "You can now find more complicated economic order quantity models extending the concept to consider discount pricing for ordering in larger quantities, backordering costs, differences in transportation rates if you ship by full truckload instead of LTL, including the step function of adding another warehouse as it impacts inventory carrying costs, or bridging into optimal production quantities. Anything that might influence the economic order quantity variables- there is probably an extension. There is probably even one considering the phases of the moon!" "There are a lot of assumptions for economic order quantity including: A continuous, constant, and known rate of demand. A constant and known replenishment or lead time. Entire order delivered at same timeno in-transit inventory. All demand is satisfied. A constant price or cost that is independent of the order quantity (i.e., no quantity discount) No inventory in transit. One item of inventory or no interaction between items Infinite planning horizon Unlimited capital At the end of the meeting, Martin agreed to take the proposals and summarize them in the following chart: Quantity Number of Orders per Annual Annual Annual Cases Year Ordering Carrying Total Cost (units) (2 decimals) Cost Cost Ferguson Proposal per Order Powell Proposal EOQ EOQ full cases (round down) EOQ full cases (round up) EOQ after RPA Change INVENTORY-CASE Classic Manufacturing Corporation CMC is a provider of equipment for farms as far north as University Park, Pennsylvania, as far west as Knoxville, Tennessee, and as far south as Statesboro, Georgia. In recent years CMC has extended their business to include the latest in agricultural engineering services for elevator design and installation. Their core business still remains the fabrication of the grain elevators. Vice President of Manufacturing Ferris Martin stopped by the office of CMC's President Robert Lewin and remarked, "I need your help resolving an issue between our Financial Comptroller, Fred Ferguson, and our Purchasing Director, Peter Powell. These two executives continue to argue with each other about our ordering policies." "How can I help?" asked Lewin, peering over his glasses. Both Fred and Peter are pretty strong-willed and protective of their areas?" "It boils down to conflicting goals," replied Martin. "Ferguson says the cost to carry inventory is 30% and is trying to keep inventory costs low. Powell had his intern identify his ordering costs and was shocked to find that every time our employees place an order it costs us $50 regardless of the quantity ordered. Each one would like to dictate how the other operates so they can achieve their own performance goals. I'd like to have them meet somewhere in the middle but I'm not sure if that is the best solution." "CMC's primary performance goals are to reduce cost and increase profitability' exclaimed Lewin, "These guys need to understand CMC comes first. Offer them a test case to propose and defend their ordering policy and we'll sort this out." "I suggest part number 64-1909?" replied Martin. 'The unit cost is $100.00, and we order 10,950 units per 365-day year. While we do not have to order by the case, it does come in 15 units per case. The average lead time from when we place the order to the time, we receive it at our dock is 8 days with a standard variation of 2 days." Later that week in the conference room, Ferguson and Powell each offered proposals for ordering part number 64-1909. Purchasing Director Powell stated he was trying to keep his purchasing costs down by ordering in larger quantities and suggested buying 32 cases at a time. He has also indicated he would like to avoid ordering in partial cases since doing so may result in shipments of incorrect quantities and consequent higher costs. Comptroller Ferguson claimed the most important issue was the cost to carry inventory and argued for ordering 4 cases at a time to keep average inventories low. Seeking a compromise, Lewin suggested using economic order quantity (EOQ). Lewin stated, Economic order quantity can be very complex. The original EOQ, known as 'Wilson's EOQ', was actually developed by F. W. Harris in 1913, but a consultant named R. H. Wilson, who embraced the model and applied it extensively, was given credit for his early in-depth analysis of it. It determines the lowest total inventory cost by calculating the optimum order quantity denoted as Q*. Economic order quantity incorporates the trade-off between inventory carrying cost and ordering cost-exactly the trade-off we are facing with Finance and Purchasing." "You can now find more complicated economic order quantity models extending the concept to consider discount pricing for ordering in larger quantities, backordering costs, differences in transportation rates if you ship by full truckload instead of LTL, including the step function of adding another warehouse as it impacts inventory carrying costs, or bridging into optimal production quantities. Anything that might influence the economic order quantity variables- there is probably an extension. There is probably even one considering the phases of the moon!" "There are a lot of assumptions for economic order quantity including: A continuous, constant, and known rate of demand. A constant and known replenishment or lead time. Entire order delivered at same timeno in-transit inventory. All demand is satisfied. A constant price or cost that is independent of the order quantity (i.e., no quantity discount) No inventory in transit. One item of inventory or no interaction between items Infinite planning horizon Unlimited capital At the end of the meeting, Martin agreed to take the proposals and summarize them in the following chart: Quantity Number of Orders per Annual Annual Annual Cases Year Ordering Carrying Total Cost (units) (2 decimals) Cost Cost Ferguson Proposal per Order Powell Proposal EOQ EOQ full cases (round down) EOQ full cases (round up) EOQ after RPA ChangeStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts