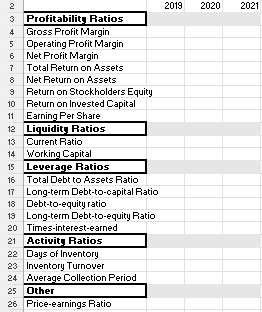

Question: Ratio analysis for the ratios shown on Table 1 in the Guide to Case Analysis (CA) of the textbook: a. Profitability ratios b. Liquidity ratios

Ratio analysis for the ratios shown on Table 1 in the Guide to Case Analysis (CA) of the textbook: a. Profitability ratios b. Liquidity ratios c. Leverage ratios d. Activity ratios e. Price-to-earnings ratio f. The changes between years are included in the calculations

![Flows - USD [\$] $ in Thousands 12 Months Ended Deo.31,2021 Deo.](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66ce267323efb_29066ce2672ce0da.jpg)

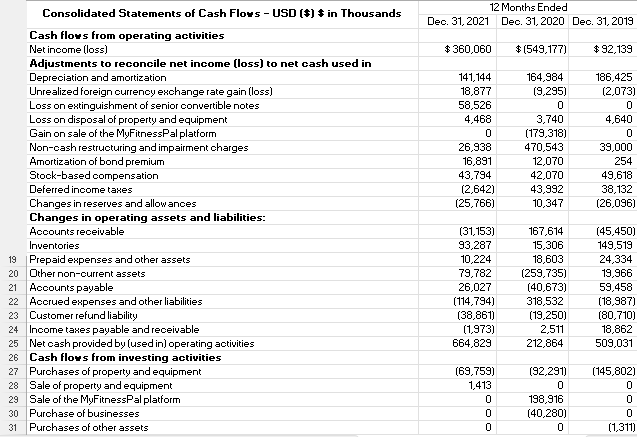

Consolidated Statements of Cash Flows - USD [\$] $ in Thousands 12 Months Ended Deo.31,2021 Deo. 31,2020 Dee. 31, 2019 Cash flows from operating activities Net inoome (loss) $360,060$[549,177)$92,139 Adjustments to reconcile net income [loss) to net cash used in Depreciation and amortization Unrealized foreign currency exchange rate gain (loss) Loss on extinguishment of senior convertible notes Loss on disposal of property and equipment Gain on sale of the MyFitnessPal platform Non-cash restructuring and impairment charges Amortization of bond premium Stook-based compensation Deferredincome tanes Changes in reserves and allow ances Changes in operating assets and liabilities: Acoounts receivable Inventories i9 Prepaid expenses and other assets 20 Dther non-current assets 21 Acoounts payable 22 Acorued expenses and other liabilities 23 Customer refund liability 24 Income tares payable and reoeivable 25 Net cash provided by (used in) operating activities 26 Cash flows from inuesting activities 27 Purchases of property and equipment 28 Sale of property and equipment 29 Sale of the MyFitnessPal plattorm 30 Purchase of businesses 31 Purohases of other assets Consolidated Statements of Cash Flows - USD [\$] $ in Thousands 12 Months Ended Deo.31,2021 Deo. 31,2020 Dee. 31, 2019 Cash flows from operating activities Net inoome (loss) $360,060$[549,177)$92,139 Adjustments to reconcile net income [loss) to net cash used in Depreciation and amortization Unrealized foreign currency exchange rate gain (loss) Loss on extinguishment of senior convertible notes Loss on disposal of property and equipment Gain on sale of the MyFitnessPal platform Non-cash restructuring and impairment charges Amortization of bond premium Stook-based compensation Deferredincome tanes Changes in reserves and allow ances Changes in operating assets and liabilities: Acoounts receivable Inventories i9 Prepaid expenses and other assets 20 Dther non-current assets 21 Acoounts payable 22 Acorued expenses and other liabilities 23 Customer refund liability 24 Income tares payable and reoeivable 25 Net cash provided by (used in) operating activities 26 Cash flows from inuesting activities 27 Purchases of property and equipment 28 Sale of property and equipment 29 Sale of the MyFitnessPal plattorm 30 Purchase of businesses 31 Purohases of other assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts