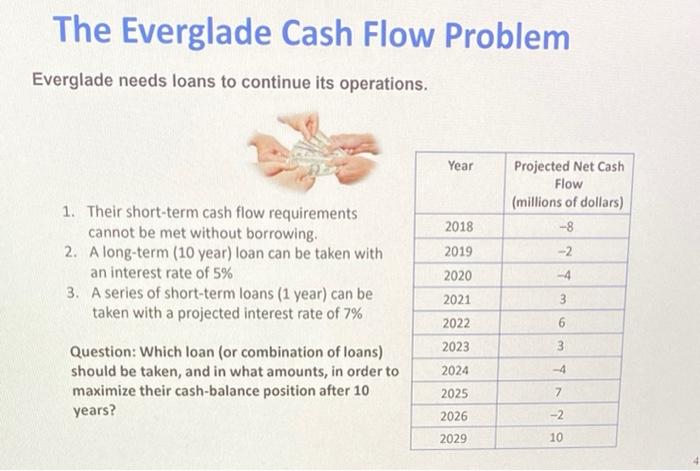

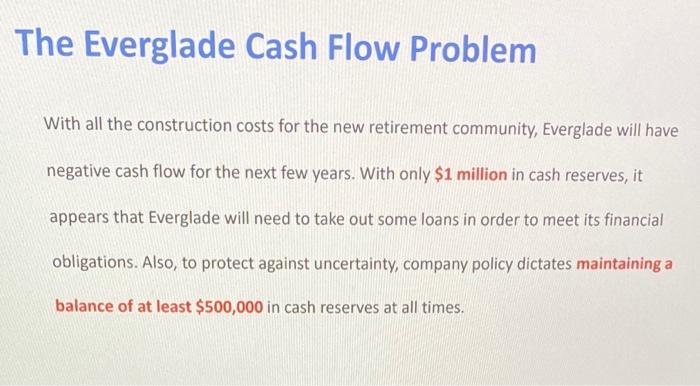

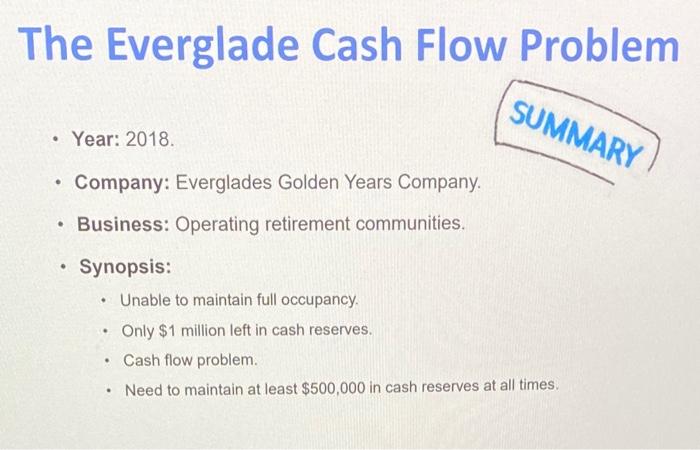

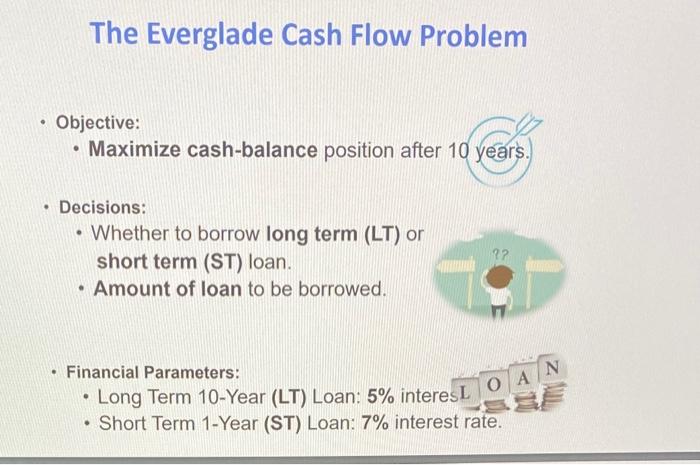

Question: Read Everglade Company's (attached Case), Build a new module to formulate the problem mathematically in a spreadsheet, and use the MS solver to find out

Read Everglade Company's (attached Case), Build a new module to formulate the problem mathematically in a spreadsheet, and use the MS solver to find out how to maximize the company cash flow in the ending cash flow in 2027.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock