Question: Read the case and answer the questions: 1). What type of competitive advantage do you think the company seeks to create by engaging in strategic

Read the case and answer the questions:

1). What type of competitive advantage do you think the company seeks to create by engaging in strategic alliances?

2). Evaluate the effectiveness of the companys strategic alliance activity.

3). Are there any risks for the company associated with pursuing strategic alliances in the future?

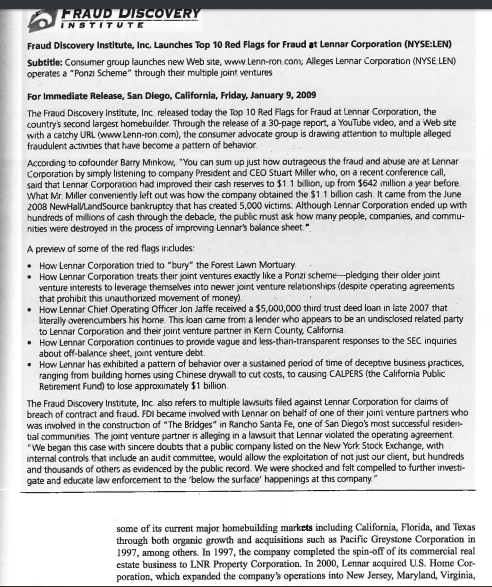

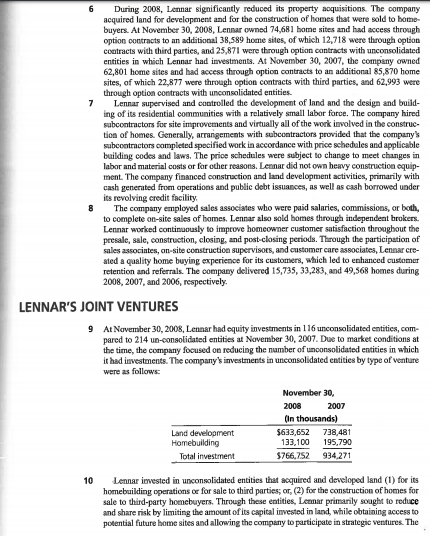

Lennar Corporation's Joint Venture Investments Amid our negative sector stance, we are upgrading our relative rating on LEN to Over weight from Neutral, as our new price target represents lower downside potential on the stocks its peers. Importantly, in addition to LEN relative underperformance and below-average valuation, our outlook for below average book value contraction by 2009-end is a key factor behind our relative ratings change. Specifically, over the last 12 months, LEN has underperformed, down 33% vs. the groups 23% decline (S&P: -36%), we believe largely driven by concerns regarding its above average JV exposure This performance, In turn, has in part led to a 35% valuation discount to its peers on a P/B basis, currently at 0.50x vs. its larger-cap peers '0.77x average. However, while we believe this valuation discount could narrow, given LEN continued reduction in JV exposure, our outlook for below-average book value contraction is the key driver for LENS lower downside risk in our view JP Morgan, Lennar, January 8, 2009, On January 8, 2009, Anna Amphlett reflected on JP Morgan's report that Lennar Corpora tion's stock price had been negatively impacted by the recent U.S. housing crisis more than other firms in the housing industry, and therefore, the investment risk was less than that of its peers (see Exhibit 1 for the company's recent stock price performance). Amphlett, a newly recruited financial analyst at Southern Cross Investments LLC, had been asked to prepare a report on Lennar's joint ventures and how the company accounted for these investments. She knew that she would be questioned by her boss about JP Morgan concer over Lennar's "above-average JV exposure," since she had learned in her MBA program that joint ventures were a practical way for a company to diversify risk and gain access to the expertise of joint venture partners. But she knew as well that joint ventures were also a method some companies used to finance investments "off-balance sheet." She wondered if the stock might even stage a comeback in the near future. JP Morgan set a price target for Lennar's stock of $8.50 per share, less than the shares trading range of around $11. Lennar had grown considerably through 2006, but in the last two years, revenues had suffered a sizeable reversal (see Exhibit 2 for historical financial information). On returning from a two-week vacation, Amphlett was shocked to learn that on Janu- ary 9, Barry Minkow's Fraud Discovery Institute (FDI) had raised questions on a Web site about Lennar's off-balance-sheet debt and a large personal loan taken out by a top company executive (see Exhibit 3 for details of the allegations). 'On the day of the announcement, the company's stock price plunged and trading volume increased dramatically (see Exhibit 4 for information about the stock price reaction to the Minkow claims). Amphlett's completed research report recommended that Southern Cross acquire Lennar's shares, but she now realized it was imperative that she understand the nature and purpose of Lennar's joint ventures before submitting the report. COMPANY BACKGROUND 3 By early 2009, Lennar Corporation was one of the nation's largest homebuilders and a provider of financial services. The company's homebuilding operations included the con- struction and sale of single-family attached and detached homes, and multilevel residential buildings, in communities targeted to first-time, move-up, and active adult homebuyers. The company was also involved in the purchase, development, and sale of residential land, and in all phases of planning and building in residential communities, including land acqui sition, site planning, preparation and improvement of land, and design, construction, and marketing of homes. The company operated in Florida, Maryland, New Jersey, Virginia, Arizona, Colorado, Texas, California, Nevada, Illinois, Minnesota, New York, and both North and South Carolina. The company's financial services business provided mortgage financing, title insurance, closing services, and other ancillary services (including high- speed Internet and cable television) for both buyers and sellers. Substantially all of the loans that the company originated were sold in the secondary mortgage market on a servicing released, nonrecourse basis. The average sales price of a Lennar home was $270,000 in fis- cal 2008, compared to $297,000 in fiscal 2007. Lennar was founded as a local Miami homebuilder in 1954. The company completed an initial public offering in 1971, and listed its common stock on the New York Stock Exchange in 1972. During the 1980s and 1990s, the company entered and expanded operations in FRAUD DISCOVERY INSTITUTE Fraud Discovery Institute, Inc. Launches Top 10 Red Flags for Fraud at Lennar Corporation (NYSE:LEN) Subtitle: Consumer group launches new Web site, www.Lenn-roncom Aleges Lennar Corporation (NYSE LENO operates a Ponzi Scheme through their multiple joint ventures For Immediate Release, San Diego, California, Friday, January 9, 2009 The Fraud Discovery Institute, Inc. released today the Top 10 Red Flags for Fraud at Lennar Corporation, the country's second largest homebuilder. Through the release of a 30-page report, a YouTube video, and a Web site with a catchy URL www Lenn-roncom), the consumer advocate group is drawing attention to multiple alleged fraudulent activities that have become a pattern of behavior According to cofounder Barry Minkow, "You can sum up just how outrageous the fraud and abuse are at Lennar Corporation by simply listening to company President and CEO Stuart Miller who, on a recent conference call, said that Lennar Corporation had improved their cash reserves to $1.1 billion, up from 5642 million a year before What Mr Miller conveniently left out was how the company obtained the $1.1 billion cash It came from the June 2008 NewHallandsource bankruptcy that has created 5,000 victims. Although Lennar Corporation ended up with hundreds of millions of cash through the debacle, the public must ask how many people companies, and commu- nities were destroyed in the process of improving Lennar's balance sheet" A preview of some of the red flags includes: How Lennar Corporation tried to "bury" the Forest Lawn Mortuary How Lennar Corporation treats their joint ventures exactly like a Ponzi scheme pledging their older joint venture interests to leverage themselves into newer joint venture relationships (despite operating agreements that prohibit this unauthorized movement of money) How Lennar Chief Operating Officer Jon Jaffe received a $5,000,000 third trust deed loan in late 2007 that literally overencumbers his home. This loan came from a lender who appears to be an undisclosed related party to Lennar Corporation and their joint venture partner in Kern County, California How Lennar Corporation continues to provide vague and less-than-transparent responses to the SEC inquiries about off-balance sheet, joint venture debt How Lennar has exhibited a pattern of behavior over a sustained period of time of deceptive business practices ranging from building homes using Chinese drywall to cut costs, to causing CALPERS (the California Public Retirement Fund) to lose approximately $1 billion The Fraud Discovery Institute, Inc also refers to multiple lawsuits filed against Lennar Corporation for claims of breach of contract and fraud. FDI became involved with Lennar on behalf of one of their joint venture partners who was involved in the construction of "The Bridges" in Rancho Santa Fe, one of San Diego's most successful resider tial communities. The joint venture partner is alleging in a lawsuit that Lennar violated the operating agreement "We began this case with sincere doubts that a public company listed on the New York Stock Exchange, with internal controls that include an audit committee, would allow the exploitation of not just our client, but hundreds and thousands of others as evidenced by the public record. We were shocked and felt compelled to further investi- gate and educate law enforcement to the below the surface' happenings at this company some of its current major homebuilding markets including California, Florida, and Texas through both organic growth and acquisitions such as Pacific Greystone Corporation in 1997, among others. In 1997, the company completed the spin-off of its commercial real estate business to LNR Property Corporation. In 2000, Lennar acquired U.S. Home Cor poration, which expanded the company's operations into New Jersey, Maryland, Virginia, Minnesota, and Colorado, and strengthened its position in other states. During 2002 and 2003, the company acquired several regional homebuilders, which brought the company into new markets and strengthened its position in several existing markets. The company balanced a local operating structure with centralized corporate level man agement. Decisions related to the overall strategy, acquisitions of land and businesses, risk management, financing, cash management, and information systems were centralized af the corporate level. The local operating structure consisted of divisions, which were man aged by individuals who had significant experience in the homebuilding industry and, in most instances, in their particular markets. They were responsible for operating decisions regarding land identification, entitlement and development, the management of inventory levels for the current volume levels, community development, home design, construction and marketing homes. See Leer Corporation 2008 10-K filing on the comm 's Website During 2008, Lennar significantly reduced its property acquisitions. The company acquired land for development and for the construction of homes that were sold to home buyers. Al November 30, 2008. Lennar owned 74,681 home sites and had access through option contracts to an additional 38.589 home sites of which 12,718 were through option contracts with third parties, and 25,871 were through option contracts with consolidated entities in which Lennar had investments. At November 30, 2007, the company owned 62,801 home sites and had access through option contracts to an additional R$ 870 home sites, of which 22.877 were through option contracts with third parties, and 62,993 were through option contracts with consolidated entities Lennar supervised and controlled the development of land and the design and build- ing of its residential communities with a relatively small labor force. The company hired subcontractors for site improvements and virtually all of the work involved in the construc tion of homes. Generally, arrangements with subcontractors provided that the company's subcontractors completed specified work in accordance with price schedules and applicable building codes and laws. The price schedules were subject to change to meet changes in labor and material costs or for other reasons. Lennar did not own heavy construction equip ment. The company financed construction and land development activities, primarily with cash generated from operations and public debt issuances, as well as cash borrowed under its revolving credit facility, The company employed sales associates who were paid salaries, commissions, or both, to complete on-site sales of homes. Lennar also sold homes through independent brokers. Lennar worked continuously to improve homeowner customer satisfaction throughout the presale, sale, construction, closing, and post closing periods. Through the participation of sales associates, on-site construction supervisors, and customer care associates, Lennar re- ated a quality home buying experience for its customers, which led to enhanced customer retention and referrals. The company delivered 15,735, 33,283, and 49,568 homes during 2008, 2007 and 2006, respectively. LENNAR'S JOINT VENTURES 9 At November 30, 2008, Lennar had equity investments in 116 unconsolidated entities, com pared to 214 un-consolidated entities at November 30, 2007. Due to market conditions at the time, the company focused on reducing the number of unconsolidated entities in which it had investments. The company's investments in unconsolidated entities by type of venture were as follows: November 30, 2008 2007 In thousands) 5633,652 738,481 133,100 195,790 5766,752 934.271 Land development Homebuilding Total investment Lennar invested in consolidated entities that acquired and developed land (1) for its homebuilding operations or for sale to third parties, or, (2) for the construction of homes for sale to third-party homebuyers. Through these entities. La primarily sought to reduce and share risk by limiting the amount of its capital invested in land, while obtaining access to potential future home sites and allowing the company to participate in strategie ventures. The use of these entities also, in some instances, enabled the company to acquire and to which is could pot obrise in access or could not obtain access on a favorable terms, without the participation of a strategic partner Participants in these joint ventures were landowner developers, other homebuilders, and financial or strategic partners. Joint ventures with land owners developers gave the company access to home sites owned or controlled by a partner Joint ventures with other home builders provided the company with the ability to bid jointly with the partner for large and paroels. Joint ventures with financial partners allowed Len ner to combine its homebuilding expertise with access to its partners' capital Joint ventures with strategic partners allowed the company to combine its homebuilding expertise with the specific expertise (eg. commercial or infill experience) of its partner Although the strategic purposes of its joint ventures and the nature of its joint venture partners varied, the joint ventures were generally designed to acquire, develop, and/or sell specific assets during a limited lifetime. The joint ventures were typically structured through noncorporate entities in which control was shared with its venture partners. Each joint ven- ture was unique in terms of its funding requirements and liquidity needs. Lennar and the other joint venture participants typically made pro-rata cash contributions to the joint ven- ture. In many cases, Lennar's risk was limited to its equity contribution and potential future capital contributions. The capital contributions usually coincided in time with the acquisition of properties by the joint venture. Additionally, most joint ventures obtained third-party debt to fund a portion of the acquisition, development, and construction costs of their communi- ties. The joint venture agreements usually permitted, but did not require, the joint ventures to make additional capital calls in the future. However, capital calls relating to the repayment of joint venture deht, under payment of maintenance guarantees, generally were required. See Exhibits and 6 for selected financial statement information about Lennar Corporation. SHARING ARRANGEMENTS 12 Alliances, partnering, mergers and acquisitions, and joint ventures are sharing ang ments that enable parties to collaborate for mutual gain that would not otherwise be avail able from working alone. Each party may enter the relationship to obtain access to physical resources, financing, risk-sharing opportunities, specific skills and technologies, and see products and markets. Joint ventures usually involve creating a separate organization estab lished through equity participation by the joint venture partners, and under their mu shared control. Mergers and acquisitions involve the acquisition and control of one cotty by another, or the creation of a third entity owned by each of the merger parties. Alliance usually involve contractual agreements to work together in specific ways and for specific periods, and share any resulting revenues, or profits, but do not involve equity participant by the parties One study found that joint venture announcements in the period 1972-1979 resulted a statistically significant two-day increase in shareholder wealth of 0.74%, suggesting that investors perceive joint ventures as enhancing shareholderwealth. Another study reported that the NUMMI joint venture established in 1983 between General Motors (GM) Toyota in an idle GM plant was a major factor in the improvement in manufacturing quality and productivity at GM. At the outset, the cooperation provided an opportunity for ca party to gain more from working together than working alonpTovota wanted to le about managing an American workforce, while GM wanted to learn about building . 14 cars using lean manufacturing methods, and to utilize an idle plant. A third study noted that joint venture formations reached a peak in 1995, but have declined in popularity beca excutives have been concerned about three key issues lack of control, lack of trust, and uncertainty about exiting from the arrangement. Evidence gests that strategic alliances also create shareholder value. One study of stra toge alliances formed during the period 1983-1992 found that there were significant posle tive announcement returns of 0.64% surrounding the announcement A study of all in the movie industry found that movie studios financed their least risky projects internally and that cofinanced projects through alliances were relatively riskier and more likely to be undertaken by studios that were more financially constrained. The authors argued that the results were consistent with the notion that a studio might improve the incentive of manag- ers of a riskier project by deploying the project outside the firm in an alliance in which the enforceable contract between the two parties guaranteed a "haseline level of financing Another form of joint venture is a financial joint venture, also known as project finan ing. Under project financing, two or more equity partners combine their capital with funds provided by lenders to invest in a specific project. Finnerty (1996) defines project finance as: "The raising of funds to finance an economically separable capital investment project in which the providers of funds look primarily to the cash flows from the project as the source of funds to service their loans and provide a return of and a return on their equity invested in the project. Some have suggested that the primary purpose of project financing is to enable equity partners to mgage inoff-balance sheet financing. For example, if each equity partner owned 50% of the total equity, accounting rules in many countries would enable the partners to avoid consolidating the financial statements of the joint venture, and thereby avoid reporting the joint venture debt on their own books, as permitted under the equity method of accounting Brealey Cooper, and Habib suggest that project financing enables equity parters to obtain debt financing on more favorable terms by reducing transactice costs incurred by lenders in assessing the creditworthiness of the specific project assets. If the equity partners borrowed debt funds directly, a leader would be required to assess the creditworthiness of the entire asset portfolio COMPETITION 16 The residential homebuilding industry is a very competitive business Participants com pete vigorously for homebuyers in each of the major market regions. Efforts by lenders to sell foreclosed homes were an increasingly competitive factor in the deep recession in the U.S. that began in 2008. Lennar competed for homebuyers on the basis of location, price, reputation, amenities, design, quality, and financing. Lennar also competed with other homebuilders for desirable properties, raw materials, reliable and skilled labor, and with third parties in selling land to home builders and others. There were several large geographi cally diversified homebuilders in the US, including D.R. Horton, Inc., KB Home, and Pulte Homes, Inc., vying in the same markets as Lennar. See Exhibits 7 and 8 for selected financial information about Lennar's competitors in the homebuilding industry DR. Horton, Inc. was the largest homebuilding company in the United States, based on homes closed during the 12 months ended September 30, 2008. The company constructed and sold high-quality homes through its operating divisions in 27 states and 77 metropolitan markets of the United States, primarily under the name of D.R. Horten, America Builder The company's homes ranged in size from 1,000 to 5,000 square feet, and in price from $90,000 to $900,000. The downturn in the industry resulted in a decrease in the size of the company operations during fiscal 2007 and 2008. For the year ended September 30, 2008, Horton closed 26,396 homes with an average closing sales price of approximately $233,500. Through the company's financial services operations, it provided mortgage financing and title agency services to homebuyers in many of its bomebuilding markets. DHI Mortgage the company's wholly owned subsidiary, provided mortgage financing services principally to purchasers of homes built by the company. Horton generally did not retain or service the mortgages it originated but, rather, sold the mortgages and related servicing rights to live tors. A subsidiary title company served as title insurance Agents by providing title insurance policies, examination, and closing services, primarily to the purchasers of its homes KB Home, one of the nation's largest homebuilders, was a Fortune 500 company listed on the New York Stock Exchange under the ticker symbol "KBH" The company four home building segments offered a variety of homes designed primarily for first time, first move . and active adult buyers, including attached and detached single-family homes, townhomes, and condominiums KB offered homes in development communities, at urbanin-fiul locations, and as part of mixed-use projects. The company delivered 12,438 homes in 2008 and 23,743 homes in 2007. In 2008, the average selling price of $236,400 decreased from $261,600 in 2007. Pulte Homes, Inc. was a publicly held holding company whose subsidiaries engaged in the homebuilding and financial services businesses. Homebuilding, the company's core business, was engaged in the acquisition and development of land primarily for residential purposes within the continental United States, and the construction of housing on such land targeted for first time, first and second move-up, and active adult home buyers. LENNAR'S FUTURE 20 Amphlett knew that understanding Lennar's business and charting the company future would be a difficult task. In addition to financial statement information, she gathered cap tal markets data (see Exhibit 9). The recent two-week vacation seemed a long while ago even though she had been back at work only three days. She wondered whether Lennar management would become distracted by efforts to control the damage caused by the Fraud Discovery Institute claims, and exacerbate the company's problems caused by the financial crisis, mortgage defaults, and a dramatic fall in house prices across the country, and pas ticularly in Arizona, Floride, and Nevada, markets where Lennar was activeStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts