Question: Read the short article: . Given the information in the article, analyze Sephora's core competency that provides them value and competitive advantage over its competition

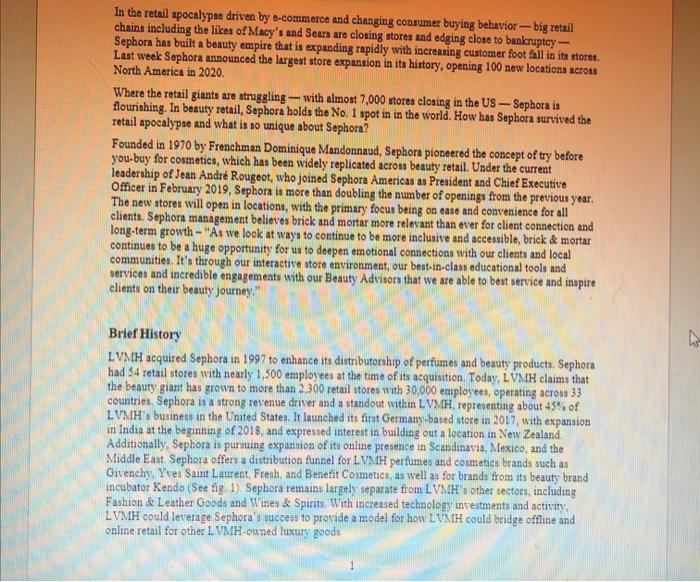

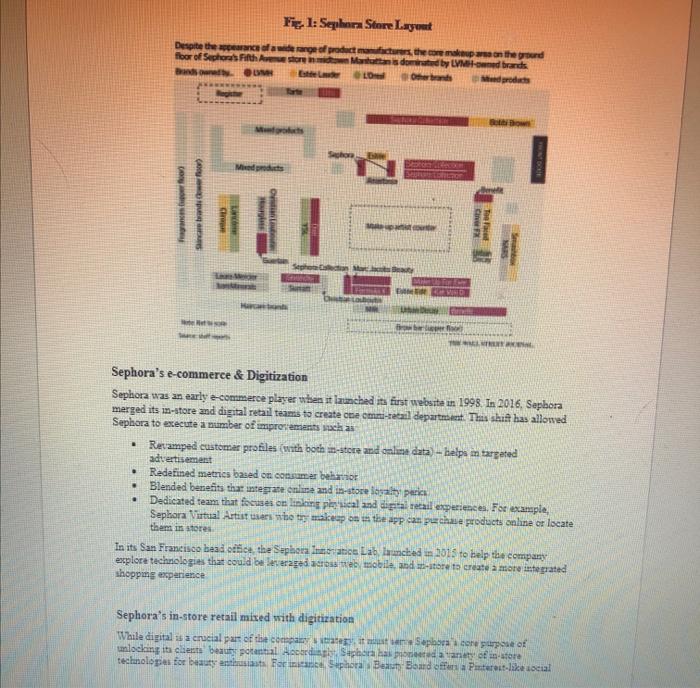

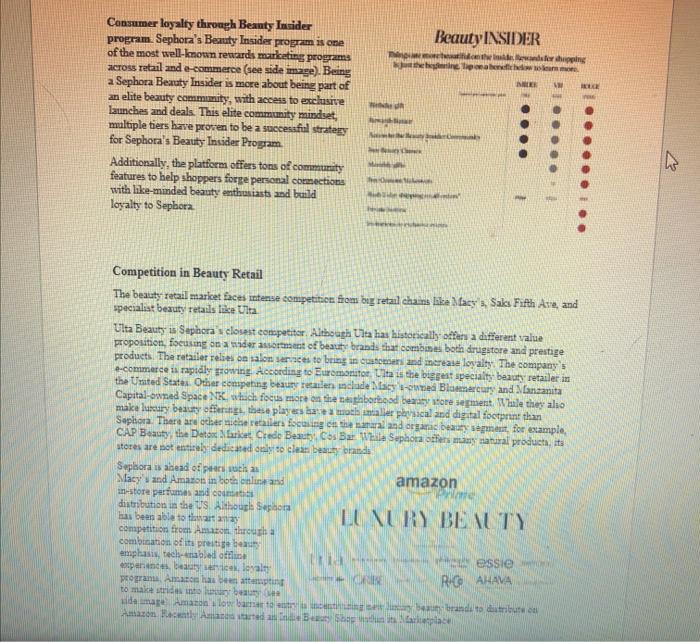

Read the short article: . Given the information in the article, analyze Sephora's core competency that provides them value and competitive advantage over its competition . Can Sephora leverage its core competency to outperform competition? Note: Please keep your answer short and efficient. If you like, you can use bullet points for your answer. In the retail apocalypse driven by e-commerce and changing consumer buying behavior - big retail chains including the likes of Macy's and Sears are closing stores and edging close to bankruptcy - Sephora has built a beauty empire that is expanding rapidly with increasing customer foot fall in its stores, Last week Sephora announced the largest store expansion in its history, opening 100 new locations across North America in 2020. Where the retail giants are struggling -- with almost 7,000 stores closing in the US -- Sephora is flourishing. In beauty retail, Sephora holds the No. 1 spot in in the world. How has Sephora survived the Tetail apocalypse and what is so unique about Sephora? Founded in 1970 by Frenchman Dominique Mandonnaud, Sephora pioneered the concept of try before you-buy for cosmetics, which has been widely replicated across beauty retail. Under the current leadership of Jean Andr Rougeot, who joined Sephora Americas as President and Chief Executive Officer in February 2019, Sephora is more than doubling the number of openings from the previous year. The new stores will open in locations, with the primary focus being on ease and convenience for all clients. Sephora management believes brick and mortar more relevant than ever for client connection and long-term growth - "As we look at ways to continue to be more inclusive and accessible, brick & mortar continues to be a huge opportunity for us to deepen emotional connection with our clients and local communities. It's through our interactive store environment, our best-in-class educational tools and services and incredible engagements with our Beauty Advisors that we are able to best service and inspire clients on their beauty journey." 7 Brief History LVMH acquired Sephora in 1997 to enhance its distributorship of perfumes and beauty products. Sephora had 54 retail stores with nearly 1,500 employees at the time of its acquisition Today, LVMH claims that the beauty giant has grown to more than 2.300 retail stores with 30,000 employees, operating acrous 33 countries Sephora is a strong revenue driver and a standout within LVMH representing about 45% of LVMH's business in the United States. It launched its first Germany based utore in 2017, with expansion in India at the beginning of 2018, and expressed interest in building out a location in New Zealand Additionally, Sephora is pursuing expansion of its online presence in Scandinavia, Mexico, and the Middle East Sephora offers a distribution funnel for LVMH perfumes and cosmetics brands such as Givenchy Yves Saint Laurent, Fresh, and Benefit Cosmetics, as well as for brands from its beauty brand incubator Kendo (See ng 1) Sephora remains largely separate from LVMH 5 other sectors, including Fashion & Leather Goods and Wines & Spirits. With increased technology investments and activity, LVMH could leverage Sephora's success to provide a model for how LVMH could bridge offline and online retail for other LVMH-owned luxury goods Fie 1: SeharStore Layout Despite the appearance of a floor of Sephors Fifth Ave Bano DUM arge of product more the core makeup on the ground Mannsdom by LVM-brands LO brands Med products forte Botir own Merlot Mirdits C Toe ce Strand 1 TRA Sephora's e-commerce & Digitization Sephora was an early e-commerce player when it launched its first website in 1998. In 2016, Sephora merged its in-store and digital retail teams to create ne cm-retail department. This shift has allowed Sephora to execute a number of improvements such as . Revamped customar profiles with both in-store and online data) helps in targeted advertisement Redefined metrics based on camarbehavior Blended benefits that integrate online and in-store loyalty price Dedicated team that focuses on liling pls cal and digital retail experiences. For example, Sephora Virtual Artistes et scop on the app can purchase products online or locate them in stores In its San Francisco baad occa the Spherice Lab launched in 2015 to belp the company explore technologies that could be leveraged across mobile and store to create a more integrated shoppmg experience . . . Sephora's in-store retail mixed with digitization While digital is a crucial part of the company, it mat Sploracone use of unlocking its clients beauty potential According Sepera has ponedatanety of in-store technolopes for beauty enthusiasts For Sephoral Beau Boud offers a Pinteratt-like seal media platform where users can post, lion, and tag different looks and share them with Sephora's beauty community. Sephora was the first beauty brand to adopt chatbots for conversational commerce to spark more natural-feeling communication between the store and its clients. Sephora leverages augmented reality for in-store and in-app makeup trials (See fig. 2). Color IQ, Launched in collaboration with Pantone Color Institute, helps shoppers identify foundation and concealers that match precisely match their skin tones. The beauty service scans a customer's skin and assigns it a Color IQ number. Customers who have had an in-store skin scan receive a follow-up email that lists matching products based on the wser's foundation match and color key. By locking a customer's perfect color match to Sephora's in-store and online platforms, customers are incentivized to clusively purchase foundation at Sephora. Fig 2. Sephora Virtual Artist app PRODUCT TY.ON PLEM