Question: really need some help solving. thank you in advance Suppose a distribution center is considering three options for expansion. The first one is to expand

really need some help solving. thank you in advance

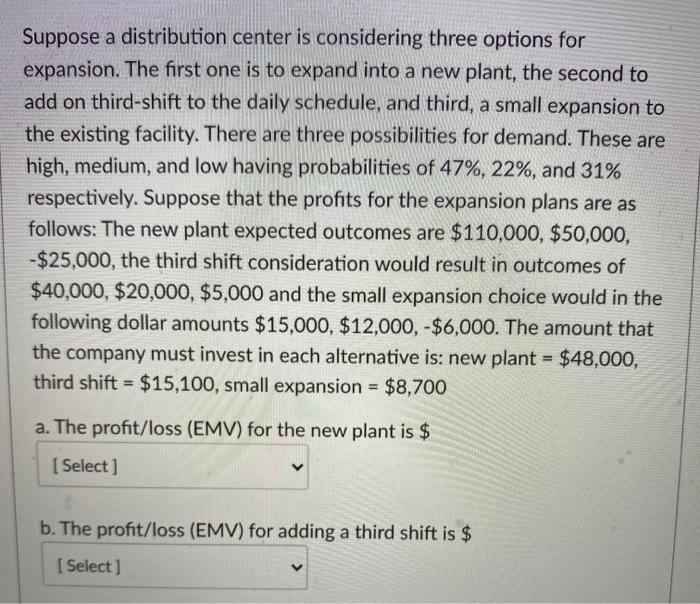

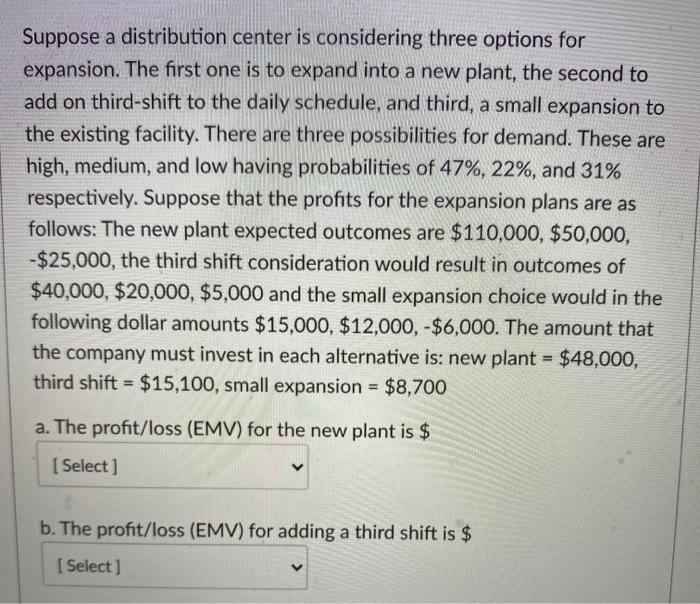

Suppose a distribution center is considering three options for expansion. The first one is to expand into a new plant, the second to add on third-shift to the daily schedule, and third, a small expansion to the existing facility. There are three possibilities for demand. These are high, medium, and low having probabilities of 47%, 22%, and 31% respectively. Suppose that the profits for the expansion plans are as follows: The new plant expected outcomes are $110,000, $50,000, -$25,000, the third shift consideration would result in outcomes of $40,000, $20,000, $5,000 and the small expansion choice would in the following dollar amounts $15,000, $12,000,-$6,000. The amount that the company must invest in each alternative is: new plant = $48,000, third shift = $15,100, small expansion = $8,700 a. The profit/loss (EMV) for the new plant is $ [ Select ] b. The profit/loss (EMV) for adding a third shift is $ [ Select] c. The profit/loss (EMV) for the small expansion is $ [Select] d. Which of the expansion plans should the manager choose? [ Select ] e. What if an outside consultant was hired by the organization and the probabilities were re-evaluated as a result of better information. The results of the research/feedback are now: 32%, 42%, 26% (high, medium, low). What choice should the manager make and what is the EMV? [Select ]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock