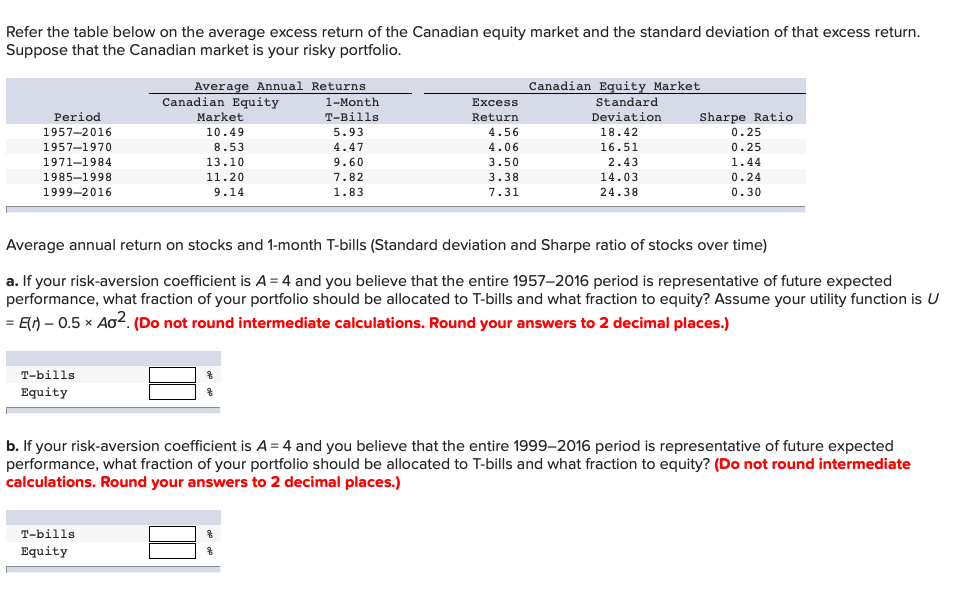

Question: Refer the table below on the average excess return of the Canadian equity market and the standard deviation of that excess return. Suppose that the

Refer the table below on the average excess return of the Canadian equity market and the standard deviation of that excess return. Suppose that the Canadian market is your risky portfolio. Period 1957-2016 1957-1970 1971-1984 1985-1998 1999-2016 Average Annual Returns Canadian Equity 1-Month Market T-Bills 10.49 5.93 8.53 4.47 13.10 9.60 11.20 7.82 1.83 Excess Return 4.56 4.06 3.50 3.38 7.31 Canadian Equity Market Standard Deviation Sharpe Ratio 18.42 0.25 16.51 0.25 2.43 1.44 14.03 0.24 24.38 0.30 9.14 Average annual return on stocks and 1-month T-bills (Standard deviation and Sharpe ratio of stocks over time) a. If your risk-aversion coefficient is A = 4 and you believe that the entire 1957-2016 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is U = En 0.5 402. (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity b. If your risk-aversion coefficient is A = 4 and you believe that the entire 1999-2016 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts