Question: Alfred Enterprises (AE) has two manufacturing divisions: the Sydney division and the Melbourne division. The Sydney division produces motors which are sold to the

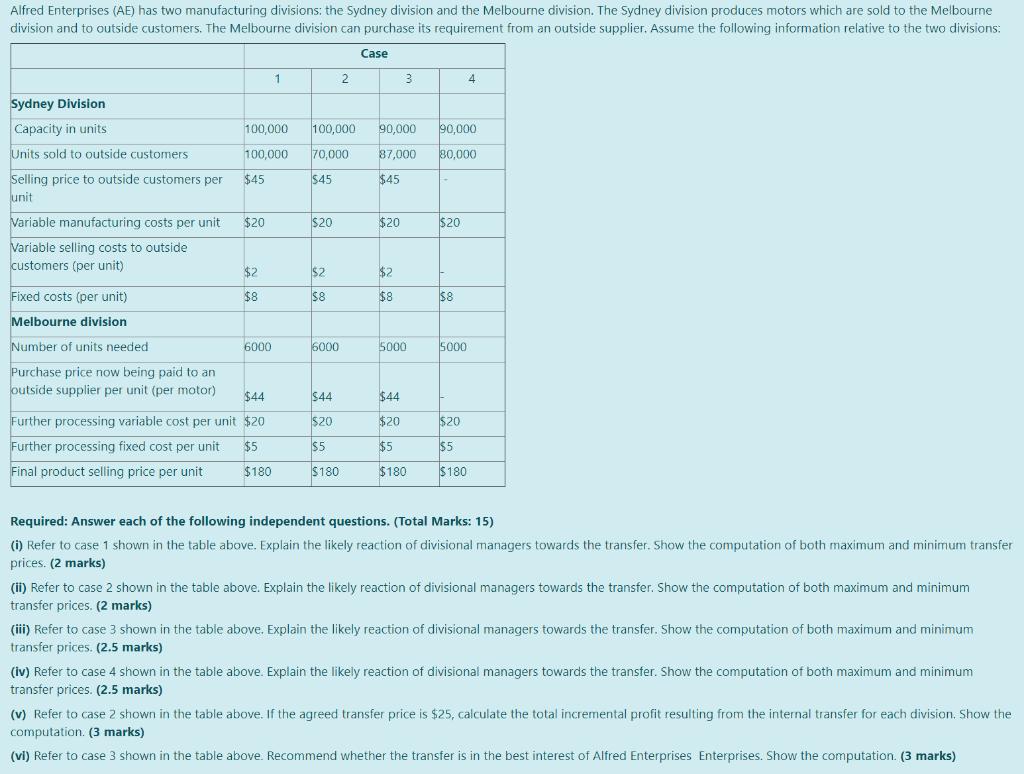

Alfred Enterprises (AE) has two manufacturing divisions: the Sydney division and the Melbourne division. The Sydney division produces motors which are sold to the Melbourne division and to outside customers. The Melbourne division can purchase its requirement from an outside supplier, Assume the following information relative to the two divisions: Case 1 2 3 4 Sydney Division Capacity in units 100,000 100,000 90,000 90,000 Units sold to outside customers 70,000 87,000 30,000 100.000 Selling price to outside customers per unit $45 $45 $45 Variable manufacturing costs per unit $20 $20 $20 $20 Variable selling costs to outside customers (per unit) $2 $2 $2 Fixed costs (per unit) $8 $8 $8 $8 Melbourne division Number of units needed 6000 6000 5000 5000 Purchase price now being paid to an outside supplier per unit (per motor) $44 $44 $44 Further processing variable cost per unit $20 $20 $20 $20 Further processing fixed cost per unit $5 $5 $5 $5 Final product selling price per unit $180 $180 $180 $180 Required: Answer each of the following independent questions. (Total Marks: 15) (i) Refer to case 1 shown in the table above. Explain the likely reaction of divisional managers towards the transfer. Show the computation of both maximum and minimum transfer prices. (2 marks) (ii) Refer to case 2 shown in the table above. Explain the likely reaction of divisional managers towards the transfer. Show the computation of both maximum and minimum transfer prices. (2 marks) (iii) Refer to case 3 shown in the table above. Explain the likely reaction of divisional managers towards the transfer. Show the computation of both maximum and minimum transfer prices. (2.5 marks) (iv) Refer to case 4 shown in the table above. Explain the likely reaction of divisional managers towards the transfer. Show the computation of both maximum and minimum transfer prices. (2.5 marks) (v) Refer to case 2 shown in the table above. If the agreed transfer price is $25, calculate the total incremental profit resulting from the internal transfer for each division. Show the computation. (3 marks) (vi) Refer to case 3 shown in the table above. Recommend whether the transfer is in the best interest of Alfred Enterprises Enterprises. Show the computation. (3 marks)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

i Case 1 There is no spare capacity available with Sydney division So transfer price from Sydney Div... View full answer

Get step-by-step solutions from verified subject matter experts