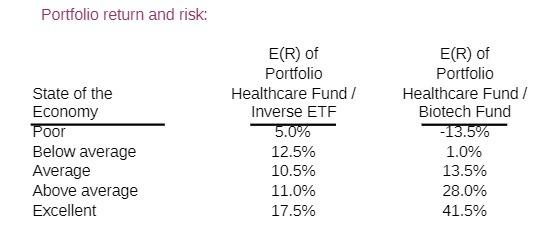

Question: How were these calculated? What equation does one use and why? Portfolio return and risk: State of the Economy Poor Below average Average Above average

How were these calculated? What equation does one use and why?

Portfolio return and risk: State of the Economy Poor Below average Average Above average Excellent E(R) of Portfolio Healthcare Fund/ Inverse ETF 5.0% 12.5% 10.5% 11.0% 17.5% E(R) of Portfolio Healthcare Fund / Biotech Fund -13.5% 1.0% 13.5% 28.0% 41.5%

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER The expected returns of the portfolios are calculated using the equation ER w1 ER1 w2 ER2 whe... View full answer

Get step-by-step solutions from verified subject matter experts