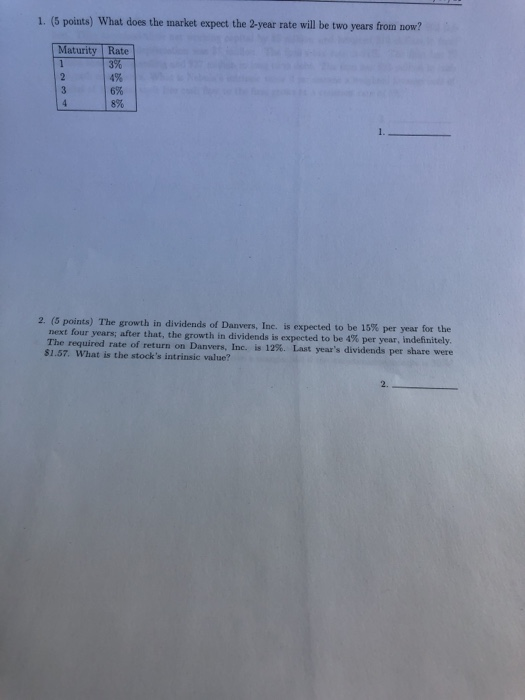

Question: required showing all the steps! 1. (5 points) What does the market expect the 2-year rate will be two years from now? Maturity Rate 3%

1. (5 points) What does the market expect the 2-year rate will be two years from now? Maturity Rate 3% 4% 6 % 8% 2 3 1. 2. (5 points) The growth in dividends of Danvers, Inc. is expected to be 15% per year for the next four years; after that, the growth in dividends is expected to be 4 % per year, indefinitely. The required rate of return on Danvers, Inc. is 12 %. Last year's dividends per share were $1.57. What is the stock's intrinsic value? 2. 3. (5 points) Nebula Corp's most recent earnings before interest and taxes (EBIT) lion. They increased their net working capital by $5 million and invested $13 million in fixed assets. The firm's depreciation million shares outstanding and $37 million in long term debt. The firm has $23 million in cash and cash equivalents. What is Nebula's intrinsic value if we assume a capital of 10% and their free cash flow to the firm grows at a constant rate of 5%? was $92 mil- was $7 million. The firm's tax rate is 21 %. The firm has 75 weighted average cost of 3. 4. (5 points) You sold short 500 shares of common stock at $37.50 per share. The initial margin is 50%. At what stock price would you receive a margin call if the maintenance margin is 30%? 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts