Question: Required: Your task is: 1. Analyze and interpret the missing transactions, record these transactions if it deems necessary. 2. Prepare either a multi-step or single

Required:

Your task is: 1. Analyze and interpret the missing transactions, record these transactions if it deems necessary.

2. Prepare either a multi-step or single step income statement.

3. Prepare a statement of owner's equity.

4. Prepare a classified balance sheet.

5. Balancing the balance sheet.

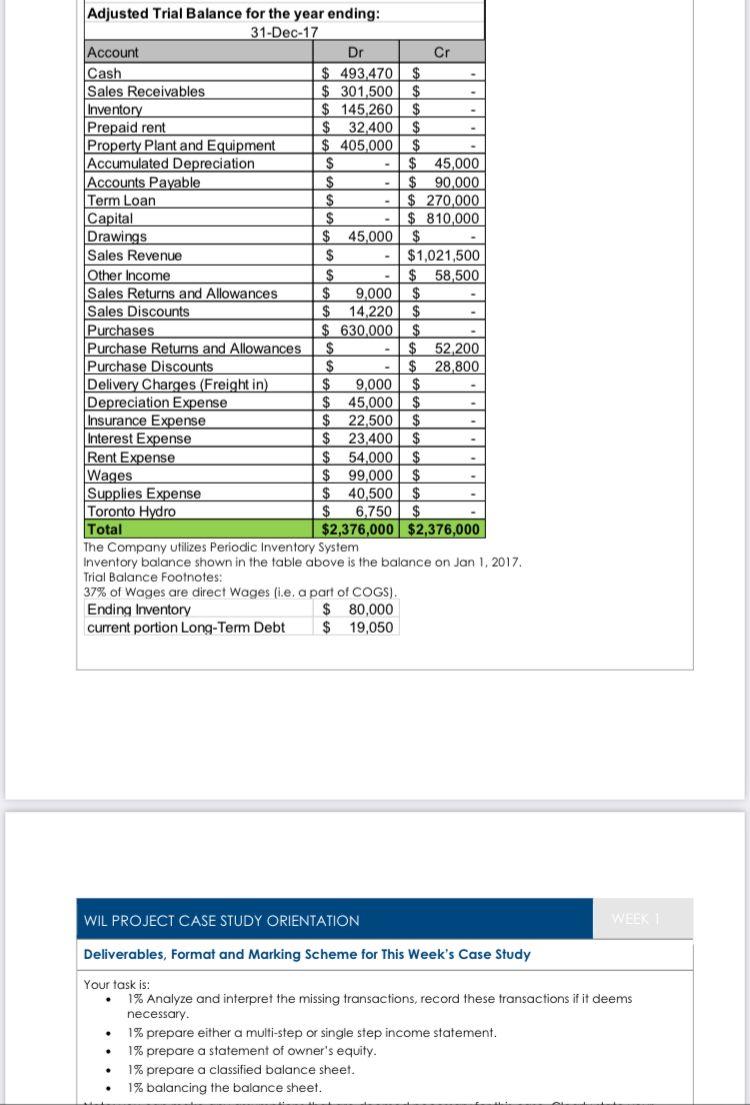

Adjusted Trial Balance for the year ending: 31-Dec-17 Account Cash Sales Receivables Inventory Prepaid rent Property Plant and Equipment Accumulated Depreciation Accounts Payable Term Loan Capital Drawings Sales Revenue Other Income Sales Returns and Allowances. Sales Discounts Purchases Purchase Returns and Allowances Purchase Discounts Delivery Charges (Freight in) Depreciation Expense Insurance Expense Interest Expense Rent Expense Wages Supplies Expense Toronto Hydro Total Dr $493,470 $ $ 301,500 $ $ 145,260 $ $32,400 $ $405,000 $ $ $ 45,000 $ $ $ $ $ . $ $ $ $ $ $ $ $ $ $ $ $ - - 9,000 $ $14,220 $ $630,000 - - 45,000 - WIL PROJECT CASE STUDY ORIENTATION - $90,000 $ 270,000 $810,000 $ $1,021,500 $58,500 9,000 $ 45,000 $ 22,500 $ 23,400 $ $2,376,000 Cr $ $ 52,200 $28,800 54,000 $ 99,000 $ 40,500 $ 6,750 $ $2,376,000 The Company utilizes Periodic Inventory System Inventory balance shown in the table above is the balance on Jan 1, 2017. Trial Balance Footnotes: 37% of Wages are direct Wages (i.e. a part of COGS). Ending Inventory $ 80,000 current portion Long-Term Debt $ 19,050 - Deliverables, Format and Marking Scheme for This Week's Case Study Your task is: 1% Analyze and interpret the missing transactions, record these transactions if it deems necessary. WEEK 1 1% prepare either a multi-step or single step income statement. 1% prepare a statement of owner's equity. 1% prepare a classified balance sheet.. 1% balancing the balance sheet.

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

The image shows an adjusted trial balance for a company for the year ending December 31 2017 along with some additional information about inventory system wages ending inventory and current portion of ... View full answer

Get step-by-step solutions from verified subject matter experts