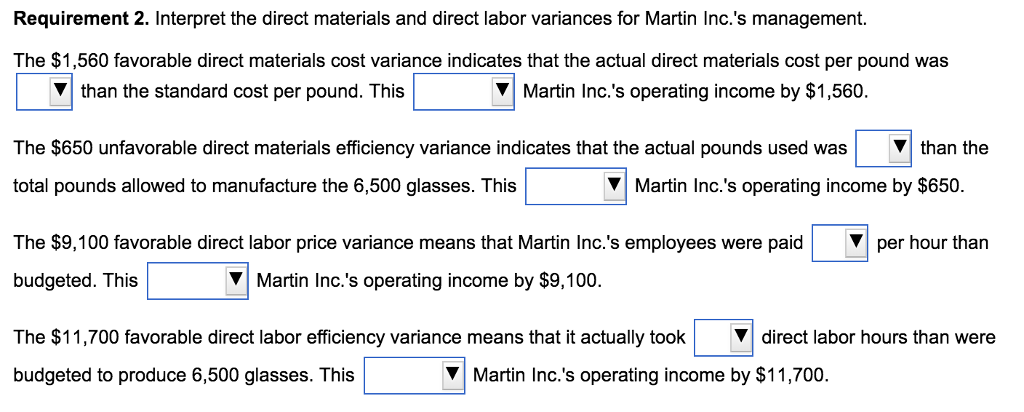

Question: Requirement 2 Dropdown choices #1: less, more Requirement 2 Dropdown choices #2: increased, decreased Requirement 2 Dropdown choices #3: less, more Requirement 2 Dropdown choices

Requirement 2 Dropdown choices #1: less, more

Requirement 2 Dropdown choices #1: less, more

Requirement 2 Dropdown choices #2: increased, decreased

Requirement 2 Dropdown choices #3: less, more

Requirement 2 Dropdown choices #4: decreased, increasesd

Requirement 2 Dropdown choices #5: more, less

Requirement 2 Dropdown choices #6: decreased, increasesd

Requirement 2 Dropdown choices #7: fewer, more

Requirement 2 Dropdown choices #8: increased, decreased

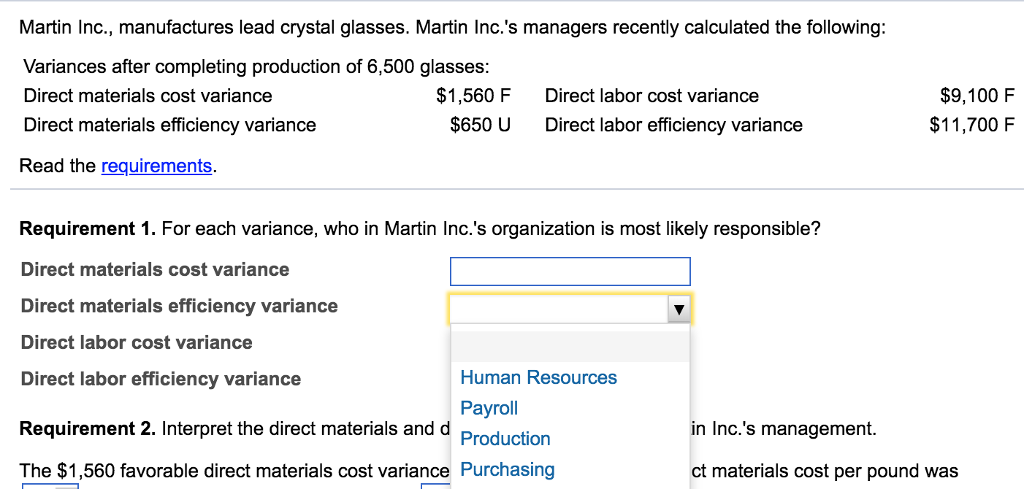

Martin Inc., manufactures lead crystal glasses. Martin Inc.'s managers recently calculated the following: Variances after completing production of 6,500 glasses: Direct materials cost variance Direct materials efficiency variance Read the requirements. $1,560 F $650 U $9,100 F $11,700 F Direct labor cost variance Direct labor efficiency variance Requirement 1. For each variance, who in Martin Inc.'s organization is most likely responsible? Direct materials cost variance Direct materials efficiency variance Direct labor cost variance Direct labor efficiency variance Human Resources Payroll Production Requirement 2. Interpret the direct materials and d in Inc.'s management. The $1,560 favorable direct materials cost variance Purchasing ct materials cost per pound was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts