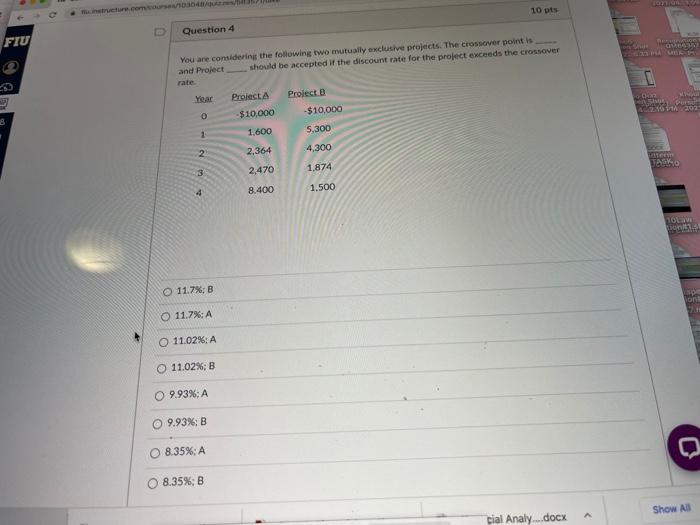

Question: return.com 10 pts Question 4 FIU . You are considering the following two mutually exclusive projects. The crossover point is and Project should be accepted

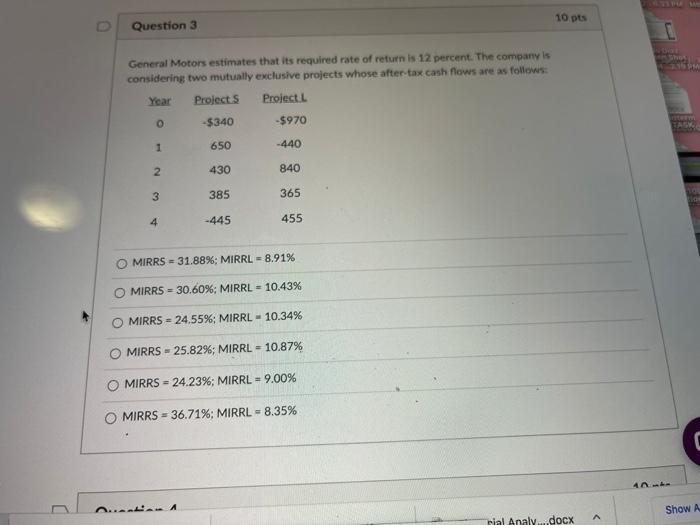

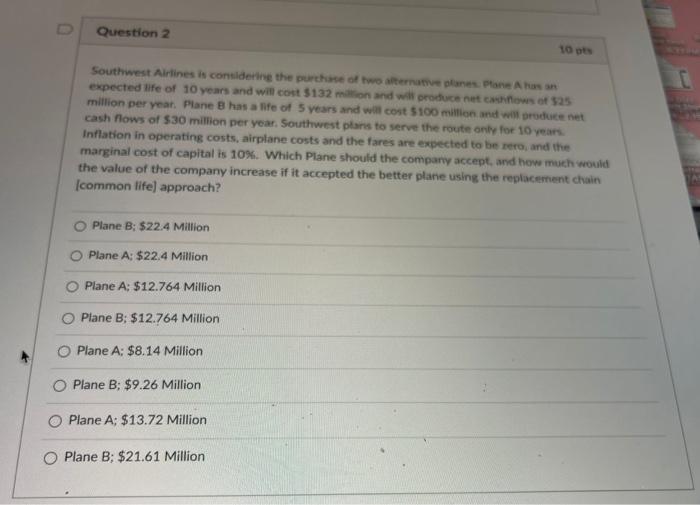

return.com 10 pts Question 4 FIU . You are considering the following two mutually exclusive projects. The crossover point is and Project should be accepted if the discount rate for the project exceeds the crossover rate Year Proiecta Proiecte O $10,000 -$10,000 1 1.600 5,300 2,364 4,300 Per 202 2 TE TAKO 3 2,470 1,874 4 8.400 1.500 TOL 11.7%: B 11.7%; A 11.02%: A 11.02%: B O 9.93%: A 9.93%; B 8.35%: A 8.35%;B Show All pial Analy....docx 10 pts Question 3 236 General Motors estimates that its required rate of return is 12 percent. The company is considering two mutually exclusive projects whose after tax cash flows are as follows: Year Projects Project L 0 -$340 -$970 LAS 1 650 -440 2 430 840 3 385 365 4 -445 455 O MIRRS = 31.88%; MIRRL - 8.91% MIRRS - 30.60%; MIRRL - 10.43% O MIRRS = 24.55%; MIRRL - 10.34% MIRRS - 25.82%; MIRRL = 10.87% MIRRS = 24.23%; MIRRL = 9.00% MIRRS = 36.71%; MIRRL = 8.35% .... LA Show A A rial Analy....docx Question 2 10 Southwest Airlines is considering the purchase of two alternative planes Plane Alasan expected life of 10 years and will cost $132 million and will producent whows of 25 million per year. Plane B has a life of 5 years and will cost $100 million and will producent cash flows of $30 million per year. Southwest plans to serve the route only for 10 years Inflation in operating costs, airplane costs and the fares are expected to be rero, and the marginal cost of capital is 10%. Which Plane should the company accept and how much would the value of the company increase if it accepted the better plane using the replacement chain [common life) approach? Plane B; $22.4 Million Plane A: $22.4 Million Plane A: $12.764 Million Plane B: $12.764 Million O Plane A: $8.14 Million Plane B: $9.26 Million Plane A: $13.72 Million Plane B: $21.61 Million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts