Roth Contractors Corporation was incorporated on December 1, 2019. Required: Part A 1 Prepare journal entries...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

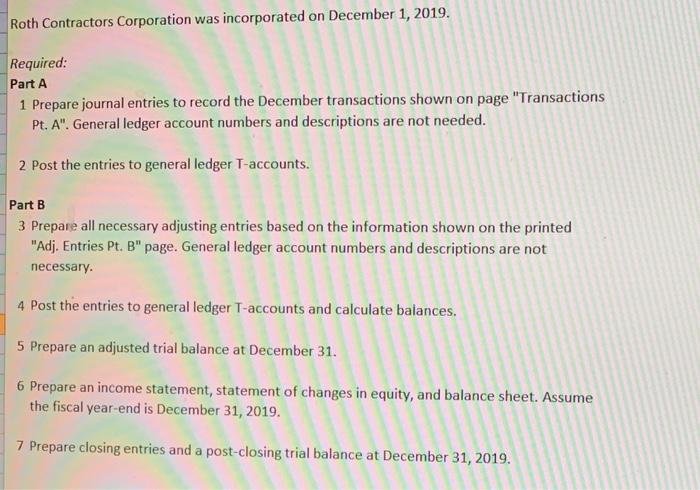

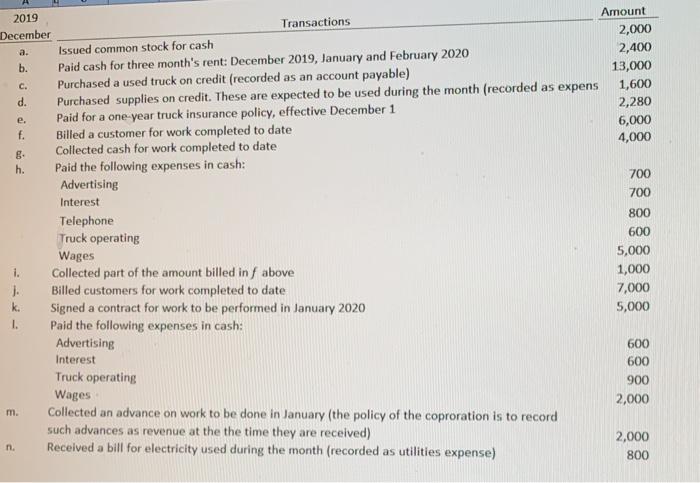

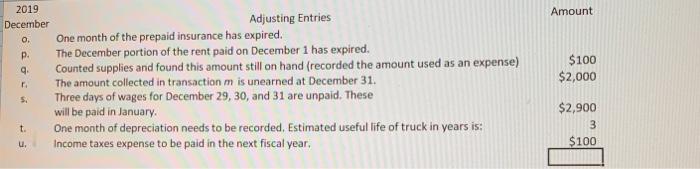

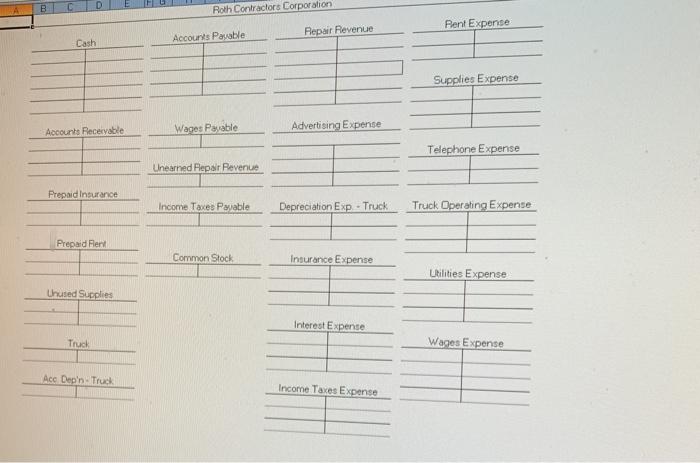

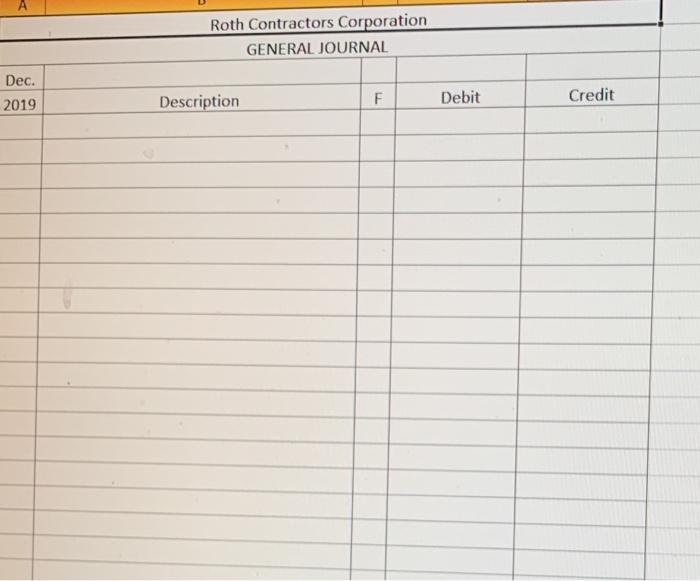

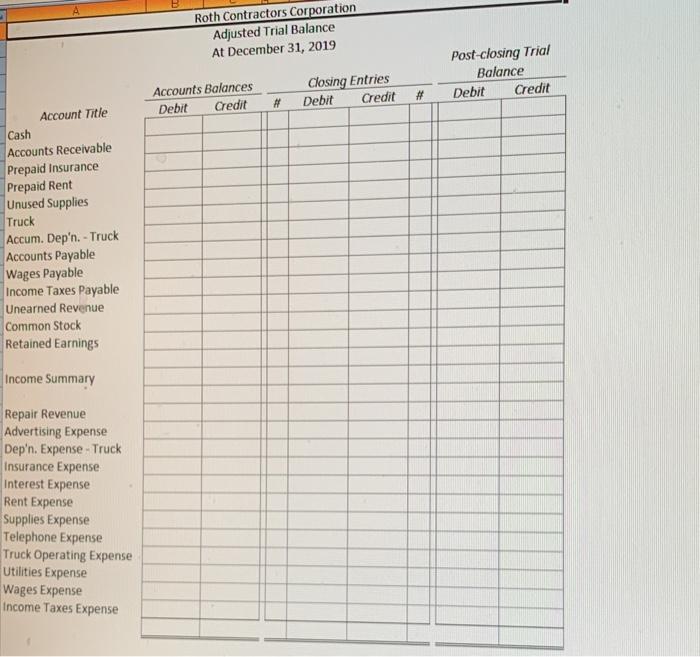

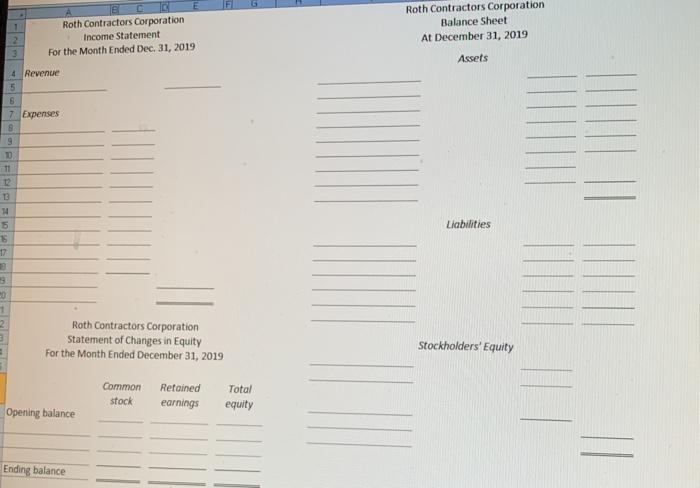

Roth Contractors Corporation was incorporated on December 1, 2019. Required: Part A 1 Prepare journal entries to record the December transactions shown on page "Transactions Pt. A". General ledger account numbers and descriptions are not needed. 2 Post the entries to general ledger T-accounts. Part B 3 Prepare all necessary adjusting entries based on the information shown on the printed "Adj. Entries Pt. B" page. General ledger account numbers and descriptions are not necessary. 4 Post the entries to general ledger T-accounts and calculate balances. 5 Prepare an adjusted trial balance at December 31. 6 Prepare an income statement, statement of changes in equity, and balance sheet. Assume the fiscal year-end is December 31, 2019. 7 Prepare closing entries and a post-closing trial balance at December 31, 2019. Amount 2019 Transactions 2,000 December Issued common stock for cash 2,400 Paid cash for three month's rent: December 2019, lanuary and February 2020 Purchased a used truck on credit (recorded as an account payable) Purchased supplies on credit. These are expected to be used during the month (recorded as expens Paid for a one-year truck insurance policy, effective December 1 Billed a customer for work completed to date Collected cash for work completed to date Paid the following expenses in cash: a. b. 13,000 C. 1,600 d. 2,280 e. 6,000 f. 4,000 g. h. 700 Advertising 700 Interest 800 Telephone 600 Truck operating Wages 5,000 1,000 Collected part of the amount billed in f above Billed customers for work completed to date Signed a contract for work to be performed in January 2020 Paid the following expenses in cash: Advertising i. j. 7,000 k. 5,000 1. 600 Interest 600 Truck operating 900 Wages 2,000 Collected an advance on work to be done in January (the policy of the coproration is to record such advances as revenue at the the time they are received) Received a bill for electricity used during the month (recorded as utilities expense) m. 2,000 n. 800 2019 Amount Adjusting Entries December One month of the prepaid insurance has expired. The December portion of the rent paid on December 1 has expired. Counted supplies and found this amount still on hand (recorded the amount used as an expense) The amount collected in transaction m is unearned at December 31. Three days of wages for December 29, 30, and 31 are unpaid. These will be paid in January. O. p. $100 $2,000 q. r. 5. $2,900 3 One month of depreciation needs to be recorded. Estimated useful life of truck in years is: Income taxes expense to be paid in the next fiscal year, t. $100 u. D. Roth Contractors Corporation Rent Expense Flepair Revenue Cash Accounts Pavable Supplies Expense Wages Paable Advertising Expense Accounts Recervable Telephone Expense Unearned Flepair Revenue Frepaid Insurance Income Taxes Payable Depreciation Exp - Truck Truck Operating Expense Prepaid Flent Common Stock Insurance Expense Lhilities Expense Unused Supplies Interest Expense Truck Wages Expense Acc Dep'n- Truck Income Taxes Expense Roth Contractors Corporation GENERAL JOURNAL Dec. Description Debit Credit 2019 Roth Contractors Corporation Adjusted Trial Balance At December 31, 2019 Post-closing Trial Balance Accounts Balances Closing Entries Debit Credit 23 Debit Credit #3 Debit Credit Account Title Cash Accounts Receivable Prepaid Insurance Prepaid Rent Unused Supplies Truck Accum. Dep'n. - Truck Accounts Payable Wages Payable Income Taxes Payable Unearned Revenue Common Stock Retained Earnings Income Summary Repair Revenue Advertising Expense Dep'n. Expense - Truck Insurance Expense Interest Expense Rent Expense Supplies Expense Telephone Expense Truck Operating Expense Utilities Expense Wages Expense Income Taxes Expense C Roth Contractors Corporation Income Statement Roth Contractors Corporation Balance Sheet At December 31, 2019 For the Month Ended Dec. 31, 2019 Assets 4 Revenue 7 Expenses 19 10 11 12 13 14 15 Liabilities 17 Roth Contractors Corporation Statement of Changes in Equity For the Month Ended December 31, 2019 Stockholders' Equity Common Retained Total stock earnings equity Opening balance Ending balance Roth Contractors Corporation was incorporated on December 1, 2019. Required: Part A 1 Prepare journal entries to record the December transactions shown on page "Transactions Pt. A". General ledger account numbers and descriptions are not needed. 2 Post the entries to general ledger T-accounts. Part B 3 Prepare all necessary adjusting entries based on the information shown on the printed "Adj. Entries Pt. B" page. General ledger account numbers and descriptions are not necessary. 4 Post the entries to general ledger T-accounts and calculate balances. 5 Prepare an adjusted trial balance at December 31. 6 Prepare an income statement, statement of changes in equity, and balance sheet. Assume the fiscal year-end is December 31, 2019. 7 Prepare closing entries and a post-closing trial balance at December 31, 2019. Amount 2019 Transactions 2,000 December Issued common stock for cash 2,400 Paid cash for three month's rent: December 2019, lanuary and February 2020 Purchased a used truck on credit (recorded as an account payable) Purchased supplies on credit. These are expected to be used during the month (recorded as expens Paid for a one-year truck insurance policy, effective December 1 Billed a customer for work completed to date Collected cash for work completed to date Paid the following expenses in cash: a. b. 13,000 C. 1,600 d. 2,280 e. 6,000 f. 4,000 g. h. 700 Advertising 700 Interest 800 Telephone 600 Truck operating Wages 5,000 1,000 Collected part of the amount billed in f above Billed customers for work completed to date Signed a contract for work to be performed in January 2020 Paid the following expenses in cash: Advertising i. j. 7,000 k. 5,000 1. 600 Interest 600 Truck operating 900 Wages 2,000 Collected an advance on work to be done in January (the policy of the coproration is to record such advances as revenue at the the time they are received) Received a bill for electricity used during the month (recorded as utilities expense) m. 2,000 n. 800 2019 Amount Adjusting Entries December One month of the prepaid insurance has expired. The December portion of the rent paid on December 1 has expired. Counted supplies and found this amount still on hand (recorded the amount used as an expense) The amount collected in transaction m is unearned at December 31. Three days of wages for December 29, 30, and 31 are unpaid. These will be paid in January. O. p. $100 $2,000 q. r. 5. $2,900 3 One month of depreciation needs to be recorded. Estimated useful life of truck in years is: Income taxes expense to be paid in the next fiscal year, t. $100 u. D. Roth Contractors Corporation Rent Expense Flepair Revenue Cash Accounts Pavable Supplies Expense Wages Paable Advertising Expense Accounts Recervable Telephone Expense Unearned Flepair Revenue Frepaid Insurance Income Taxes Payable Depreciation Exp - Truck Truck Operating Expense Prepaid Flent Common Stock Insurance Expense Lhilities Expense Unused Supplies Interest Expense Truck Wages Expense Acc Dep'n- Truck Income Taxes Expense Roth Contractors Corporation GENERAL JOURNAL Dec. Description Debit Credit 2019 Roth Contractors Corporation Adjusted Trial Balance At December 31, 2019 Post-closing Trial Balance Accounts Balances Closing Entries Debit Credit 23 Debit Credit #3 Debit Credit Account Title Cash Accounts Receivable Prepaid Insurance Prepaid Rent Unused Supplies Truck Accum. Dep'n. - Truck Accounts Payable Wages Payable Income Taxes Payable Unearned Revenue Common Stock Retained Earnings Income Summary Repair Revenue Advertising Expense Dep'n. Expense - Truck Insurance Expense Interest Expense Rent Expense Supplies Expense Telephone Expense Truck Operating Expense Utilities Expense Wages Expense Income Taxes Expense C Roth Contractors Corporation Income Statement Roth Contractors Corporation Balance Sheet At December 31, 2019 For the Month Ended Dec. 31, 2019 Assets 4 Revenue 7 Expenses 19 10 11 12 13 14 15 Liabilities 17 Roth Contractors Corporation Statement of Changes in Equity For the Month Ended December 31, 2019 Stockholders' Equity Common Retained Total stock earnings equity Opening balance Ending balance

Expert Answer:

Related Book For

Fundamental Accounting Principles

ISBN: 978-0078110870

20th Edition

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

Posted Date:

Students also viewed these accounting questions

-

1. Prepare journal entries to record the February transactions for Splashing Around using the General Journal February GJ7 tab . Update the FIFO worksheet in the working papers when a transaction...

-

Prepare journal entries to record the following transactions in the appropriate funds of a nongovernmental not-for-profit university: 1. Tuition and fees assessed total $6,000,000. Eighty percent is...

-

Prepare journal entries to record the following transactions for Emerson Corporation. April 15 Declared a cash dividend payable to common stockholders of $40,000. May 15 Date of record is May 15 for...

-

Although epoxides are always considered to have their oxygen atom as part of a threemembered ring, the prefix epoxy in the IUPAC system of nomenclature can be used to denote a cyclic ether of various...

-

An open tubular column is 30.1 m long and has an inner diameter of 0.530 mm. It is coated on the inside wall with a layer of stationary phase that is 3.1 m thick. Unretained solute passes through in...

-

Draw a hybrid network topology in such a way that a star backbone connects the bus and ring topologies to another ring backbone.

-

With reference to Exercise 4.88, find the variance of the probability distribution using (a) the formula that defines \(\sigma^{2}\); (b) the special formula for the variance of a binomial...

-

Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firms outstanding debt are selling to yield 8 percent while the...

-

1. Suggest at least three ideas educators could use to involve service personnel in developing an environmental responsibility plan focused on reducing energy. 2. Name two qualitative evaluation...

-

Ramsey Liquors owns and operates a chain of beer and wine shops throughout the Dallas-Fort Worth metroplex. The rapidly expanding population of the area has resulted in the firm requiring a growing...

-

Last year Lakesha's Lounge Furniture Corporation had an ROE of 15.8 percent and a dividend payout ratio of 29 percent. What is the sustainable growth rate? What is the sustainable growth rate? (Do...

-

= If total assets = $900, fixed assets = $550, current liabilities = $250, equity $175, long-term debt = $475, and current assets is the only remaining item on the balance sheet, what is the value of...

-

On September 4, 2017, United Technologies Corporation (UTC) announced the acquisition of Rockwell Collins Corporation for $30 billion. As of their June 30, 2017 Form 10-Q, the Balance Sheet of...

-

When using the Claritas Zip Code look up for 92562 and 32830 how would you describe how Starbucks' key product and brand elements fit the needs of each of those 2 markets? How are they able to...

-

Two years ago, Bob purchased a 20-year $1,000 par value zero-coupon bond for $311.80. If today (with 18 years to maturity) the bond is priced to yield 4.85%, what is his annualized return if he sells...

-

Are companies acting ethically when they increase the size of their portions as a way to get consumers to consume more and ultimately pay more for a product?

-

The total cost for a department is 1,301,714 and the total payment to the department is 1,183,641. What is the total loss or gain to this department? Show your calculations.

-

Refer to the data for problem 13-36 regarding Long Beach Pharmaceutical Company. Required: Compute each division's residual income for the year under each of the following assumptions about the...

-

Refer to the information in Exercise 10-6. Determine the machines second-year depreciation using the double-declining-balance method.

-

Listed here are the total costs associated with the 2011 production of 1,000 drum sets manufactured by NeatBeat. The drum sets sell for $300 each. Required 1. Classify each cost and its amount as (a)...

-

a. Prepare the journal entry to record Stefan Companys issuance of 12,000 shares of $50 par value 6% cumulative preferred stock for $75 cash per share. b. Assuming the facts in part 1, if Stefan...

-

Figure 5 shows a scatterplot for the variables number of farms and mean farm size in the United States. Each dot represents data from a single year between 1950 and 2000; on this diagram, the earlier...

-

Youve conducted a study to determine how the number of calories a person consumes in a day correlates with time spent in vigorous bicycling. Your sample consisted of ten women cyclists, all of...

-

The scatterplots in Figure 6 show two weeks of data comparing the actual high temperature for the day with the same-day forecast (part a) and the three-day forecast (part b). Estimate the correlation...

Study smarter with the SolutionInn App