Question: Savana Sdn Bhd is a manufacturer of taxable goods in Penang since 2021. The company is not familiar with the Sales & Service Tax

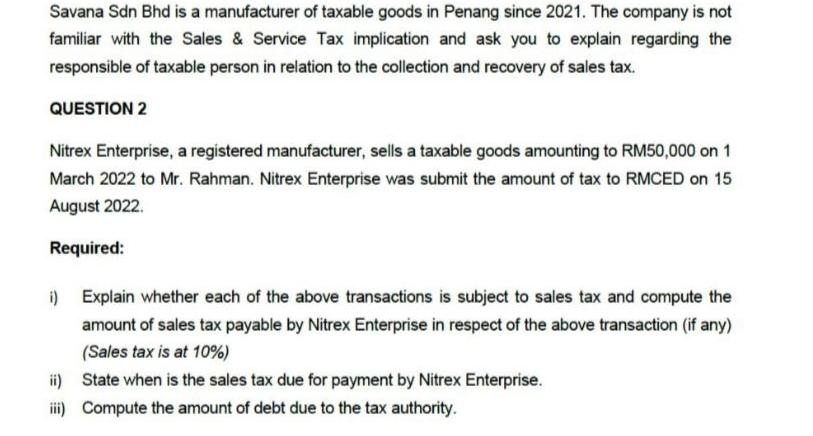

Savana Sdn Bhd is a manufacturer of taxable goods in Penang since 2021. The company is not familiar with the Sales & Service Tax implication and ask you to explain regarding the responsible of taxable person in relation to the collection and recovery of sales tax. QUESTION 2 Nitrex Enterprise, a registered manufacturer, sells a taxable goods amounting to RM50,000 on 1 March 2022 to Mr. Rahman. Nitrex Enterprise was submit the amount of tax to RMCED on 15 August 2022. Required: i) Explain whether each of the above transactions is subject to sales tax and compute the amount of sales tax payable by Nitrex Enterprise in respect of the above transaction (if any) (Sales tax is at 10%) ii) iii) State when is the sales tax due for payment by Nitrex Enterprise. Compute the amount of debt due to the tax authority.

Step by Step Solution

There are 3 Steps involved in it

Answer to Question 1 As a manufacturer of taxable goods in Malaysia Savana Sdn Bhd is considered a t... View full answer

Get step-by-step solutions from verified subject matter experts