Question: Save Answer other question will save this response. >> Question 2 50 points A retailer needs to decide whether to update its product portfolio or

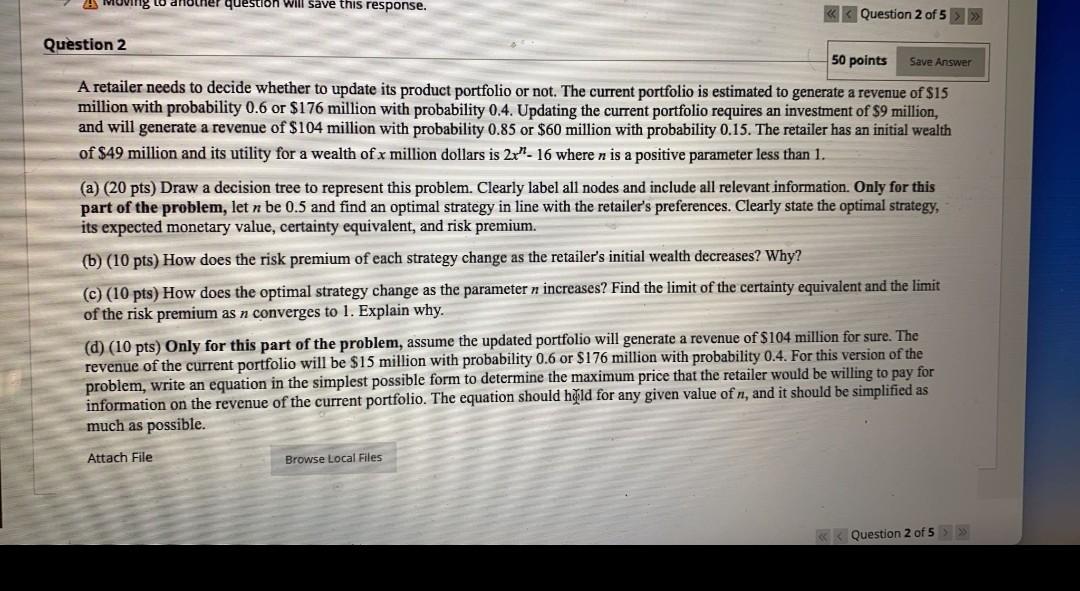

Save Answer other question will save this response. >> Question 2 50 points A retailer needs to decide whether to update its product portfolio or not. The current portfolio is estimated to generate a revenue of $15 million with probability 0.6 or $176 million with probability 0.4. Updating the current portfolio requires an investment of $9 million, and will generate a revenue of $104 million with probability 0.85 or $60 million with probability 0.15. The retailer has an initial wealth of $49 million and its utility for a wealth of x million dollars is 2x"- 16 where n is a positive parameter less than 1. (a) (20 pts) Draw a decision tree to represent this problem. Clearly label all nodes and include all relevant information. Only for this part of the problem, let n be 0.5 and find an optimal strategy in line with the retailer's preferences. Clearly state the optimal strategy, its expected monetary value, certainty equivalent, and risk premium. (b) (10 pts) How does the risk premium of each strategy change as the retailer's initial wealth decreases? Why? c) (10 pts) How does the optimal strategy change as the parameter n increases? Find the limit of the certainty equivalent and the limit of the risk premium as n converges to 1. Explain why. (d) (10 pts) Only for this part of the problem, assume the updated portfolio will generate a revenue of $104 million for sure. The revenue of the current portfolio will be $15 million with probability 0.6 or $176 million with probability 0.4. For this version of the problem, write an equation in the simplest possible form to determine the maximum price that the retailer would be willing to pay for information on the revenue of the current portfolio. The equation should held for any given value of n, and it should be simplified as much as possible. Attach File Browse Local Files Question 2 of 5 > >>

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock