Question: Saved ework Check my work mode : This shows what is correct or incorrect for the work you have com Use the following information for

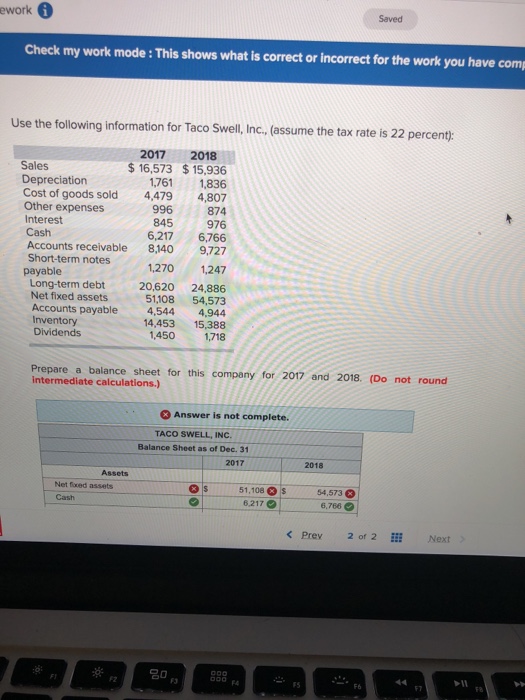

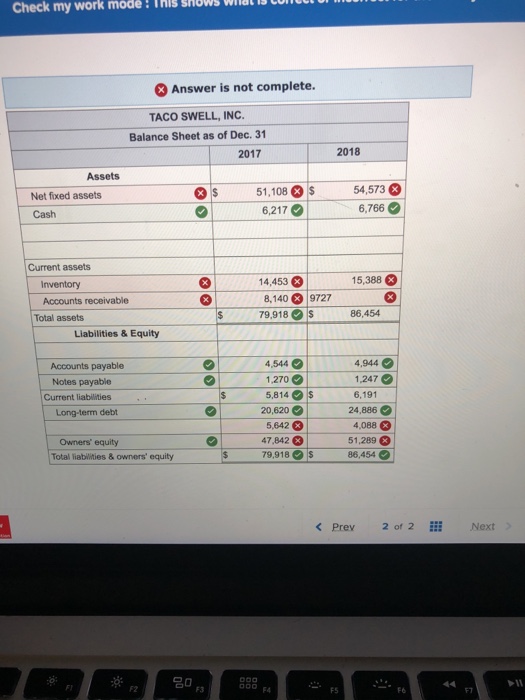

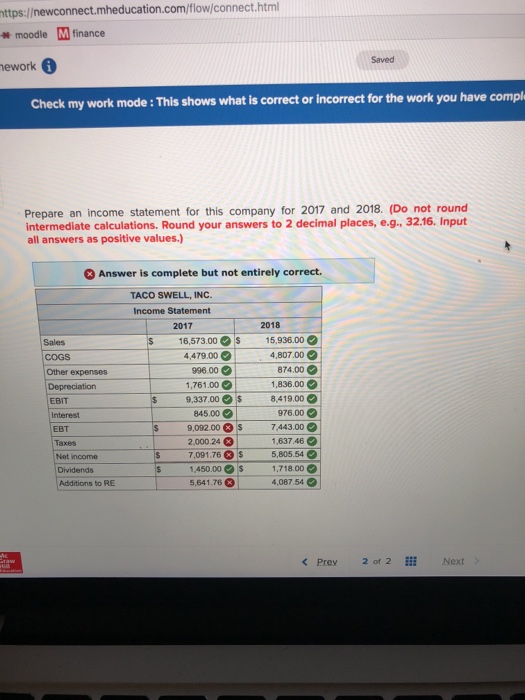

Saved ework Check my work mode : This shows what is correct or incorrect for the work you have com Use the following information for Taco Swell, Inc., (assume the tax rate is 22 percent: 2017 2018 $16,573 $15,936 1761 1,836 Cost of goods sold 4,479 4,807 996 874 845 976 6,217 6,766 Accounts receivable 8,140 9,727 Short-term notes 1270 1.247 Sales Depreciation Other expenses Interest Cash payable Long-term debt Net fixed assets 20,620 24,886 51,108 54,573 Accounts payable 4,544 4,944 14,45315,388 1,450 1,718 Inventory Dividends Prepare a balance sheet for this company for 2017 and 2018. (Do not round intermediate calculations.) Answer is not complete. TACO SWELL, INC Balance Sheet as of Dec. 31 2017 2018 Assets Net fxed assets Cash 51.108 6.217 s 54,573 6,766

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts