Question: Section 3: Please answer all the questions. Show your calculations and state any assumptions made (if any). (38 marks) Q1. You are an owner of

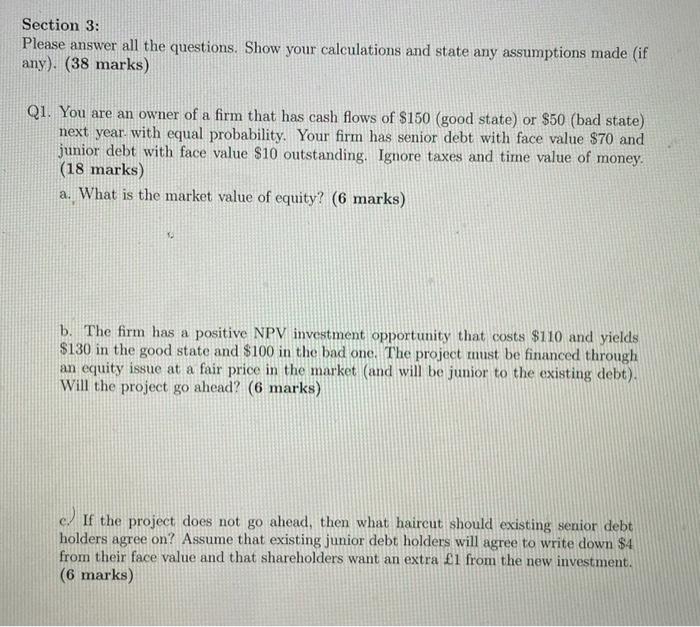

Section 3: Please answer all the questions. Show your calculations and state any assumptions made (if any). (38 marks) Q1. You are an owner of a firm that has cash flows of $150 (good state) or $50 (bad state) next year with equal probability. Your firm has senior debt with face value $70 and junior debt with face value $10 outstanding. Ignore taxes and time value of money. (18 marks) a. What is the market value of equity? (6 marks) b. The firm has a positive NPV investment opportunity that costs $110 and yields $130 in the good state and $100 in the bad one. The project must be financed through an equity issue at a fair price in the market (and will be junior to the existing debt). Will the project go ahead? (6 marks) c) If the project does not go ahead, then what haircut should existing senior debt holders agree on? Assume that existing junior debt holders will agree to write down $4 from their face value and that shareholders want an extra 1 from the new investment. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts