Question: Select the correct answer: Question 1 (0.5 points) Which of the following best describes a claim under section 101(5)? .1: Any right to payment as

Select the correct answer:

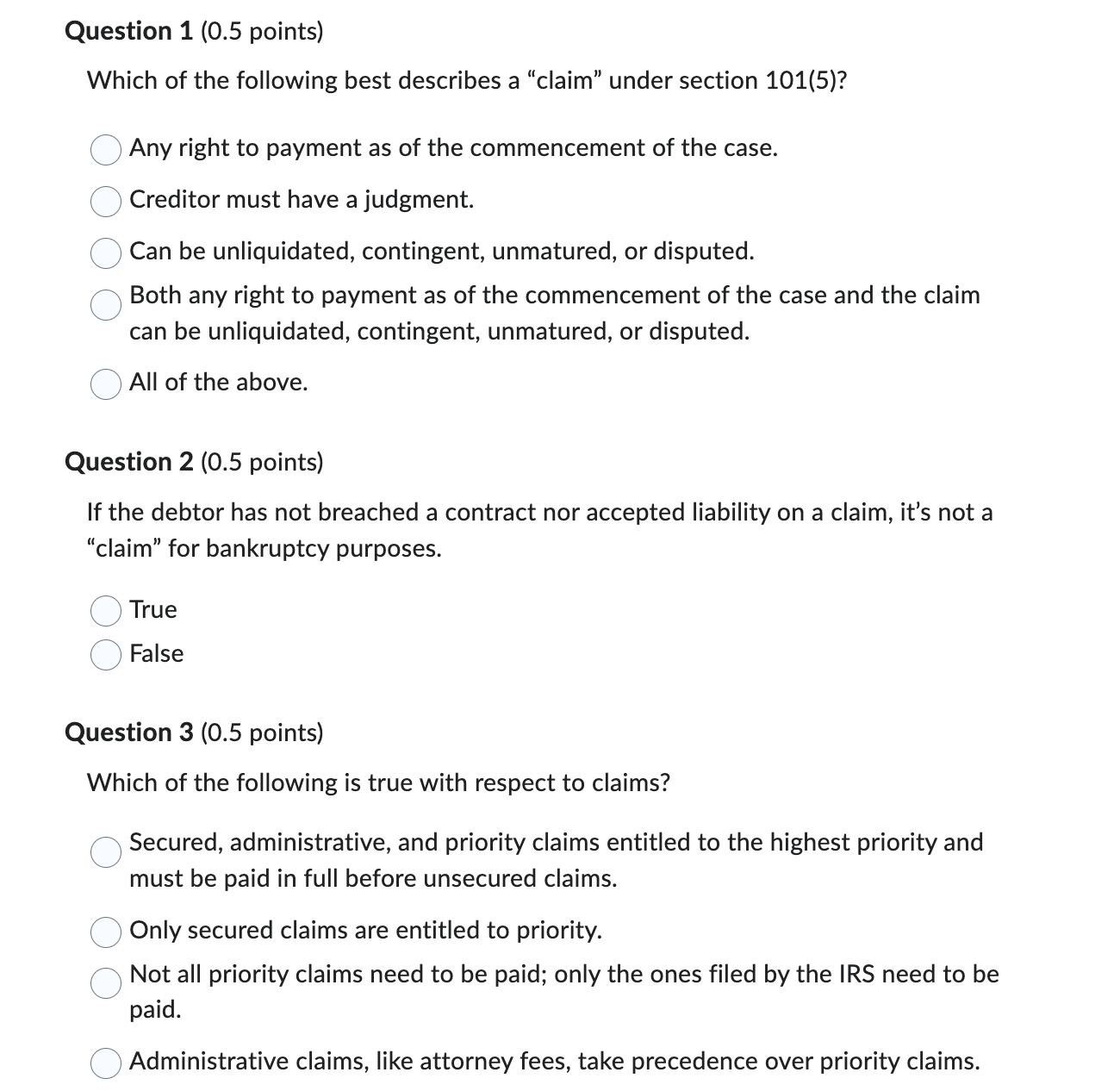

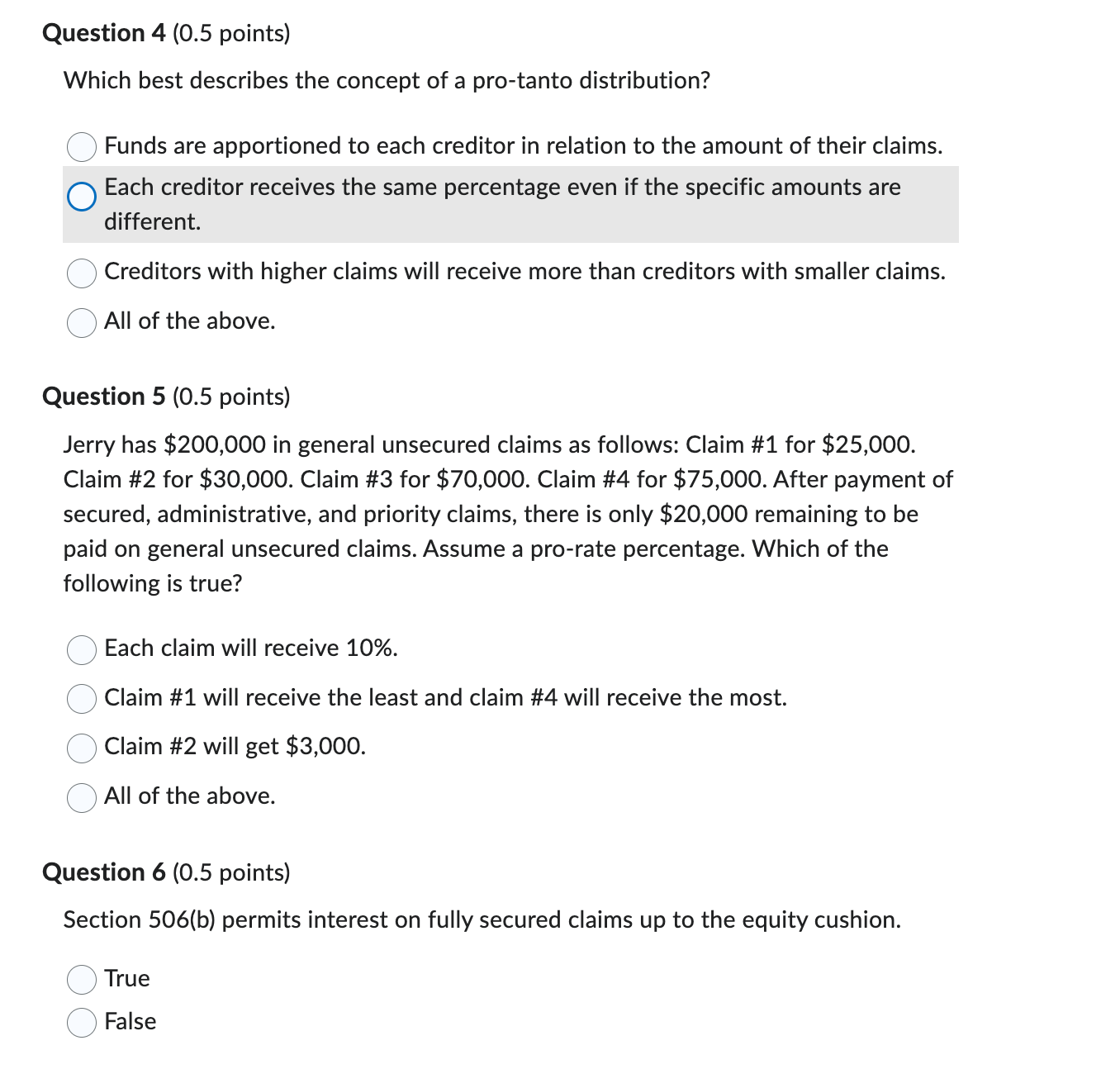

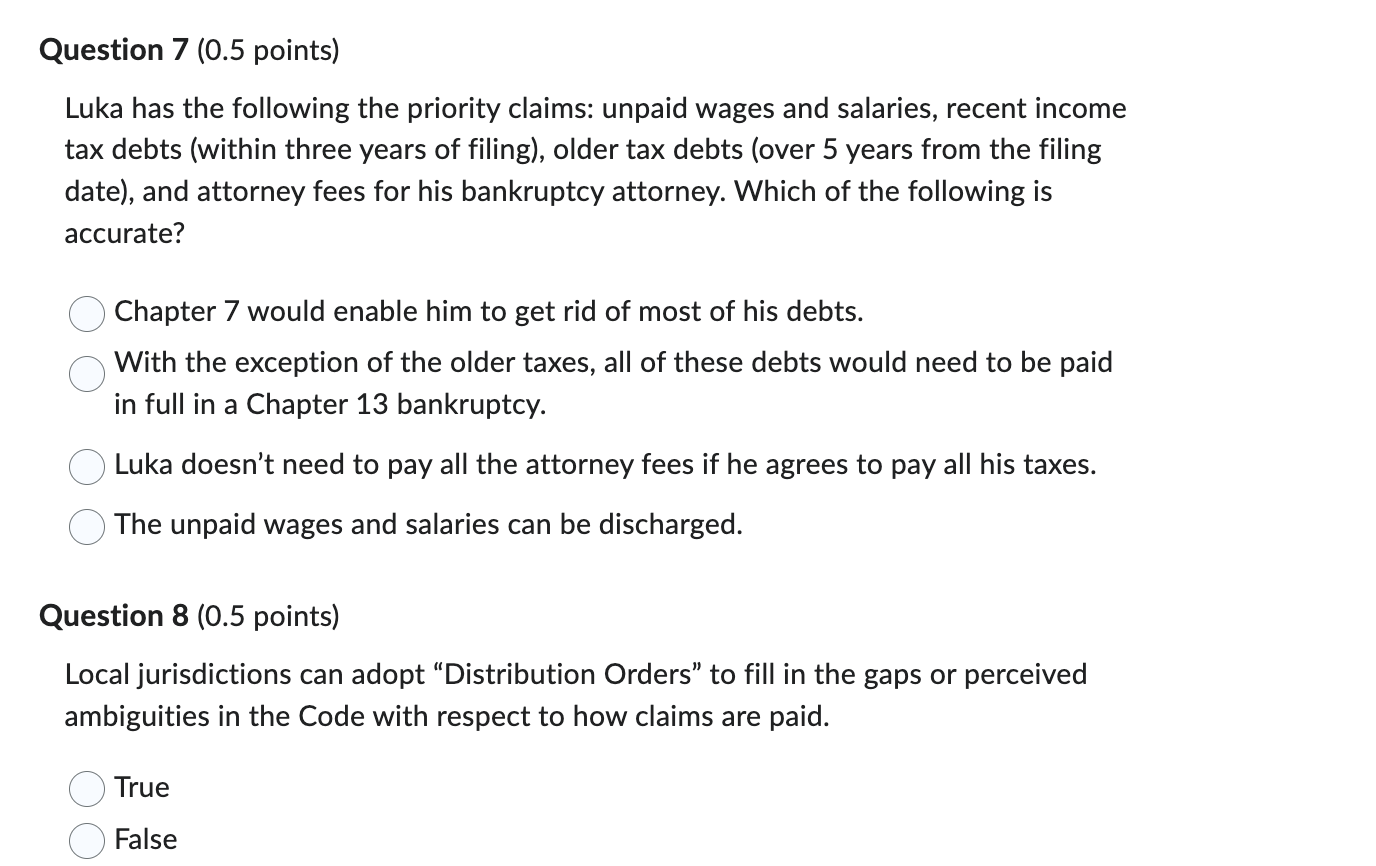

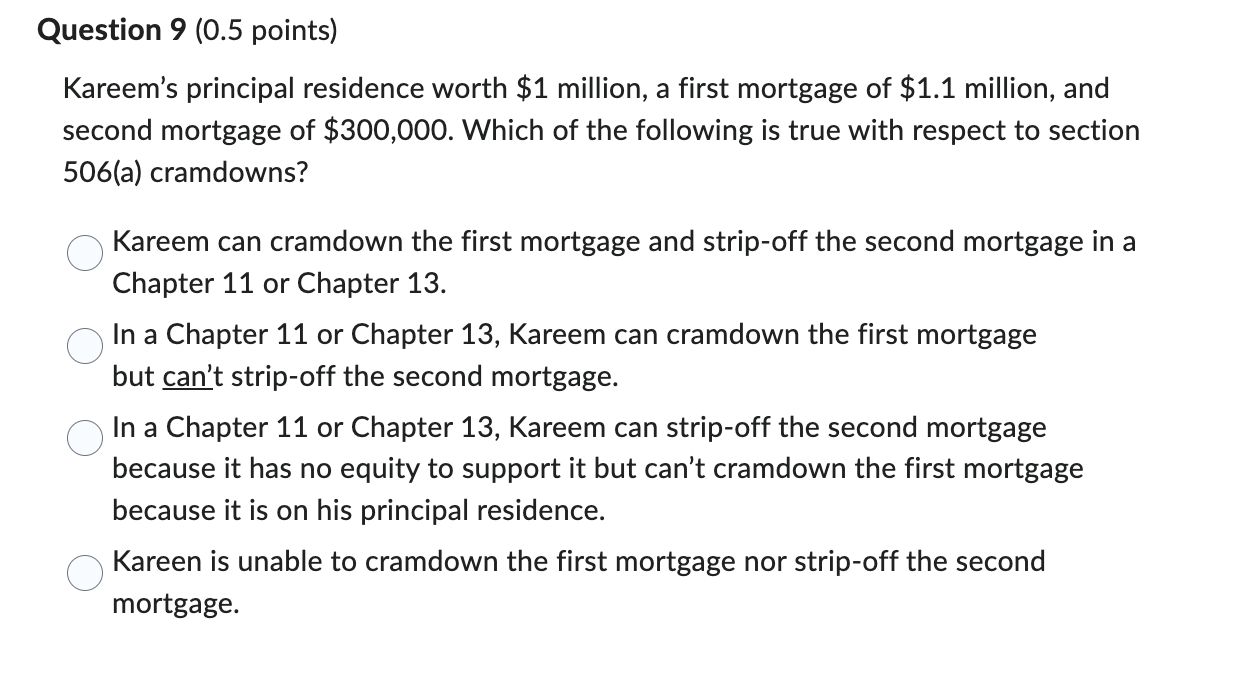

Question 1 (0.5 points) Which of the following best describes a \"claim\" under section 101(5)? .1: Any right to payment as of the commencement of the case. I: Creditor must have a judgment. If: Can be unliquidated, contingent, unmatured, or disputed. Both any right to payment as of the commencement of the case and the claim can be unliquidated, contingent, unmatured, or disputed. If All of the above. Question 2 (0.5 points) If the debtor has not breached a contract nor accepted liability on a claim, it's not a \"claim\" for bankruptcy purposes. .; True I: False Question 3 (0.5 points) Which of the following is true with respect to claims? Secured, administrative, and priority claims entitled to the highest priority and I must be paid in full before unsecured claims. I: Only secured claims are entitled to priority. Not all priority claims need to be paid; only the ones filed by the IRS need to be ' paid. I: Administrative claims, like attorney fees, take precedence over priority claims. Question 4 (0.5 points) Which best describes the concept of a pro-tanto distribution? Funds are apportioned to each creditor in relation to the amount of their claims. Each creditor receives the same percentage even if the specific amounts are different. (\"'3' Creditors with higher claims will receive more than creditors with smaller claims. All of the above. Question 5 (0.5 points) Jerry has $200,000 in general unsecured claims as follows: Claim #1 for $25,000. Claim #2 for $30,000. Claim #3 for $70,000. Claim #4 for $75,000. After payment of secured, administrative, and priority claims, there is only $20,000 remaining to be paid on general unsecured claims. Assume a pro-rate percentage. Which of the following is true? Each claim will receive 10%. Claim #1 will receive the least and claim #4 will receive the most. ('3. Claim #2 will get $3,000. All of the above. Question 6 (0.5 points) Section 506(b) permits interest on fully secured claims up to the equity cushion. True False Question 7 (0.5 points) Luka has the following the priority claims: unpaid wages and salaries, recent income tax debts (within three years of filing), older tax debts (over 5 years from the filing date), and attorney fees for his bankruptcy attorney. Which of the following is accurate? (\":1 Chapter 7 would enable him to get rid of most of his debts. ( With the exception of the older taxes, all of these debts would need to be paid in full in a Chapter 13 bankruptcy. (it) Luka doesn't need to pay all the attorney fees if he agrees to pay all his taxes. The unpaid wages and salaries can be discharged. Question 8 (0.5 points) Local jurisdictions can adopt \"Distribution Orders\" to fill in the gaps or perceived ambiguities in the Code with respect to how claims are paid. True False Question 9 (0.5 points) Kareem's principal residence worth $1 million, a first mortgage of $1.1 million, and second mortgage of $300,000. Which of the following is true with respect to section 506(a) cramdowns? O Kareem can cramdown the first mortgage and strip-off the second mortgage in a Chapter 11 or Chapter 13. O In a Chapter 11 or Chapter 13, Kareem can cramdown the first mortgage but can't strip-off the second mortgage. In a Chapter 11 or Chapter 13, Kareem can strip-off the second mortgage because it has no equity to support it but can't cramdown the first mortgage because it is on his principal residence. O Kareen is unable to cramdown the first mortgage nor strip-off the second mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts