Question: SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 6: The Blue Dog Company has common stock outstanding that has a current

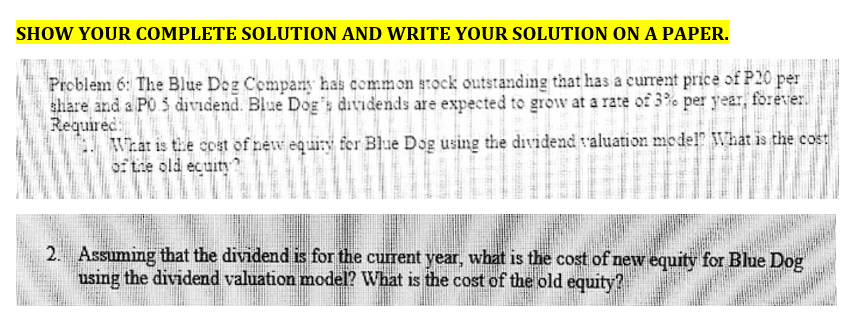

SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 6: The Blue Dog Company has common stock outstanding that has a current price of P20 per share and a PO.3 dividend. Blue Dog's dividends are expected to grow at a rate of 3% per year, forever. Required:" What is the cost of new equity for Blue Dog using the dividend valuation model? What is the cost of the old equity? 2. Assuming that the dividend is for the current year, what is the cost of new equity for Blue Dog using the dividend valuation model? What is the cost of the old equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock