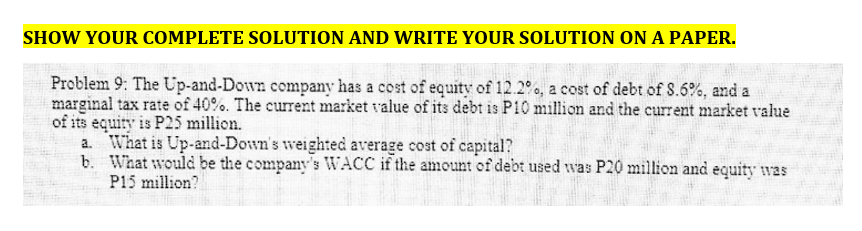

Question: SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 9: The Up-and-Down company has a cost of equity of 12.2%, a cost

SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 9: The Up-and-Down company has a cost of equity of 12.2%, a cost of debt of $.6%, and a marginal tax rate of 40%. The current market value of its debt is P10 million and the current market value of its equity is P25 million. a. What is Up-and-Down's weighted average cost of capital? b. What would be the company's WACC if the amount of debt used was P20 million and equity was P15 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock