Question: Shrek Casting Company is considering adding a new line to its product mix. The production line would be set up in unused space in Shrek's'

Shrek Casting Company is considering adding a new line to its product mix. The production line would be set up in unused space in Shrek's' main plant. The machinerys invoice price would be approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and would be a class 8 with a 20% CCA rate. The machinery is expected to have a salvage value of $20,000 after 4 years of use.

The new line would generate incremental sales of 1,300 units per year for four years at an incremental cost of $125 per unit in the first year, excluding depreciation. Each unit can be sold for $225 in the first year. The sales price and cost are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firms net operating working capital would have to increase by an amount of $37,000. The firms tax rate is 31%, and its overall weighted average cost of capital is 10 percent.

| r = | 10% | |

| T = | 31% | |

| d = CCA rate = | 20% | |

| Machine Cost = | 200,000 | |

| Shipping Cost = | 10,000 | |

| Installation cost = | 30,000 | |

| Change in NOWC = | 37,000 | |

| # Units = | 1,300 | |

| Price = | 225 | |

| Costs = | 125 | |

| Inflation = | 3% | |

| Salvage Value = | 20,000 | |

| Economic life = | 4.00 | years |

| A. Initial Outlay (in 1000s) | |

| New Machine Cost | 200.00 |

| Plus: Setup & Training | 40.00 |

| Capital Cost | 240.00 |

| Change in NOWC | 37.00 |

| Initial Investment CF | 277.00 |

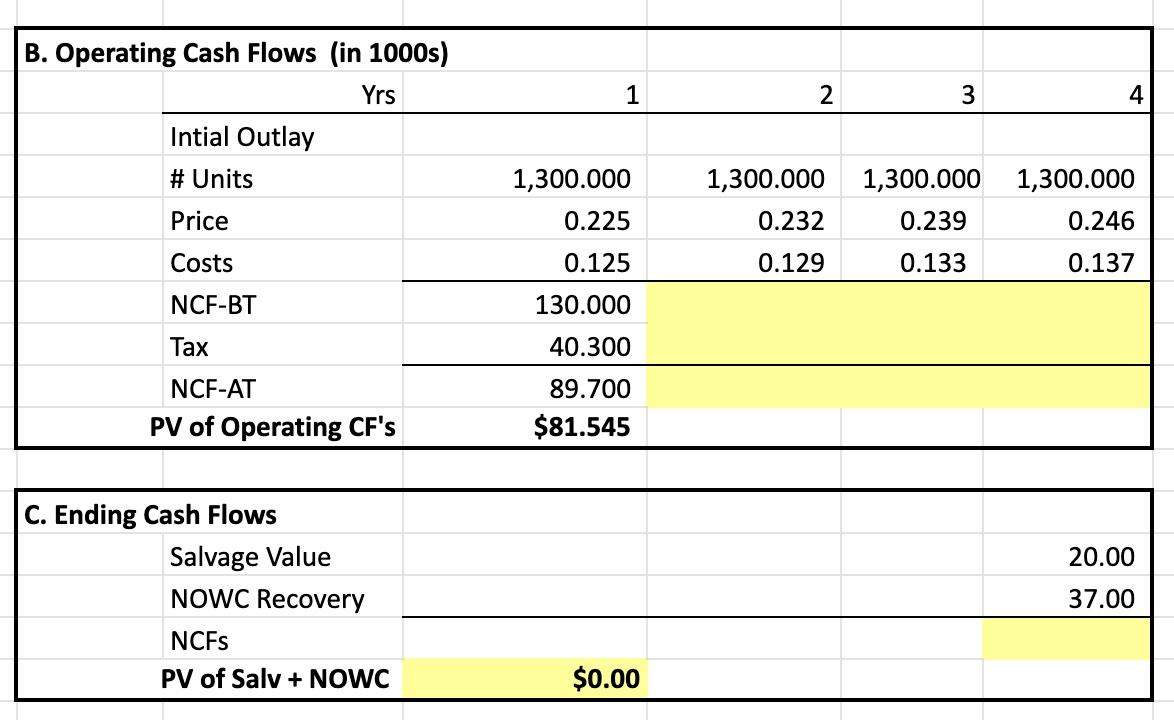

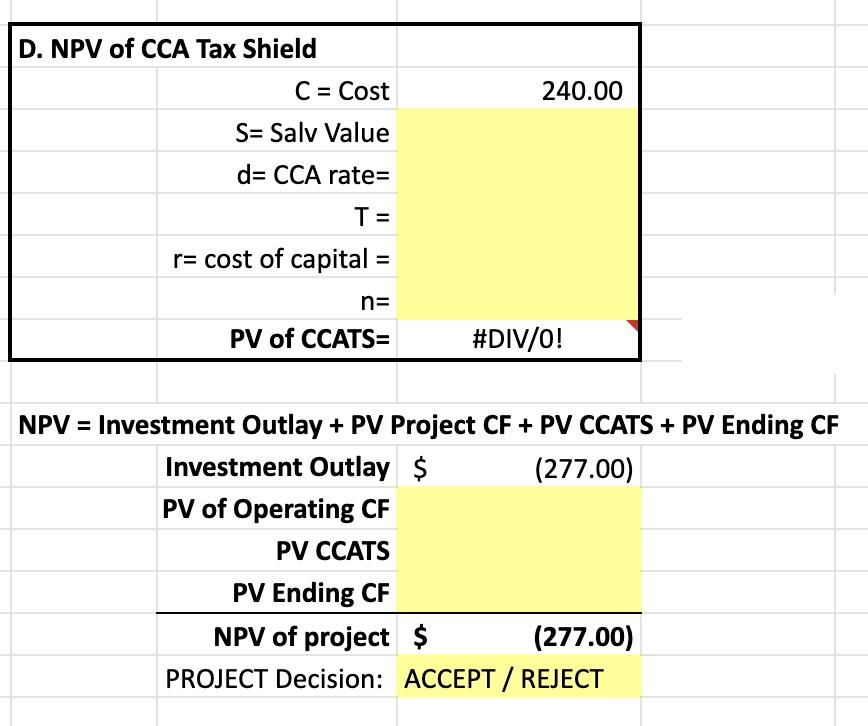

1 2 3 4 B. Operating Cash Flows (in 1000s) Yrs Intial Outlay # Units 1,300.000 0.225 1,300.000 0.232 1,300.000 1,300.000 0.239 0.246 Price Costs 0.125 0.129 0.133 0.137 NCF-BT 130.000 Tax 40.300 NCF-AT PV of Operating CF's 89.700 $81.545 20.00 C. Ending Cash Flows Salvage Value NOWC Recovery NCFs PV of Salv + NOWC 37.00 $0.00 D. NPV of CCA Tax Shield C = Cost 240.00 S= Salv Value d= CCA rate= T= r= cost of capital = n= PV of CCATS= #DIV/0! NPV = Investment Outlay + PV Project CF + PV CCATS + PV Ending CF Investment Outlay $ (277.00) PV of Operating CF PV CCATS PV Ending CF NPV of project $ (277.00) PROJECT Decision: ACCEPT / REJECT 1 2 3 4 B. Operating Cash Flows (in 1000s) Yrs Intial Outlay # Units 1,300.000 0.225 1,300.000 0.232 1,300.000 1,300.000 0.239 0.246 Price Costs 0.125 0.129 0.133 0.137 NCF-BT 130.000 Tax 40.300 NCF-AT PV of Operating CF's 89.700 $81.545 20.00 C. Ending Cash Flows Salvage Value NOWC Recovery NCFs PV of Salv + NOWC 37.00 $0.00 D. NPV of CCA Tax Shield C = Cost 240.00 S= Salv Value d= CCA rate= T= r= cost of capital = n= PV of CCATS= #DIV/0! NPV = Investment Outlay + PV Project CF + PV CCATS + PV Ending CF Investment Outlay $ (277.00) PV of Operating CF PV CCATS PV Ending CF NPV of project $ (277.00) PROJECT Decision: ACCEPT / REJECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts