Question: Since the answer has been provided in the yellow line. Could you please provide step by step and the FORMULA? How do we get this

Since the answer has been provided in the yellow line. Could you please provide "step by step" and "the FORMULA"? How do we get this solution number?

Best Regards

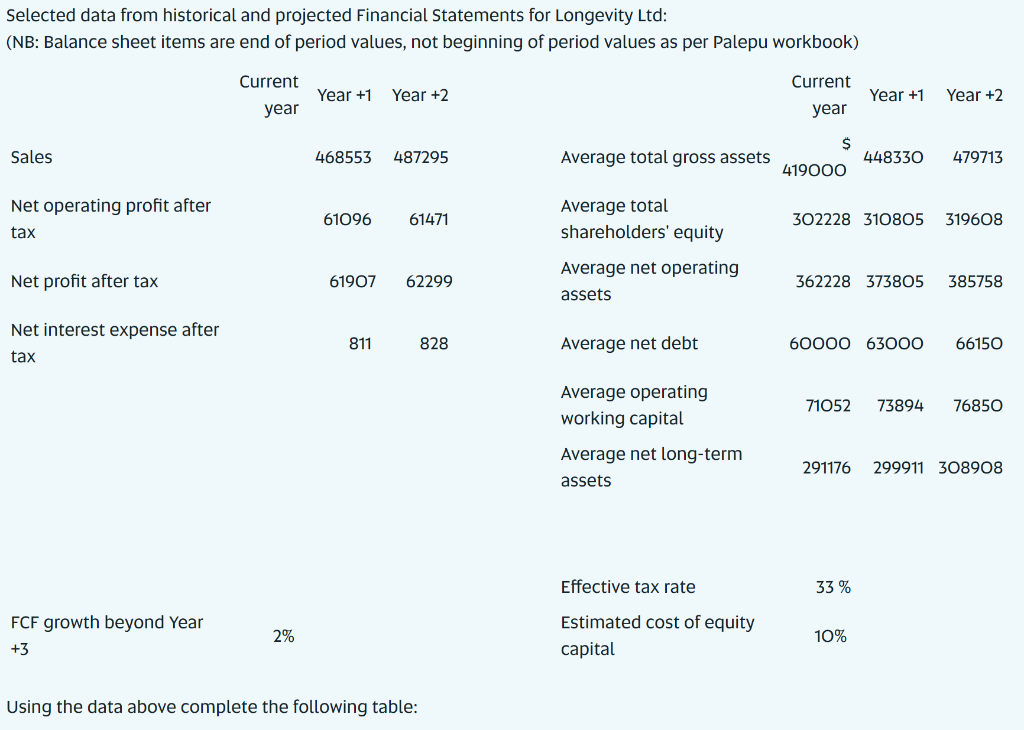

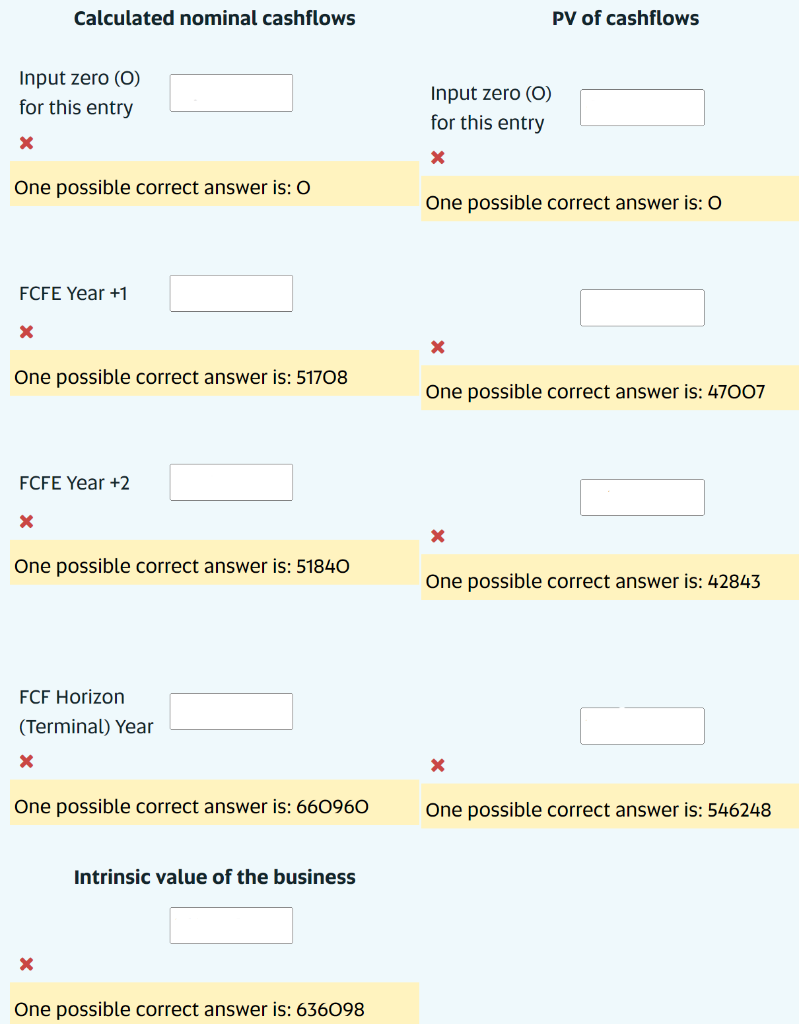

Selected data from historical and projected Financial Statements for Longevity Ltd: (NB: Balance sheet items are end of period values, not beginning of period values as per Palepu workbook) Current year Year +1 Year +2 Current year Year +1 Year +2 $ Sales 468553 487295 Average total gross assets 448330 479713 419000 Net operating profit after tax 61096 61471 Average total shareholders' equity 302228 310805 319608 Net profit after tax 61907 62299 Average net operating assets 362228 373805 385758 Net interest expense after tax 811 828 Average net debt 60000 63000 66150 71052 73894 76850 Average operating working capital Average net long-term assets 291176 299911 308908 Effective tax rate 33 % FCF growth beyond Year +3 2% Estimated cost of equity capital 10% Using the data above complete the following table: Calculated nominal cashflows PV of cashflows Input zero (O) for this entry Input zero (O) for this entry X X One possible correct answer is: 0 One possible correct answer is: 0 FCFE Year +1 x X One possible correct answer is: 51708 One possible correct answer is: 47007 FCFE Year +2 X X One possible correct answer is: 51840 One possible correct answer is: 42843 FCF Horizon (Terminal) Year X X One possible correct answer is: 660960 One possible correct answer is: 546248 Intrinsic value of the business X One possible correct answer is: 636098 Selected data from historical and projected Financial Statements for Longevity Ltd: (NB: Balance sheet items are end of period values, not beginning of period values as per Palepu workbook) Current year Year +1 Year +2 Current year Year +1 Year +2 $ Sales 468553 487295 Average total gross assets 448330 479713 419000 Net operating profit after tax 61096 61471 Average total shareholders' equity 302228 310805 319608 Net profit after tax 61907 62299 Average net operating assets 362228 373805 385758 Net interest expense after tax 811 828 Average net debt 60000 63000 66150 71052 73894 76850 Average operating working capital Average net long-term assets 291176 299911 308908 Effective tax rate 33 % FCF growth beyond Year +3 2% Estimated cost of equity capital 10% Using the data above complete the following table: Calculated nominal cashflows PV of cashflows Input zero (O) for this entry Input zero (O) for this entry X X One possible correct answer is: 0 One possible correct answer is: 0 FCFE Year +1 x X One possible correct answer is: 51708 One possible correct answer is: 47007 FCFE Year +2 X X One possible correct answer is: 51840 One possible correct answer is: 42843 FCF Horizon (Terminal) Year X X One possible correct answer is: 660960 One possible correct answer is: 546248 Intrinsic value of the business X One possible correct answer is: 636098

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts