Question: Skill builder: Human Resource Forecasting Assignment (pp. 103-105) You have been given the assignment of forecasting the human resource needs of the National Bank and

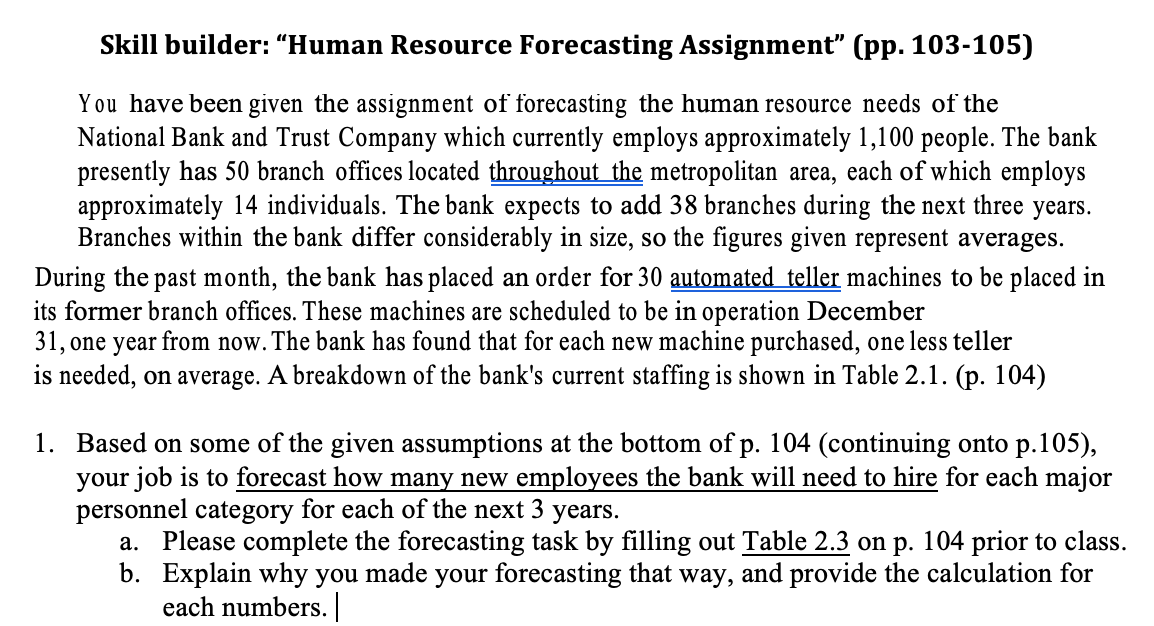

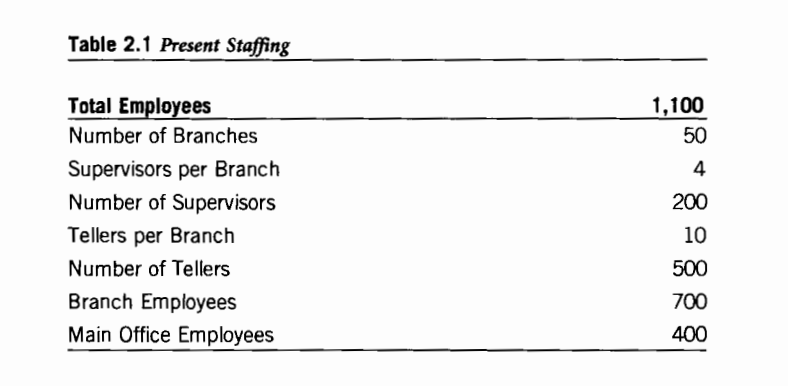

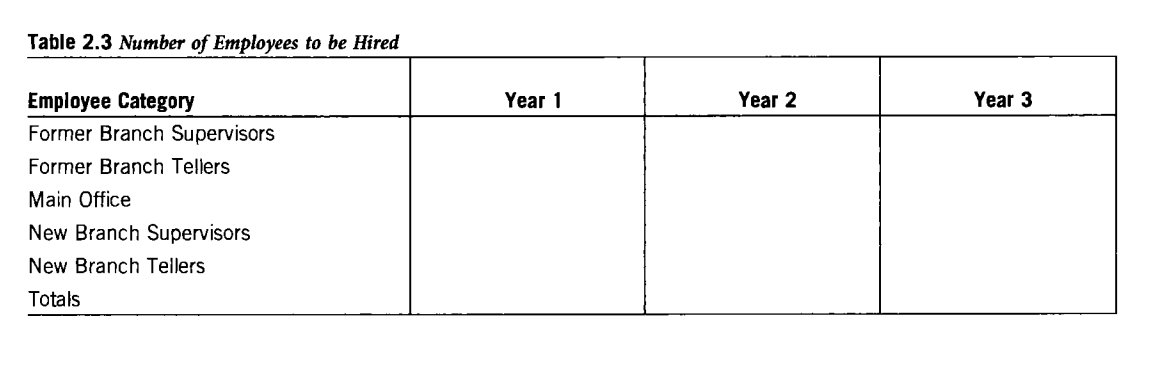

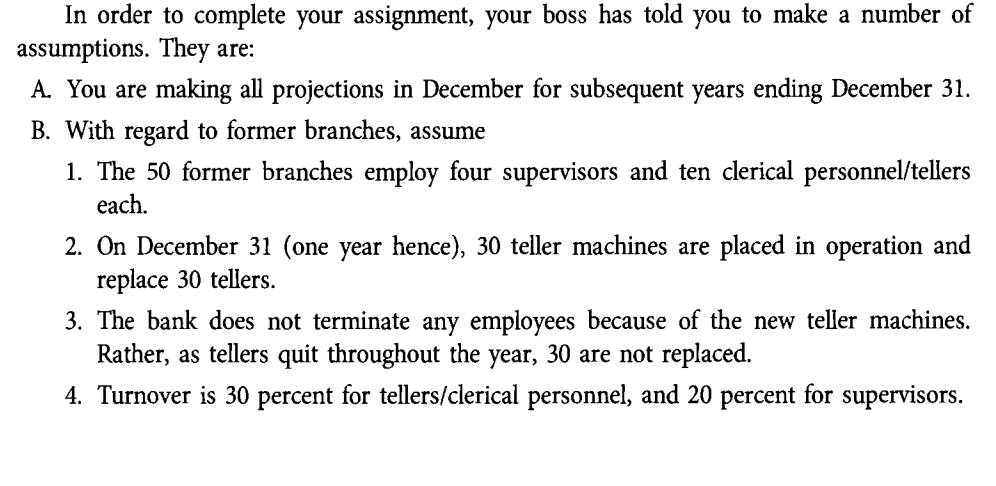

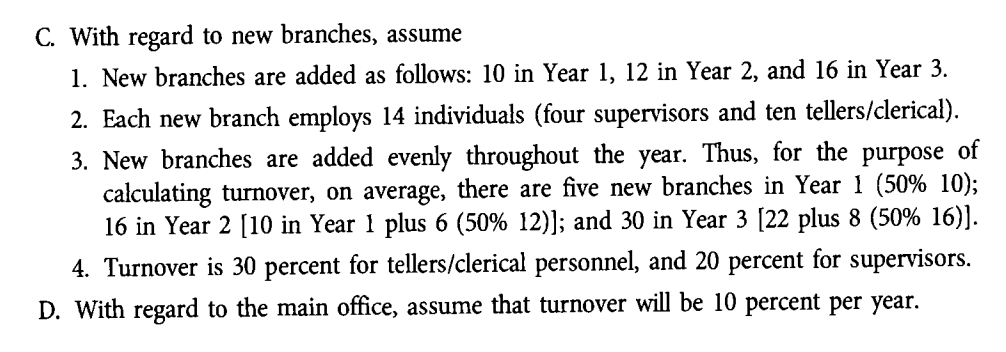

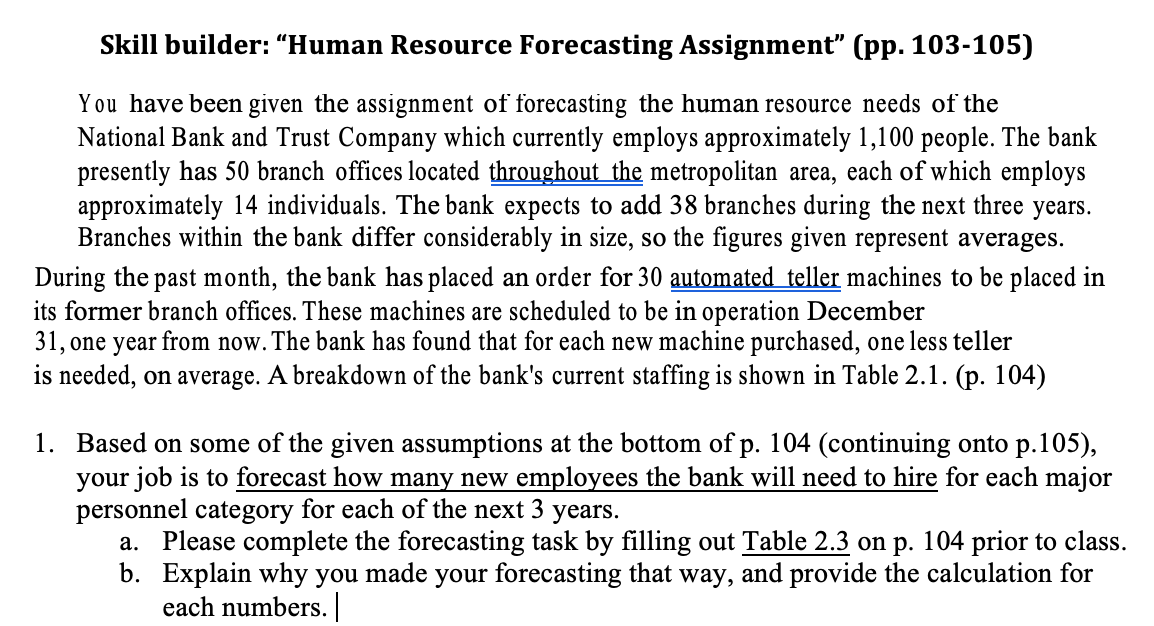

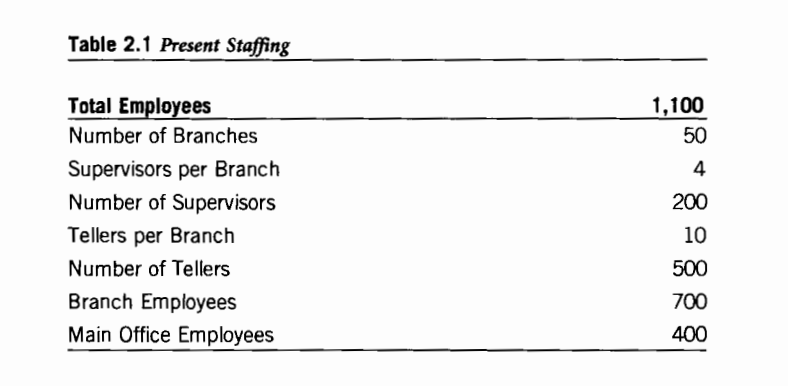

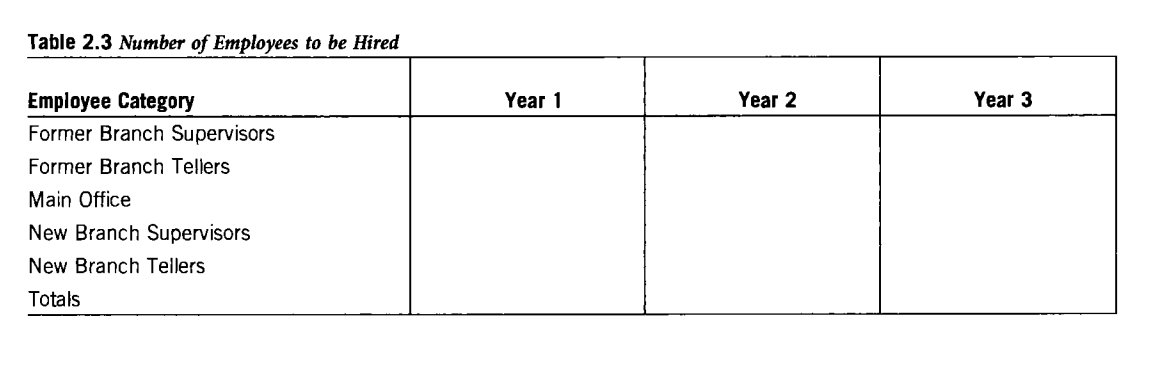

Skill builder: Human Resource Forecasting Assignment (pp. 103-105) You have been given the assignment of forecasting the human resource needs of the National Bank and Trust Company which currently employs approximately 1,100 people. The bank presently has 50 branch offices located throughout the metropolitan area, each of which employs approximately 14 individuals. The bank expects to add 38 branches during the next three years. Branches within the bank differ considerably in size, so the figures given represent averages. During the past month, the bank has placed an order for 30 automated teller machines to be placed in its former branch offices. These machines are scheduled to be in operation December 31, one year from now. The bank has found that for each new machine purchased, one less teller is needed, on average. A breakdown of the bank's current staffing is shown in Table 2.1. (p. 104) 1. Based on some of the given assumptions at the bottom of p. 104 (continuing onto p.105), your job is to forecast how many new employees the bank will need to hire for each major personnel category for each of the next 3 years. a. Please complete the forecasting task by filling out Table 2.3 on p. 104 prior to class. b. Explain why you made your forecasting that way, and provide the calculation for each numbers. Table 2.1 Present Staffing 1,100 50 Total Employees Number of Branches Supervisors per Branch Number of Supervisors Tellers per Branch Number of Tellers Branch Employees Main Office Employees 4 200 10 500 700 400 Table 2.3 Number of Employees to be Hired Year 1 Year 2 Year 3 Employee Category Former Branch Supervisors Former Branch Tellers Main Office New Branch Supervisors New Branch Tellers Totals In order to complete your assignment, your boss has told you to make a number of assumptions. They are: A. You are making all projections in December for subsequent years ending December 31. B. With regard to former branches, assume 1. The 50 former branches employ four supervisors and ten clerical personnel/tellers each. 2. On December 31 (one year hence), 30 teller machines are placed in operation and replace 30 tellers. 3. The bank does not terminate any employees because of the new teller machines. Rather, as tellers quit throughout the year, 30 are not replaced. 4. Turnover is 30 percent for tellers/clerical personnel, and 20 percent for supervisors. C. With regard to new branches, assume 1. New branches are added as follows: 10 in Year 1, 12 in Year 2, and 16 in Year 3. 2. Each new branch employs 14 individuals (four supervisors and ten tellers/clerical). 3. New branches are added evenly throughout the year. Thus, for the purpose of calculating turnover, on average, there are five new branches in Year 1 (50% 10); 16 in Year 2 [10 in Year 1 plus 6 (50% 12)]; and 30 in Year 3 (22 plus 8 (50% 16)). 4. Turnover is 30 percent for tellers/clerical personnel, and 20 percent for supervisors. D. With regard to the main office, assume that turnover will be 10 percent per year