Question: solve it Example 1 Consider a porfolio with three assets S, S and Ss which have expected rates of return 0.1,0.15 and 0.2 respectively, and

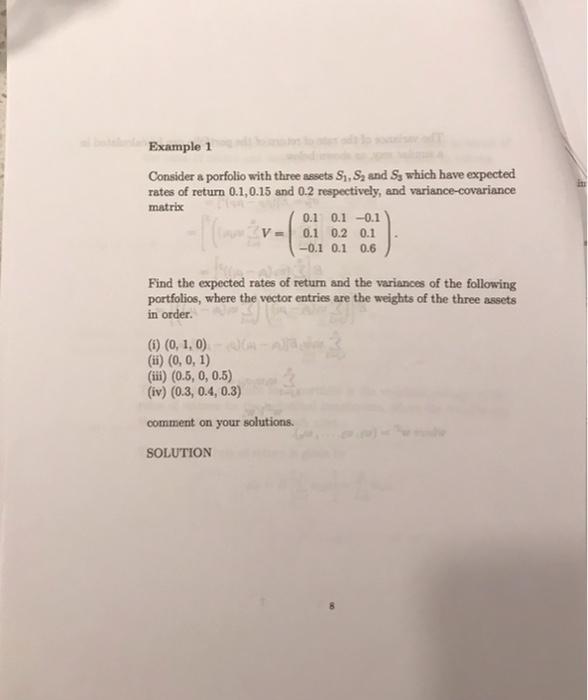

Example 1 Consider a porfolio with three assets S, S and Ss which have expected rates of return 0.1,0.15 and 0.2 respectively, and variance-covariance matrix 0.1 0.1 -0.1 V= 0.1 0.2 0.1 -0.1 0.1 0.6 - [ (in Find the expected rates of return and the variances of the following portfolios, where the vector entries are the weights of the three assets in order (1) (0, 1.0) (ii) (0, 0, 1) (iii) (0.5, 0, 0.5) (iv) (0.3, 0.4, 0.3) comment on your solutions. SOLUTION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts