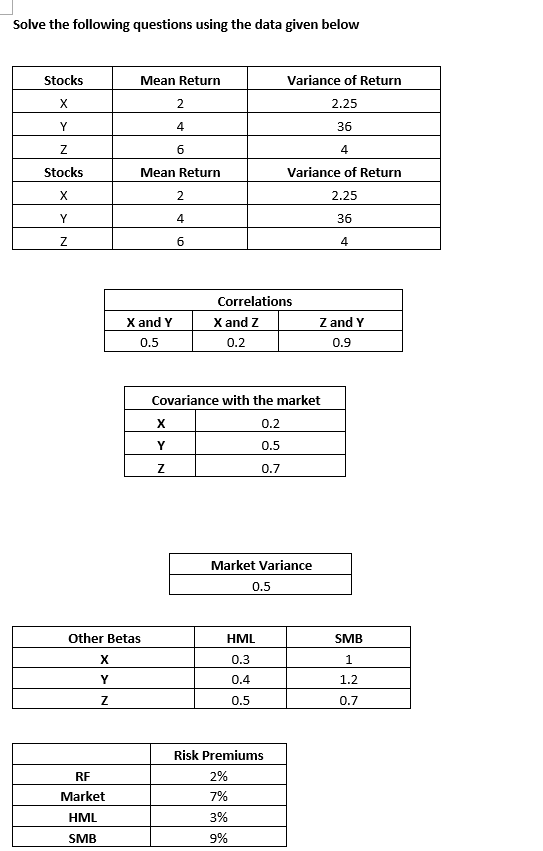

Question: Solve the following questions using the data given below a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance

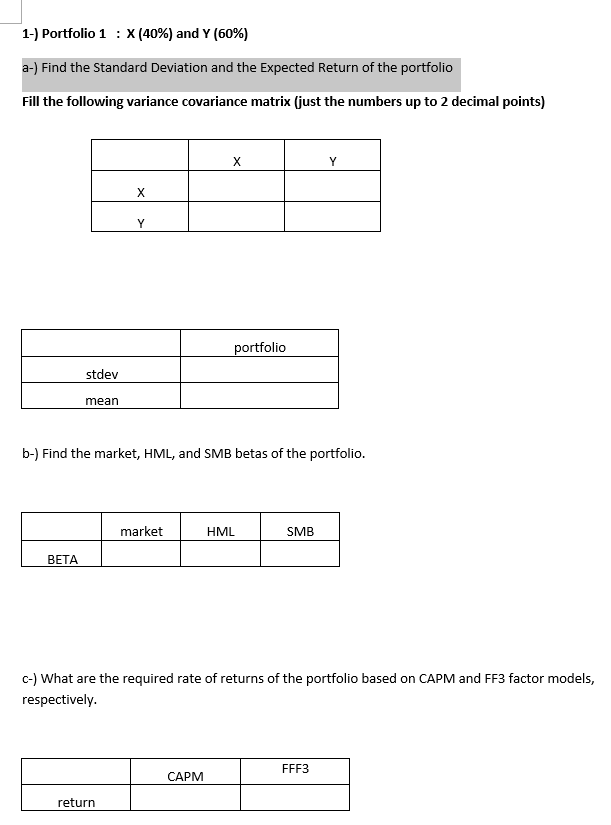

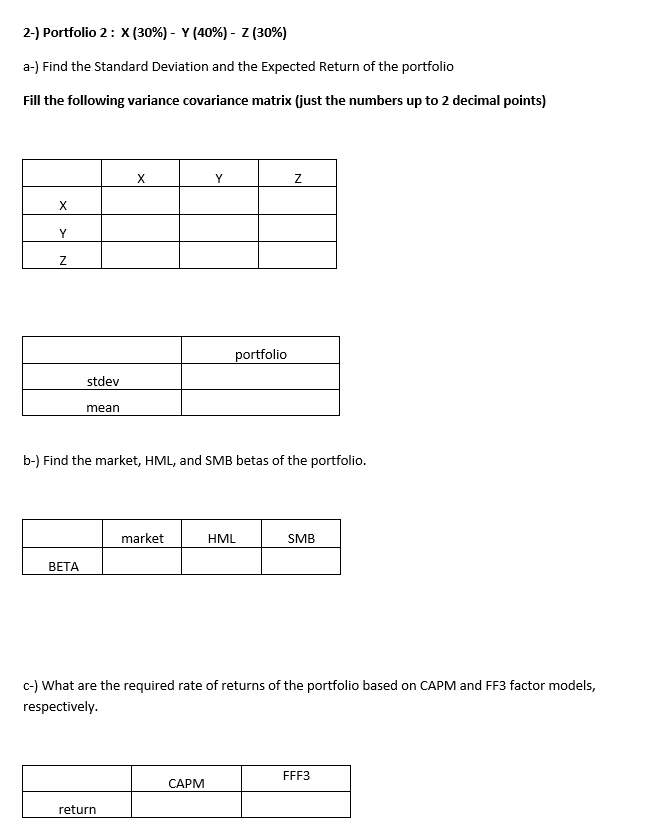

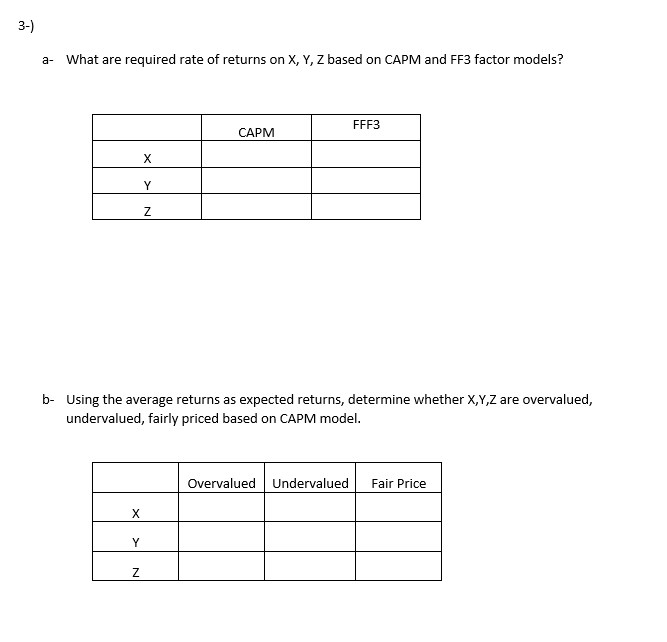

Solve the following questions using the data given below a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) b-) Find the market, HML, and SMB betas of the portfolio. c-) What are the required rate of returns of the portfolio based on CAPM and FF3 factor models, respectively. 2-) Portfolio 2: X (30\%) - Y (40\%) - Z (30\%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) b-) Find the market, HML, and SMB betas of the portfolio. c-) What are the required rate of returns of the portfolio based on CAPM and FF3 factor models, respectively. a- What are required rate of returns on X,Y,Z based on CAPM and FF3 factor models? b- Using the average returns as expected returns, determine whether X,Y,Z are overvalued, undervalued, fairly priced based on CAPM model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts