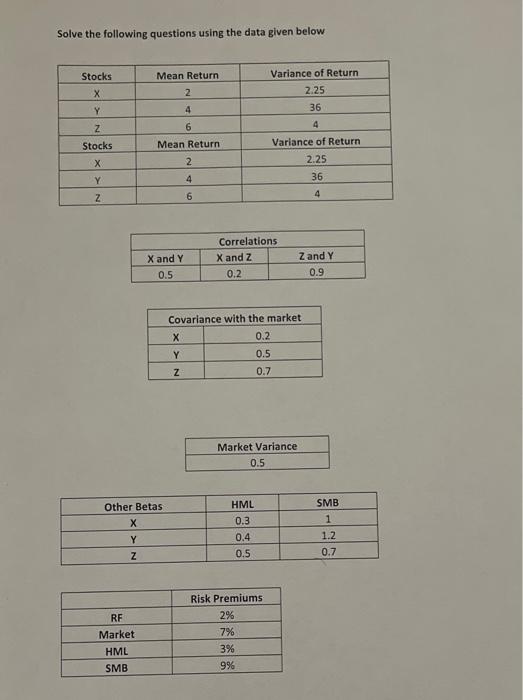

Question: Solve the following questions using the data given below 1-) Portfolio 1 : X(40%) and Y(60%) a-) Find the Standard Deviation and the Expected Return

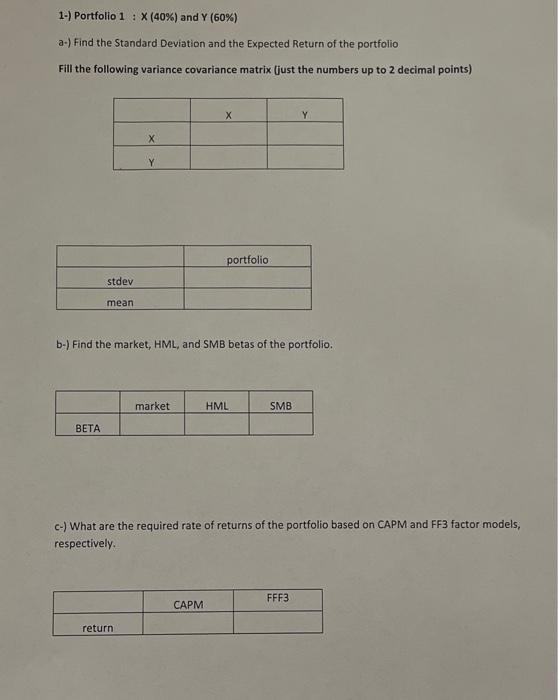

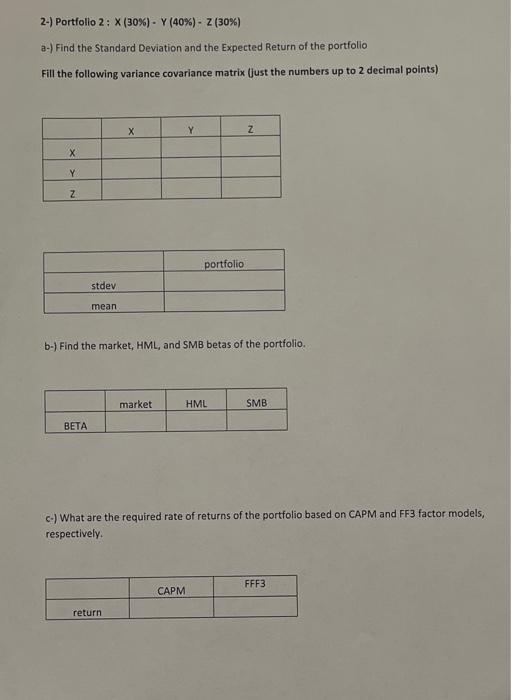

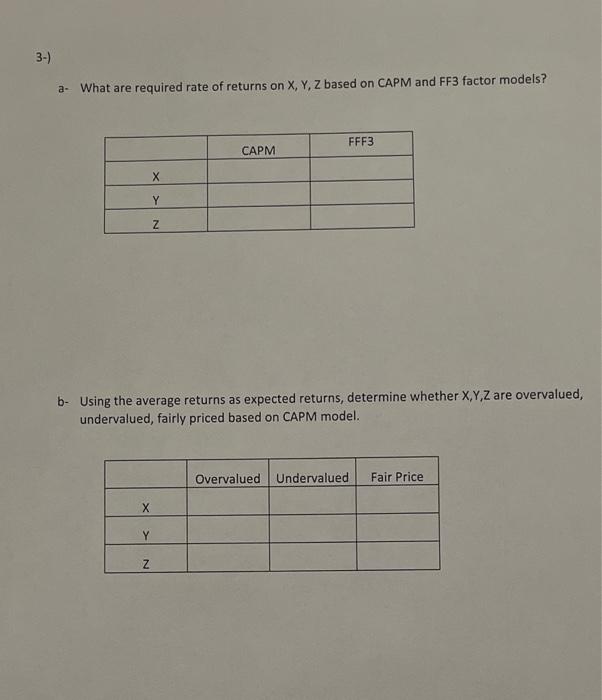

Solve the following questions using the data given below 1-) Portfolio 1 : X(40%) and Y(60%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) b-) Find the market, HML, and SMB betas of the portfolio. c-) What are the required rate of returns of the portfolio based on CAPM and FF3 factor models, respectively. 2.) Portfollo 2; X(30%)Y(40%)Z(30%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) b-) Find the market, HML, and SMB betas of the portfolio. c) What are the required rate of returns of the portfolio based on CAPM and FF3 factor models, respectively. a. What are required rate of returns on X,Y,Z based on CAPM and FF3 factor models? b. Using the average returns as expected returns, determine whether X,Y,Z are overvalued, undervalued, fairly priced based on CAPM model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts