Question: solve these problems:- An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor

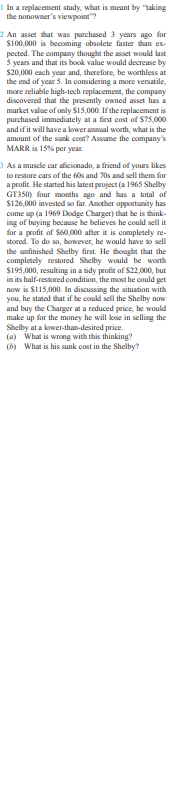

solve these problems:-

An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor and company records. Retention AW Value. Period, Years 5 per Year -RI, OOD -87,DOD -890OD -95,000 A challenger has an economic service life of 7 years with an AW of $ 86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARR is 12%% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: [a) Now (b) After 2 years [o) After 3 years () NeverIn a replacement study, what is meant by "taking the nonowner's viewpoint"? An asset that was purchased 3 years ago for $100,000 is becoming obsolete faster than ex- pected. The company thought the asset would last 3 years and that its book value would decrease by $20,000 each year and, therefore, be worthless at the end of year 3. In considering a more versatile, more reliable high-tech replacement, the company discovered that the presently owned asset has a market value of only $15,000. If the replacement is purchased immediately at a first cost of $75,000 and if it will have a lower annual worth, what is the amount of the sunk cost?' Assume the company's MARR is 15% per year. As a muscle car aficionado, a friend of yours likes to restore cars of the 60s and 70s and sell them for a poofit. He started his latest project (a 1965 Shelby GT350) four months ago and has a total of $126,000 invested so far. Another opportunity has come up (a 1969 Dodge Charger) that he is think- ing of buying because he believes he could sell it for a profit of $60,000 after it is completely re- stored. To do so, however, he would have to sell the unfinished Shelby first. He thought that the completely restored Shelby would be worth $195,000, resulting in a tidy profit of $22,000, but in its half-restored condition, the most he could get now is $115,000. In discussing the situation with you, he stated that if he could sell the Shelby now and buy the Charger at a reduced price, he would make up for the money he will lose in selling the Shelby at a lower-than-desired price. (a) What is wrong with this thinking? (b) What is his sunk cost in the Shelby?\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts