Question: S&P 500 CCE MMM BIIB Average St. Dev. Variance 1.55% 3.12% 0.000973 1.6496 8.90% 0.007928 1.06% 2.3296 9.26% 7.56% 0.008569 0.005711 Intercept Beta Var of

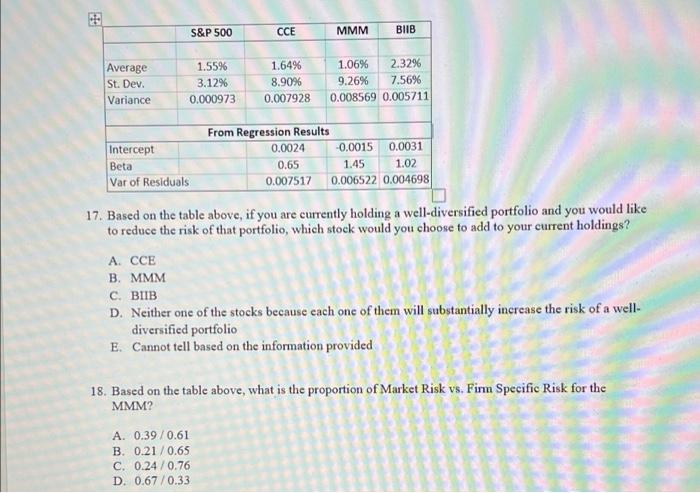

S&P 500 CCE MMM BIIB Average St. Dev. Variance 1.55% 3.12% 0.000973 1.6496 8.90% 0.007928 1.06% 2.3296 9.26% 7.56% 0.008569 0.005711 Intercept Beta Var of Residuals From Regression Results 0.0024 -0.0015 0.0031 0.65 1.45 1.02 0.007517 0.006522 0.004698 17. Based on the table above, if you are currently holding a well-diversified portfolio and you would like to reduce the risk of that portfolio, which stock would you choose to add to your current holdings? . B. MMM C. BIIB D. Neither one of the stocks because each one of them will substantially increase the risk of a well- diversified portfolio E. Cannot tell based on the information provided 18. Based on the table above, what is the proportion of Market Risk vs. Firm Specific Risk for the MMM? A. 0.39 /0.61 B. 0.21 / 0.65 C. 0.24/0.76 D. 0.67/0.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts