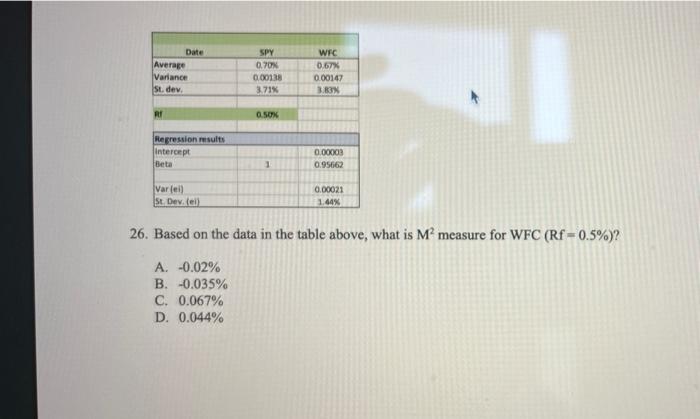

Question: SPY Date Average Variance Ist dev. 0.70 0.00135 3.71% WEC 0.67% 0.00147 3.63% RI 0.50N Regression results intercept Beta 0.0000 0.95662 1 Vareil St Dev.

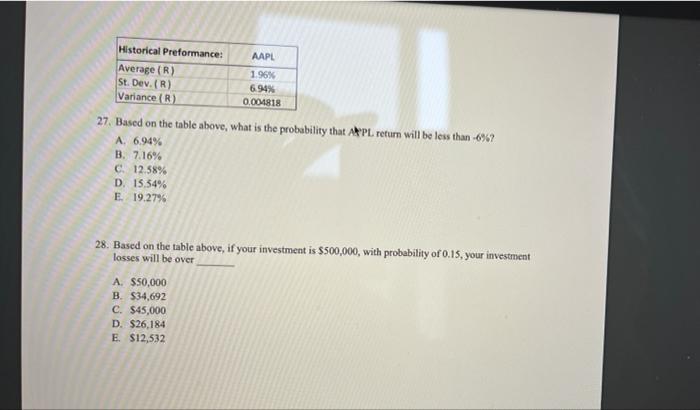

SPY Date Average Variance Ist dev. 0.70 0.00135 3.71% WEC 0.67% 0.00147 3.63% RI 0.50N Regression results intercept Beta 0.0000 0.95662 1 Vareil St Dev. leil 0.00021 1.64% 26. Based on the data in the table above, what is M measure for WFC (Rf -0.5%)? A. -0.02% B. -0,035% C. 0.067% D. 0.044% AAPL Historical Preformance: Average (R) St. Dev. (R) Variance (R) 1.96% 6.94% 0.004818 27. Based on the table above, what is the probability that APL return will be less than -6%? A. 6.94% B 7.16% C12.58% D. 15.54% E 19.2796 28. Based on the table above, if your investment is $500,000, with probability of 0.15, your investment losses will be over A. $50,000 B S34,692 C. $45,000 D. $26,184 E $12,532

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts