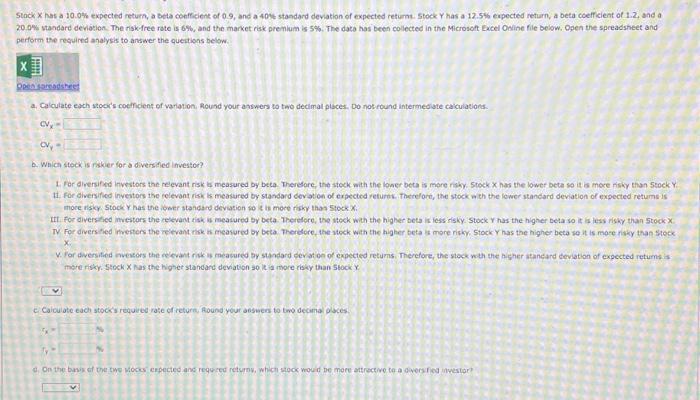

Question: Stack x has a 10.0 th expected return, a beta confficent of 0.9 , and a 401 standard deviation of expected refurn. Stock Y has

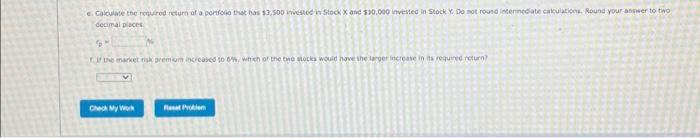

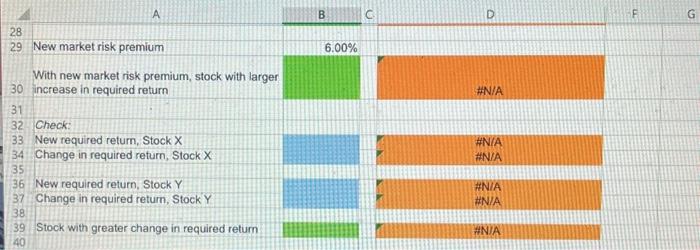

Stack x has a 10.0 th expected return, a beta confficent of 0.9 , and a 401 standard deviation of expected refurn. Stock Y has a 12.5 th expected return, a beta coeff cient of 1.2 , and a 20. 0\% standard deviation. The risk-free rate is 6%, and the market risk prenlum is 5%. The data has been collected in the Microsont Excel Ooline file below, Open the spreadsheet and perform the requirnd analysis to answer the quentions below. a. Calculate exch stoer's coefficient of variation, Round your axswers to two decimal ploces, po nos round intermediate caiculations. Cvvx=cvvy= b. Which stockis riskier for a diversifed investor? I. Par aliensifdd investors the rejevant risk a measured by beta. Therdore, the stock with the bher beta is more rishy. 5tock x has the lower beta so it is moce fisky than 5 bock Y. It. for diversified inventors the felevant risk is measured by standard dev at on ol expected returnk. Therefort, the stock a th the lower standard deviation of expected retums is more risicy stock y has the ioper stahcard deviation so is is more righ thas 5 sock x : III for diversfied mvestors the cesevam tisk is meatured by beta. Therefore, the wheck whth the higher beta is less irisky. Stock Y has the higher beta so it is less risky than 5 toek x. x mere risky. Stock X Nas the higher standard deviation ao it a more ribky than 5 tock Y decimal pisces 5=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts