Question: Study Questions for Itos Dilemma Case Using the Black-Scholes pricing function in Excel, calculate how sensitive IBMs March 110 call price is to changes in

Study Questions for Itos Dilemma Case

-

Using the Black-Scholes pricing function in Excel, calculate how sensitive IBMs March 110 call price is to changes in stock price. How much does the call price vary for $0.50 changes in IBM share price when the option is at the money (assume stock price=$110), in the money (assume stock price=$115), and out of the money (assume stock price=$105)? What does this sensitivity analysis tell you?

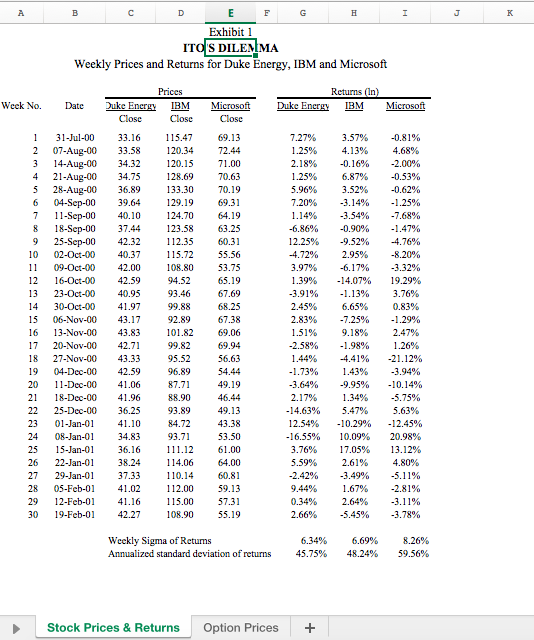

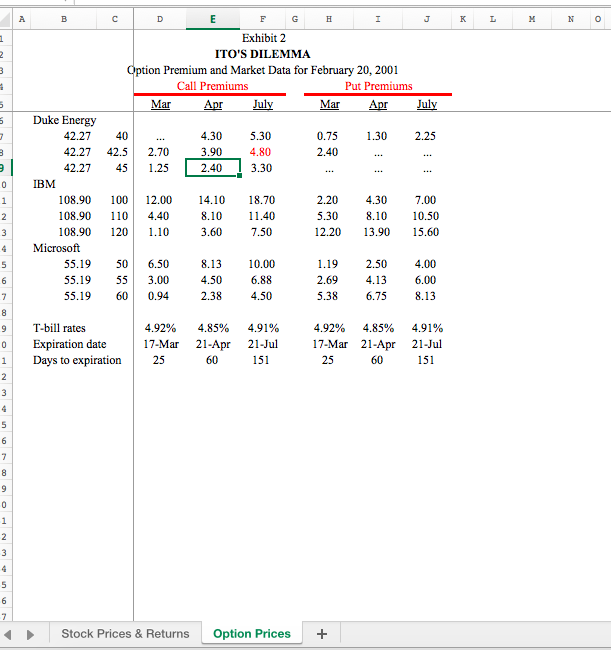

ITO'S DILENIMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft Week No. Dat ke Energy IBM Microsoft Duke Energy IBM Microsoft 0 Weekly Sigma of Retums returns Stock Prices & Returns Option Prices 0 Exhibit 2 ITO'S DILEMMA n Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Duke Energy 2.27 40 2.27 42.5 2.70 2.27 45 1.25 4.30 5.30 3.90 4.80 2.40 3.30 0.75 2.40 1.30 2.25 0 IBM 108.90 100 12.00 14.10 18.70 108.90 110 4.40 108.90 120 1.10 8.10 11.40 3.60 7.50 2.20 4.30 7.00 5.30 8.1010.50 12.20 13.90 15.60 4 Microsoft 8.13 55.19 50 6.50 55.19 553.00 55.19 60 0.94 10.00 6.88 1.19 2.50 4.00 2.69 4.13 6.00 5.38 6.758.13 2.384.50 9 Tbill rates 0 Expiration date 17-Mar 1 Days to expiration25 4.92% 4.85% 4.91% 21-Apr 21-Jul 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 151 Stock Prices & Returns Option Prices + ITO'S DILENIMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft Week No. Dat ke Energy IBM Microsoft Duke Energy IBM Microsoft 0 Weekly Sigma of Retums returns Stock Prices & Returns Option Prices 0 Exhibit 2 ITO'S DILEMMA n Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Duke Energy 2.27 40 2.27 42.5 2.70 2.27 45 1.25 4.30 5.30 3.90 4.80 2.40 3.30 0.75 2.40 1.30 2.25 0 IBM 108.90 100 12.00 14.10 18.70 108.90 110 4.40 108.90 120 1.10 8.10 11.40 3.60 7.50 2.20 4.30 7.00 5.30 8.1010.50 12.20 13.90 15.60 4 Microsoft 8.13 55.19 50 6.50 55.19 553.00 55.19 60 0.94 10.00 6.88 1.19 2.50 4.00 2.69 4.13 6.00 5.38 6.758.13 2.384.50 9 Tbill rates 0 Expiration date 17-Mar 1 Days to expiration25 4.92% 4.85% 4.91% 21-Apr 21-Jul 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 151 Stock Prices & Returns Option Prices +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts