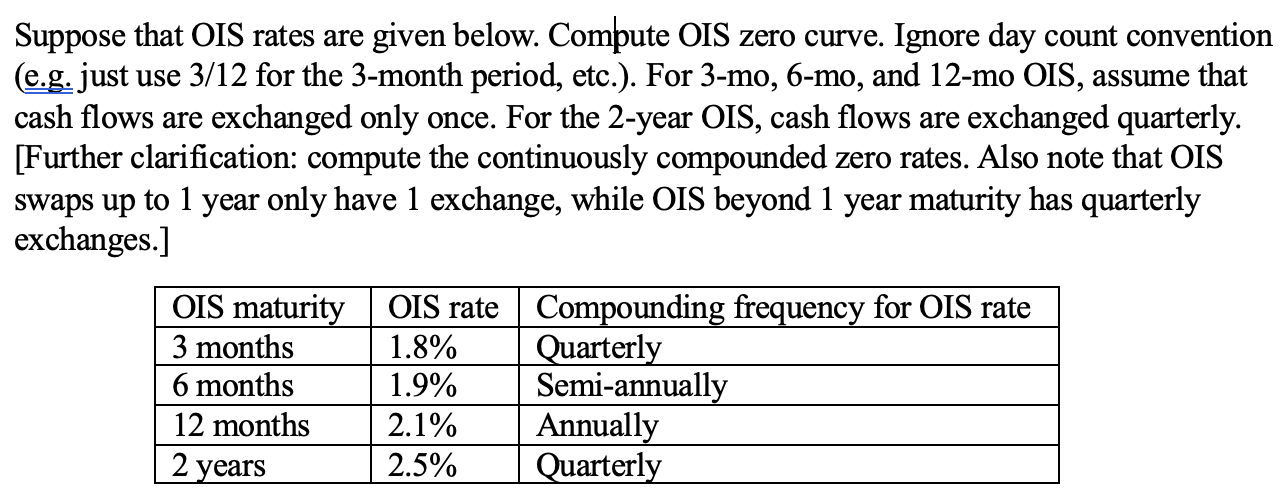

Question: Suppose that OIS rates are given below. Compute OIS zero curve. Ignore day count convention (e.g. just use 3/12 for the 3-month period, etc.).

Suppose that OIS rates are given below. Compute OIS zero curve. Ignore day count convention (e.g. just use 3/12 for the 3-month period, etc.). For 3-mo, 6-mo, and 12-mo OIS, assume that cash flows are exchanged only once. For the 2-year OIS, cash flows are exchanged quarterly. [Further clarification: compute the continuously compounded zero rates. Also note that OIS swaps up to 1 year only have 1 exchange, while OIS beyond 1 year maturity has quarterly exchanges.] OIS maturity OIS rate 1.8% 1.9% 2.1% 2.5% 3 months 6 months 12 months 2 years Compounding frequency for OIS rate Quarterly Semi-annually Annually Quarterly

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

To compute the OIS zero curve we will use the given OIS rates and compounding frequencies Well assum... View full answer

Get step-by-step solutions from verified subject matter experts