Question: Suppose that the spot rate curve (continuously compounded) is 4% for t less than or equal to 5 years, and the forward rate f5,t is

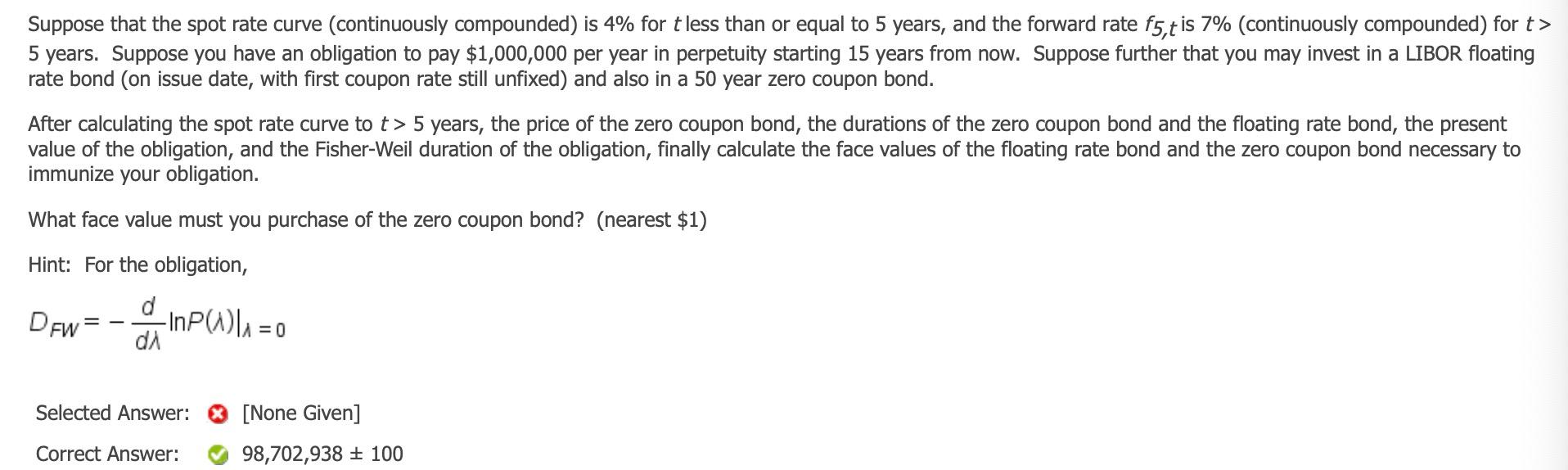

Suppose that the spot rate curve (continuously compounded) is 4% for t less than or equal to 5 years, and the forward rate f5,t is 7% (continuously compounded) for t> 5 years. Suppose you have an obligation to pay $1,000,000 per year in perpetuity starting 15 years from now. Suppose further that you may invest in a LIBOR floating rate bond (on issue date, with first coupon rate still unfixed) and also in a 50 year zero coupon bond. After calculating the spot rate curve to t> 5 years, the price of the zero coupon bond, the durations of the zero coupon bond and the floating rate bond, the present value of the obligation, and the Fisher-Weil duration of the obligation, finally calculate the face values of the floating rate bond and the zero coupon bond necessary to immunize your obligation. What face value must you purchase of the zero coupon bond? (nearest $1) Hint: For the obligation, Dow=-INPWIA=0 = DFW d di 0 Selected Answer: [None Given] Correct Answer: 98,702,938 100 Suppose that the spot rate curve (continuously compounded) is 4% for t less than or equal to 5 years, and the forward rate f5,t is 7% (continuously compounded) for t> 5 years. Suppose you have an obligation to pay $1,000,000 per year in perpetuity starting 15 years from now. Suppose further that you may invest in a LIBOR floating rate bond (on issue date, with first coupon rate still unfixed) and also in a 50 year zero coupon bond. After calculating the spot rate curve to t> 5 years, the price of the zero coupon bond, the durations of the zero coupon bond and the floating rate bond, the present value of the obligation, and the Fisher-Weil duration of the obligation, finally calculate the face values of the floating rate bond and the zero coupon bond necessary to immunize your obligation. What face value must you purchase of the zero coupon bond? (nearest $1) Hint: For the obligation, Dow=-INPWIA=0 = DFW d di 0 Selected Answer: [None Given] Correct Answer: 98,702,938 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts