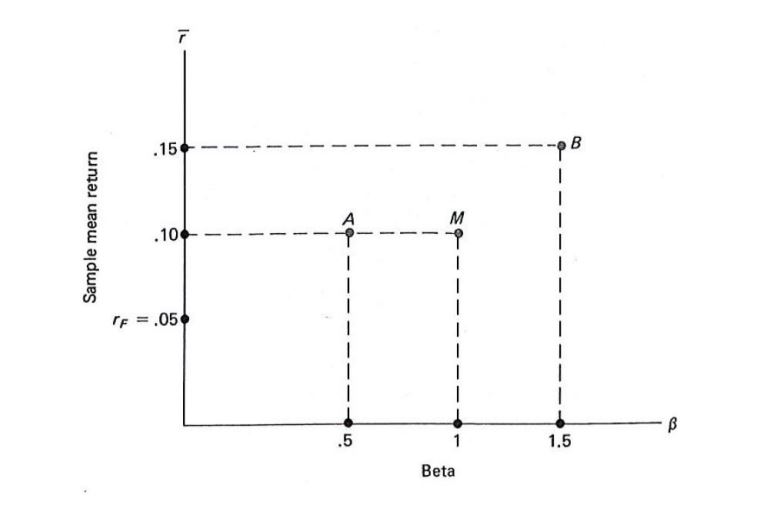

Question: Suppose the returns and corresponding beta values for two assets (A and B) and the market (M) are as indicated in the accompanying figure as

Suppose the returns and corresponding beta values for two assets (A and B) and the market (M) are as indicated in the accompanying figure as per below:

(i) Compute the Treynor Index for A and B. Interpret the results.

(ii) Compute the Jensen index for A and B. Interpret the results.

(iii) Suppose one manager had selected a portfolio represented by A and another manager had selected a portfolio represented by B. Would you feel confident in evaluating the managers relative performance with the Treynor or Jensen results? Explain.

Sample mean return .15 .10 TF = .05 A I .5 M 1 Beta 1 1.5 B Sample mean return .15 .10 TF = .05 A I .5 M 1 Beta 1 1.5 B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts